The coming week will be decisive for stock markets for the remainder of January, as suggested by one of leading our crash indicators. A make or break week, and a good outcome will push stocks really higher in January. The opposite is true as well, and a retracement might start mildly or wildly, it will depend. Long term, our bullish Dow Jones forecast didn’t change, and several bullish 2021 forecasts neither.

The crash indicator we feature as the first trading week of 2021 comes to an end is VIX. Yes, it’s a volatility index, but the point is that we use its an intermarket correlation indicator.

What can we read into this chart, and how does it help us to understand future direction of stock markets?

Note that this is the type of analysis and market readings we share with premium members of our short term Trade Alerts service and our medium term oriented Momentum Investing portfolio, every weekend.

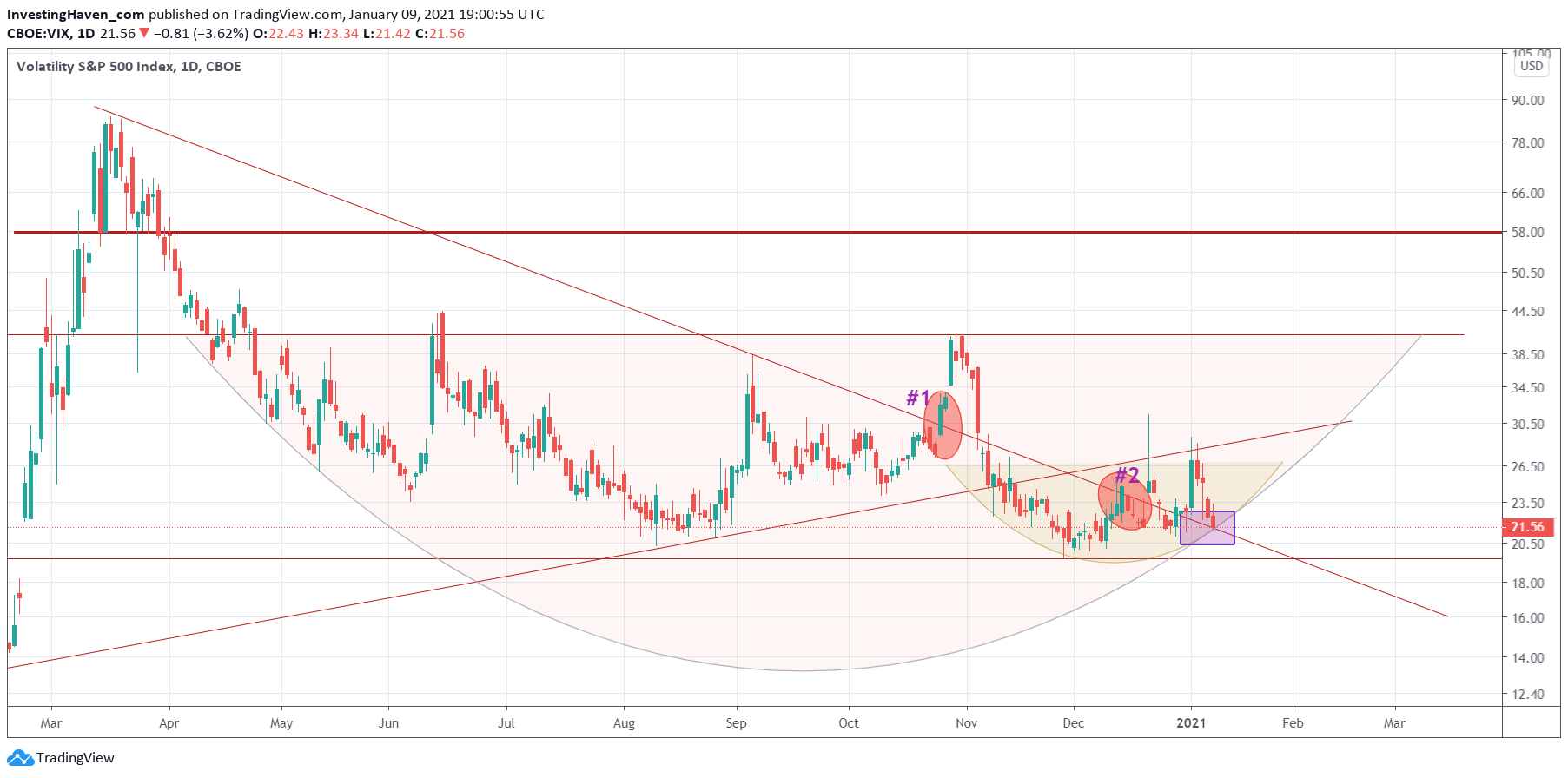

VIX has been testing the Corona crash trendline last week (rising trendline), but also the recovery trendline (falling trendline). Moreover, and equally important, price is touching a 9 month ‘potential’ reversal.

No coincidence, Friday’s close was right at the intersection of the falling ‘relief’ trendline and the 75% area of the 9 month reversal.

What does this mean, in human language?

- It means that once VIX falls below 21.56 points, for 3 consecutive days, we’ll have a strongly bullish stock market in the near term.

- It means that VIX might refuse to move lower, in which case stocks might consolidate around current levels. They will have a bullish bias, but the upside potential of indexes will be capped.

- Depending on whether it is scenario 1 or 2 (above) that plays out it will help us understand how selective we have to be with stock picking … but also how defensive/offensive we have to be with stop losses.

This is an illustration of how we analyze markets, read markets based on intermarket correlations and accurate / advanced chart analysis.

Want to receive detailed analysis like this, every weekend, combined with buy/sell signals? If you want to play the S&P 500 index in the short term we recommend you join our Trade Alerts. If you prefer signals on individual stocks, and have a focus on the medium term (from a few weeks to a few months out) we recommend you join our Momentum Investing service.