On Friday, stock markets went sharply lower in a way they have not done since end of last year. The Russell 2000, one of our 15 leading indicators, lost 3.6 pct which is a red flag! What’s the deal? Forget about the news, it is not going to add value, as per our investing tips. The interest rates is where it all starts. The chart of the rates is key, and only that one deserves your time! It suggests more volatility ahead, it does not suggest a stock market crash in 2019 (yet).

Intuitively, as markets go deep in red like they did on Friday, investors start looking for the news. As expected the news is … the news.

Stock Market Rally Trips on Global Growth Fears (WSJ)

Why stock market investors should worry about a bearish divergence in financials (MarketWatch)

How Far Could The Stock Market Drop? Will These Support Levels Hold? (Forbes)

Stocks End Week Lower Amid Hints of Slowing Growth: Markets Wrap (Bloomberg)

Alright, so there is clearly signs of slowing growth (not good) as well as bearish divergences (not good neither).

Where does this leave us, investors?

No idea, economic data are not good.

But wait a second just one month ago financial media were talking about the historic rally of Jan and Feb 2019. So things looked great a month ago, and now not any longer?

It’s the interest rate, stupid!

As said over and over again, stop reading news. As per Tsaklanos his 1/99 Investing Principles, the financial market variant on the generic Pareto’s law, just 1% of the news is relevant for investors.

Let’s turn our attention to the charts and focus on leading indicators.

Any turmoil in markets starts in currency and credit markets.

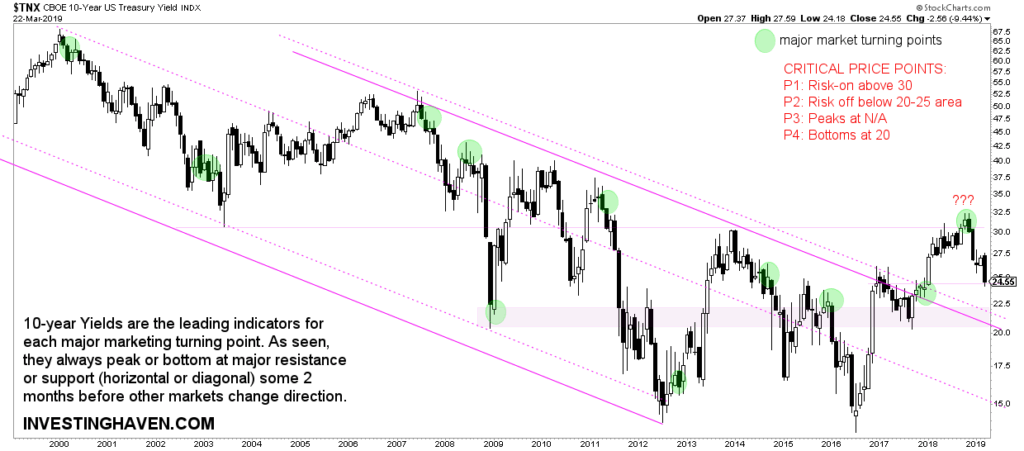

The 10-year rate is the key chart to watch. The annotations on our chart (in red) make the point: rates were not able to cross 30 points. They are now in this twilight zone: the 20 to 25 area. It is above the falling channel that connects the 2007 peak with the one in 2014 and 2017, most of them turning points for markets.

Is this chart suggesting a stock market crash is imminent? No, at least not yet. We expect a fast decline to the 20 to 22 point area. This will lead to more volatility in global markets. So April will be a volatile month, it’s almost a given!

However, a fast decline below 20 points will be really bad provided it comes with major breakdowns in stock market indices.

We are far from that point.

Bonds: Capital Inflow Sucks Money Out of Stock Markets

Markets are a closed system.

Capital moves from one asset class to another one. As rates decline, see chart above, capital moves to Treasuries, out of stocks.

