Stocks markets had a great recovery in April, and end of May / early June. Most of the time though they have been consolidating. And the most recent consolidation that started around June 8th is now going on for almost 2 months. Pretty nerve wracking, as explained in our Trade Alerts service, right? It is, and this consolidation is pretty effective in that it is destroying trader’s capital of both bulls and bears. Moreover, it is effective in playing mental games which is the ultimate ‘weapon’ of the market to send your capital to ‘money heaven’.

This weekend we helped our Trade Alerts members understand the essence of a consolidation, the risk and the right answer(s).

Exceptionally, we’ll share some of our work which we share with members of our Trade Alerts methodology.

Consolidations are the perfect setup to trigger frustrations. We have seen this so many times, and in the early years we fell victim of it as well. But you *must* learn to become self aware, map these emotions of frustrations to the chart only to realize that they occur in the consolidation periods. The chart can help us become self aware, and avoid the pitfalls that sends massive amounts of money to … money heaven …

The risk of a consolidation is that it plays emotional and mental games which are the trigger for a ‘wrong’ decision.

And if there is one thing we have seen again recently is how a consolidation may spark frustration. Not here at InvestingHaven though, and also not with our premium members. We are here to help, make (y)ourselves more self aware, and be among the 1%.

In terms of how to handle a consolidation this is the guidance we give as per our methodology:

It is absolutely ‘ok’ to take a few trades during a consolidation and close them right after. It is NOT ok to keep a position open during a consolidation if the market goes against you. The point about trading is not to be right 100% of times. It is to maximize profits while minimizing the downside (risk/potential). In fact, the better way to put it is this: first minimize the downside, then maximize profits.

It always helps to check a chart in order to visualize a consolidation. It is so helpful.

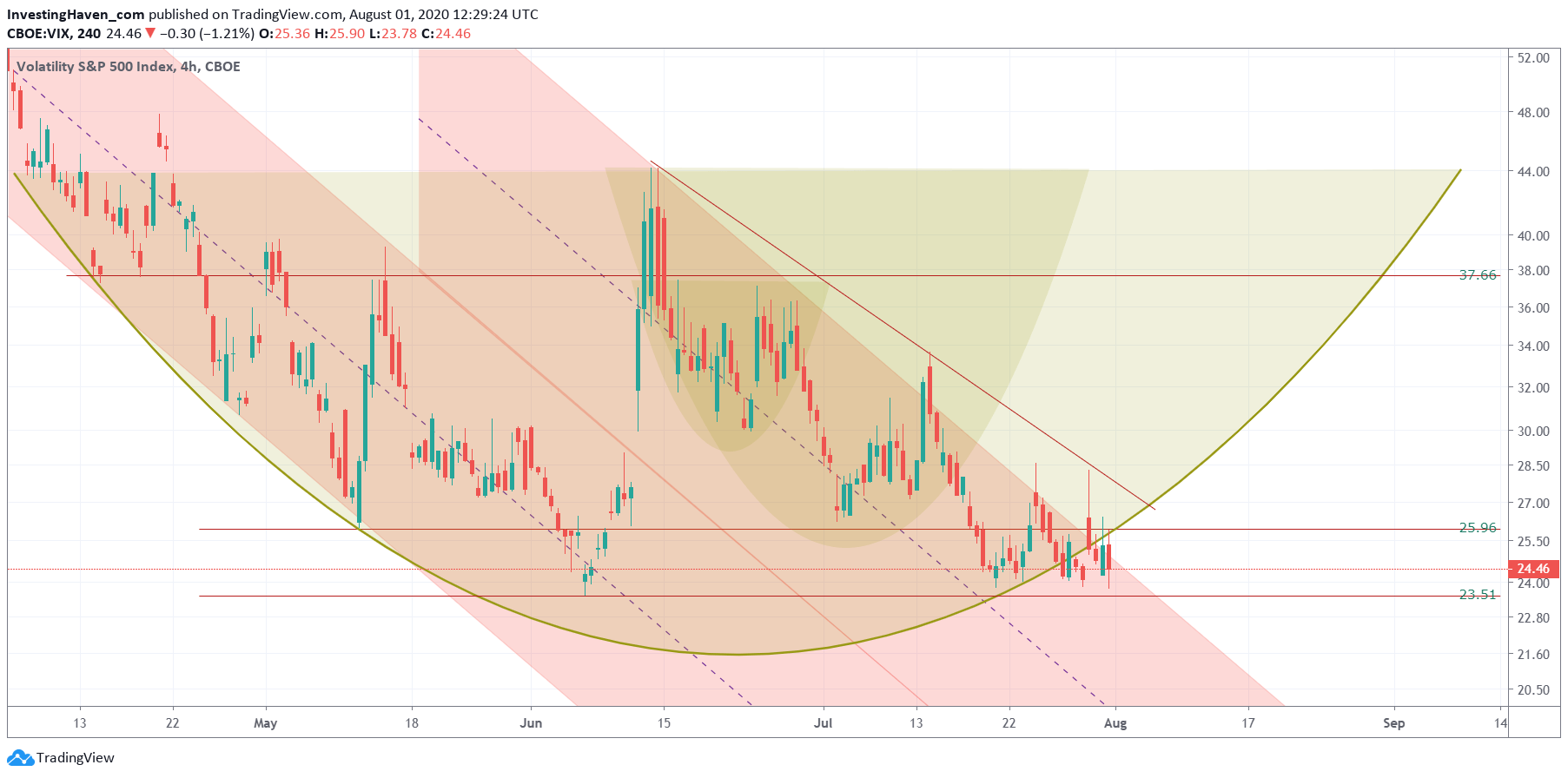

The one chart that helps a lot is the VIX index, one of our leading crash indicators. As per this chart it becomes clear how ‘violent’ the current consolidations. It also shows how relentless it is to not give up.

The fight between bulls and bears is brutal, is what this chart suggests!

But there is also another conclusion we can derive: the consolidation is about to conclude. It is a matter of days, ultimate two weeks, until a new trend will arise.

Whether it is up or down is unclear at this point, so better to stay sharp now.

Enjoying our work? In our Trade Alerts premium service we go after small and larger profits on the very short term, trading the S&P 500 as well as from time to time emerging markets / precious metals prices. Our return was almost +80% in the first half of this year.