The Covid stock market crash came with extreme fear but also with extreme opportunity. We vividly remember stocks like Zoom, Moderna and dry bulk shipping stocks going through the roof. After a really strong momentum cycle that took some 18 to 24 months to complete, we see that all stocks that went through big momentum in the Covid period are all back to ground zero. This is important because it puts the current volatile period in markets in perspective. Moreover, it tells that a new cycle is upon is.

One market dynamic we often cover in our Momentum Investing research alerts is how to think about volatility. Emphasis on the word think because volatility is great in triggering emotions, especially fear. By thinking things through you neutralize emotions and can see the reality as opposed to missing out important insights because of fear.

Volatility is market rotation in disguise.

That’s the market dynamic that we cover very often (almost constantly) in our Momentum Investing writings.

2022 is an unusually volatile year.

2022 is a year of market rotation like we have hardly ever seen before.

Volatility and rotation go hand in hand.

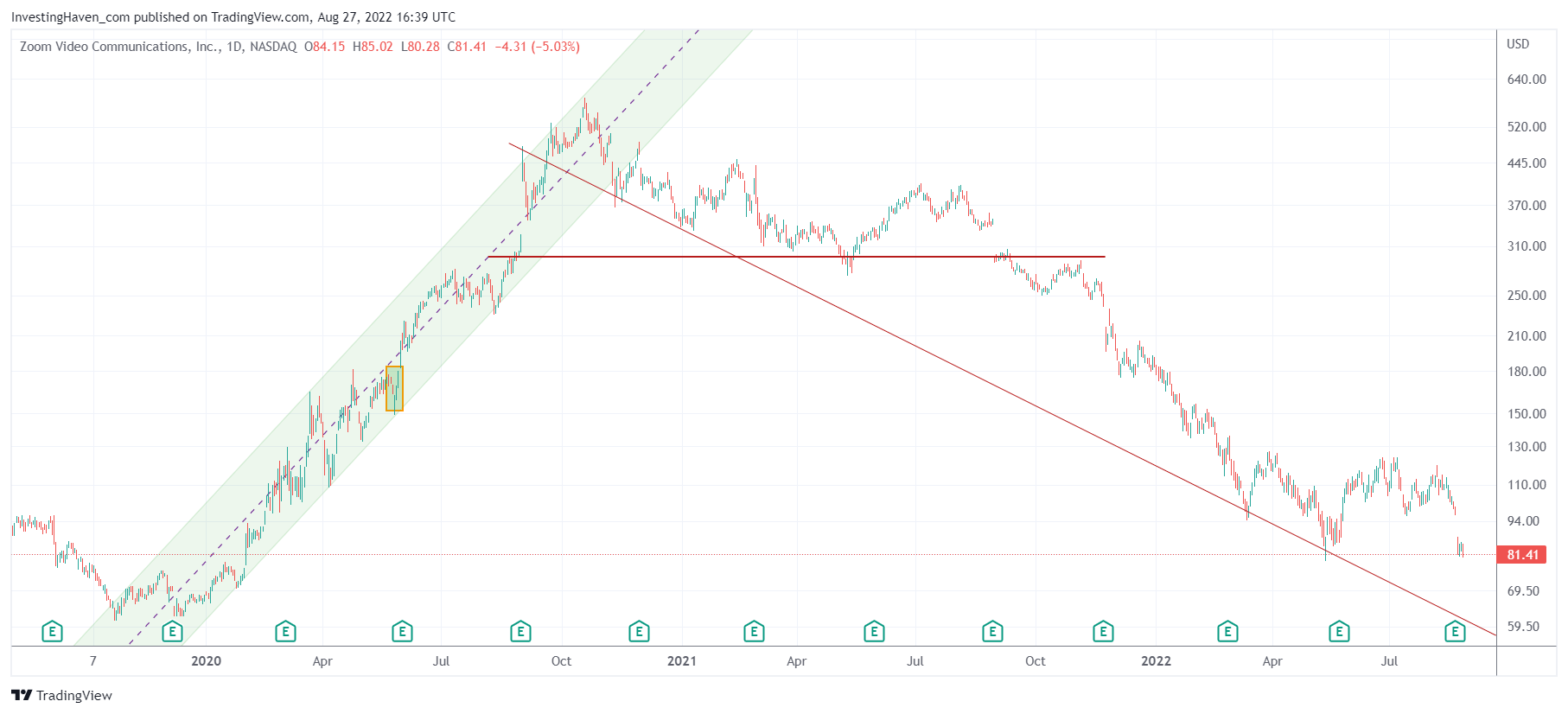

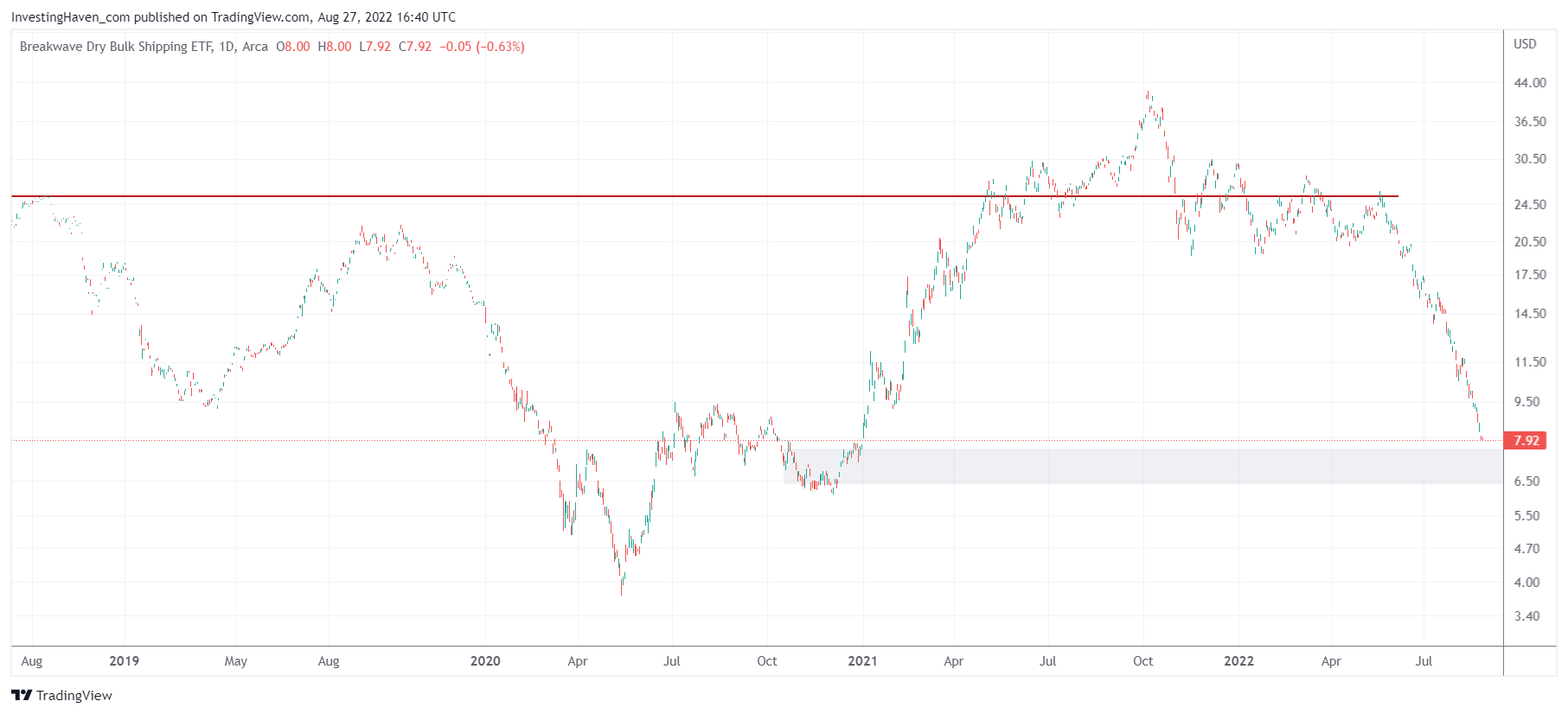

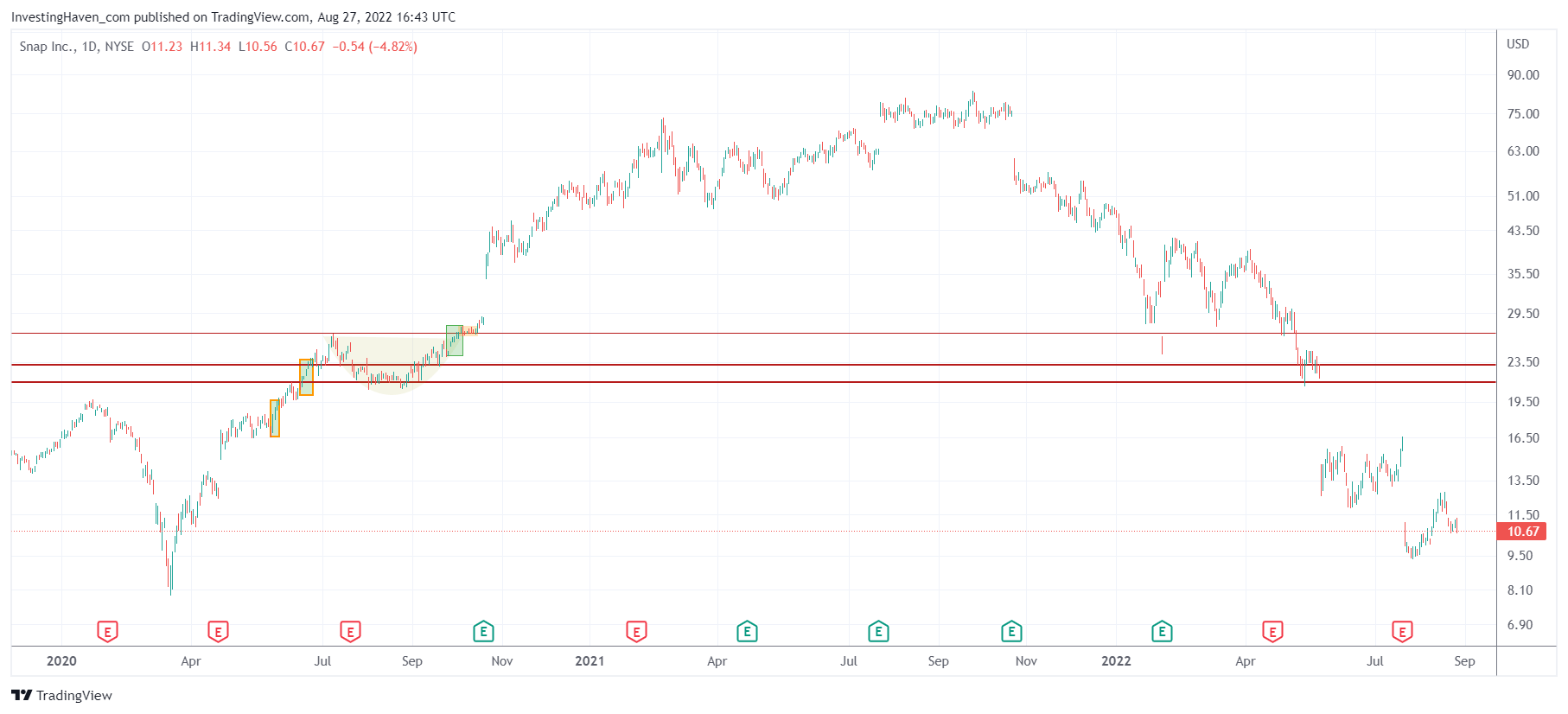

The market is completing the very unusual Covid period. All trends that came with Covid are now officially being completed. Here are a few illustrations to make our point.

Zoom went through the roof during the lockdown periods. It topped in October of 2022, consolidated until last summer. In 2022, it broke down completely and now trades to pre-Covid levels.

Dry bulk shipping was unusually hot because of supply shocks and demand/supply imbalances in many products. This trend peaked a few months ago, the dry bulk shipping ETF came down more than 50% in the last few months and is not showing signs of slowing down its downtrend.

Snap, another Covid momentum stock, very hot during the lockdowns, went through a similar topping process.

The Covid momentum cycle is over, is what these stock charts tell us.

The end of a cycle comes with the start of a new cycle.

Which cycle?

There are not a lot of bullish cycles out there, right now, but there are early signs of new bullish trends ‘under construction’. One thing is clear: new trends are unrelated to the old ones. The world is moving to a new state, the Covid momentum cycle is over.

Once extreme fear around inflation will be contained, which should be in a few months from now, we will start seeing new trends. We believe December 1st is an important date for reasons outlined in our research service(s).

We start seeing the first signs of a new cycle. There are not a lot of new trends underway, there are some of them. We cover what we believe is a new 18 month trend in a few sectors, particularly in our Momentum Investing service.