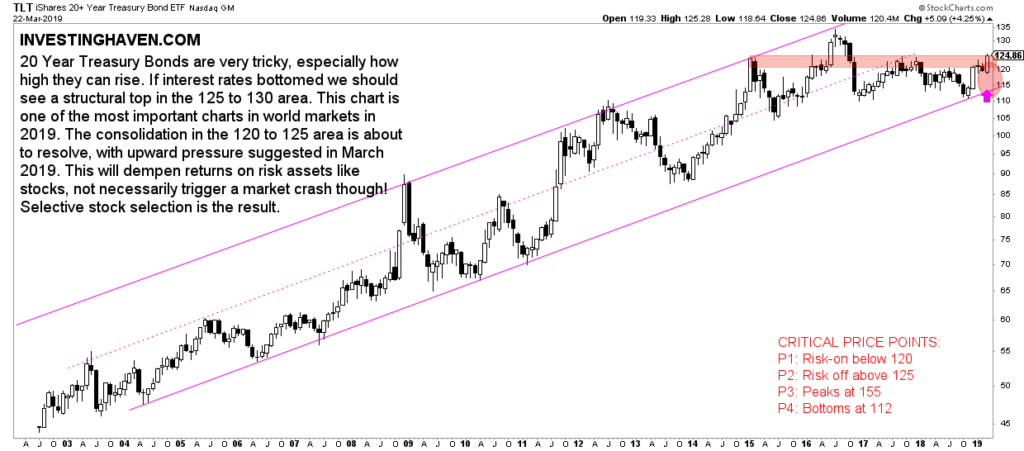

That’s what the TLT ETF chart as well as the Russell 2000 charts below show.

The TLT ETF, a measure for interest in Treasuries, is attempting to move above 125 points, after 4 years.

This brakout, if and when confirmed, certainly will suck money into Treasuries, out of stocks.

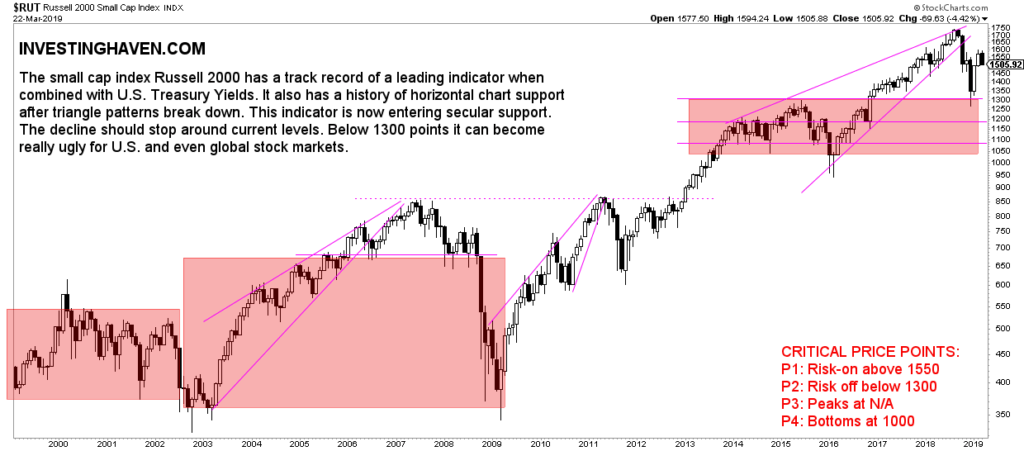

The Russell 2000 shows that money indeed starts flowing out of stocks after a great rally in Jan and Feb 2019. The Russell 2000 has another 200 points to fall before it will flash a real warning signal. Below 1300 points it might test 1050 in the worst case scenario. We are far from that point, no reason to be overly concerned.

The key message of the last 2 charts is this: as Treasuries will attract capital there will be an outflow out of stocks. It will dempen returns on stocks in the next few months. It will not lead to a crash per se.

Being selective in the stock market is key. And investing in utility stocks is the way to play the short term trend as said in our article published earlier today Investing Tips To Play The Volatility In April of 2019.