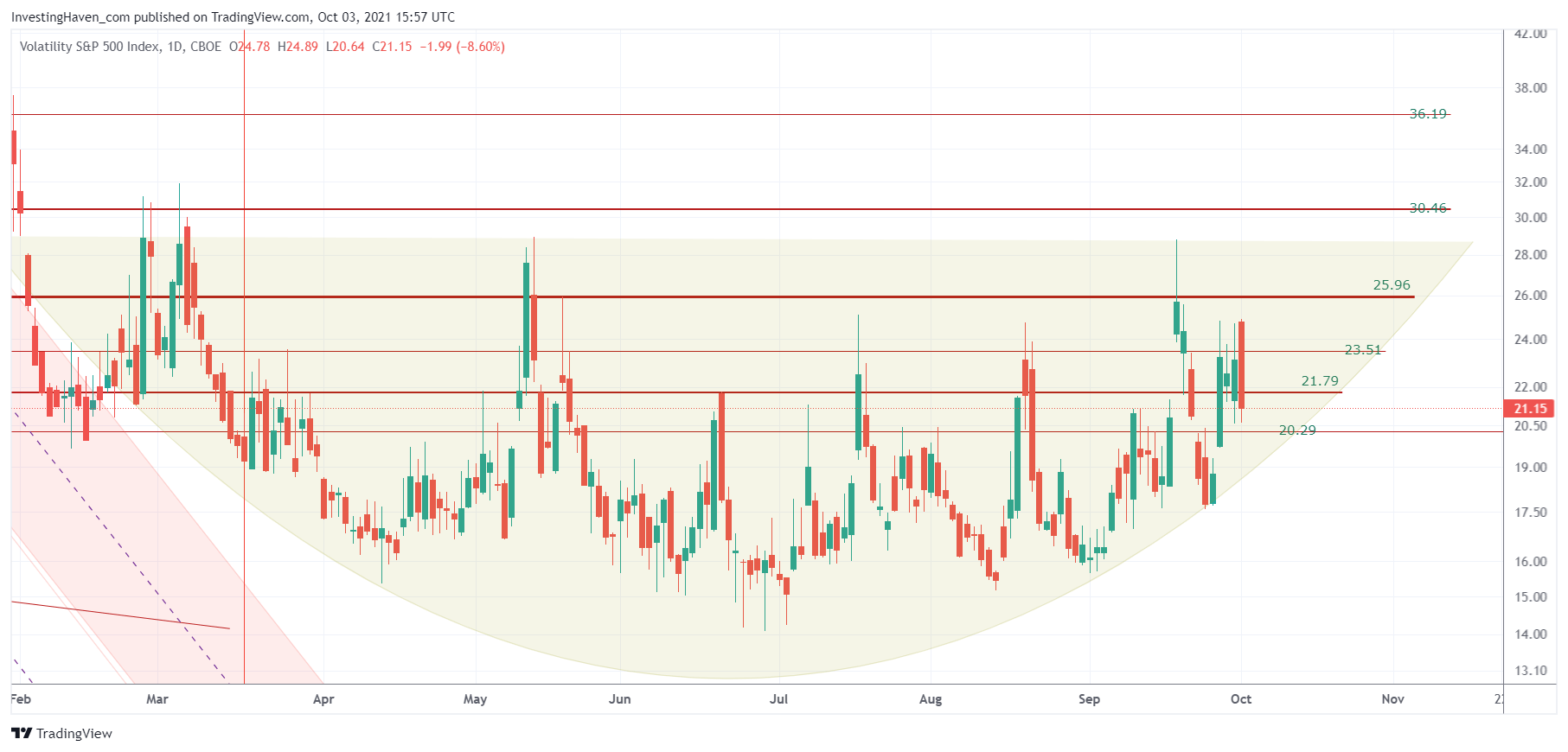

The volatility index is in great shape. This is not so great for many stocks though, as a rising volatility index tends to shake out most sectors and only push a few select stocks (sectors) higher. As said many times, volatility comes with market rotation. Many sectors got sold lately, a select few are improving.

The volatility index VIX is one of our leading indicators. It helps us understand short term price action in the S&P 500 which in turn helps understand how some sectors might perform.

The rounded reversal pattern in the VIX index is pretty powerful. It certainly is clean which increases the reliability of its outcome.

The month of October will continue to be volatile unless one of the following levels is broken to the downside:

- Early October: 19.00 points.

- Mid October: 20.29 points.

- End of October: 23.51 points.

We are eagerly waiting for a resolution in the VIX index. As long as the above mentioned levels are not cleared (to the downside, that is) we can expect elevated volatility levels.

More detailed analysis on short term timeframes is what we offer in our Trade Alerts service with our weekend updates. VIX as an indicator, how it relates to S&P 500 readings and we how handle rising and falling markets with short term trades on the S&P 500 is our focus. Starting in October we will offer automatic trading of the S&P 500 with short term trades, you can sign up here to be onboarded later this month and be notified whenever we start auto-trading.