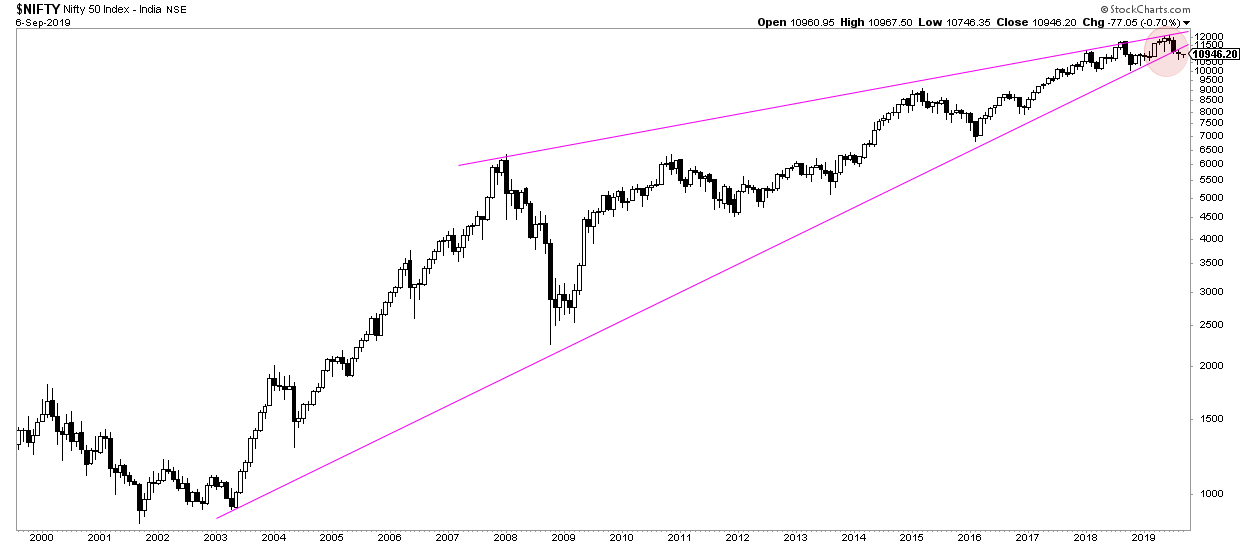

In recent years we covered the stock market in India. In fact the materials from early 2016 are still available on our site suggesting that India’s stock market would become one of the hottest stock markets in the world. It did exactly what we forecasted, and 2016-2018 was a stellar period for India stock market investors! We are changing our tone and forecast now, and are on record to be ultra conservative when investing in the stock market in India. We even believe there might be a big stock market crash looming in India, which needs additional confirmation before feeling re-assured about this outcome. The key point is this though: the stock market in India feels normal and stable, with a rise earlier this year and a retracement lately, but chart wise Indian stocks started a major (secular) breakdown! The perception of a stable stock market in the light of a secular breakdown is very concerning, and likely very misleading as well.

We have a long list of 100 investing tips which are meant for serious investors to study and apply in day-to-day market analysis. One of those investing tips is this one:

The chart is crucial, and it is the most factual and data driven way to look at any market. That’s why we apply the ‘start with the chart’ principle. It means we first identify trends and opportunities in assets or markets based on chart patterns, only to consider this as green light to look into fundamentals and, when relevant, financials. So first the chart, then fundamentals.

This is such an intuitively easy to understand investing principle but so hard to apply in real life.

Let’s take the Indian stock market as an illustration. A stock market that has a stable year, with a rise followed by an equal retracement, should not be any reason for concern, right?

Wrong, is what we argue based on our investing principle ‘start with the chart’. The longest term timeframe from the Nifty 50 Index in India has a very clear message: a breakdown from a 16-year rising trend.

This is serious, and has the potential to morph into a major crash.

We are not predicting, yet, any major bearish outcome. But any India stock market investor should be on high alert now, and this bearish breakdown can go any direction: steep decline, slight decline, sideways, etc.

We recommend to closely monitor the underlying indexes, as well as the Bombay 30 (which also shows a similar start of a breakdown). New positions are certainly _not_ justified right now!