This week was very interesting with several sudden moves introduced by the European Central Bank announcing a continuation of bond purchases until the end of this year. This resulted in weakness in the Euro and strength in the US Dollar. Because of this commodities showed weakness with the commodity index losing 4.5 pct this week. Is this meaningful or not, is the question we answer in this article.

Before checking the commodities chart for any potential damage as a result of this week’s decline we quickly review our thoughts of the last months.

In our Commodities Forecast For 2018 we looked into the medium and long term charts, and concluded that we believed that commodities may very bullish in 2018 but only if they move structurally above their breakout level for at least 4 consecutive weeks. This scenario did not materialize yet. We also said that if the USD remains very bullish it likely can crush the commodities complex though we don’t see it happening. Yet, any scenario is possible in markets, and we recommend readers to check both charts closely in the coming weeks and months in order to identify the next trend in both assets!

Exactly 2 months ago commodities were on the verge of a breakout. In Commodities Inches Away From Bull Market To Start In 2018 we identified there is a fair chance the new bull market of 2018 in commodities is about to start anytime soon because several commodities like crude oil as well as gold and silver are breaking out. Momentum was bullish in the commodities space, and the commodities index was testing a secular breakout level. Yet, no breakout took place.

Last but not least, in Emerging Markets And Commodities Very Bullish In 2018 and 2019 we saw another mega breakout chance. We said: “the pattern that is unfolding is strongly bullish. Not much will stand in the way of commodities. Because of this, and the intermarket dynamics, we also believe that emerging markets will outperform in 2018 and 2019.”

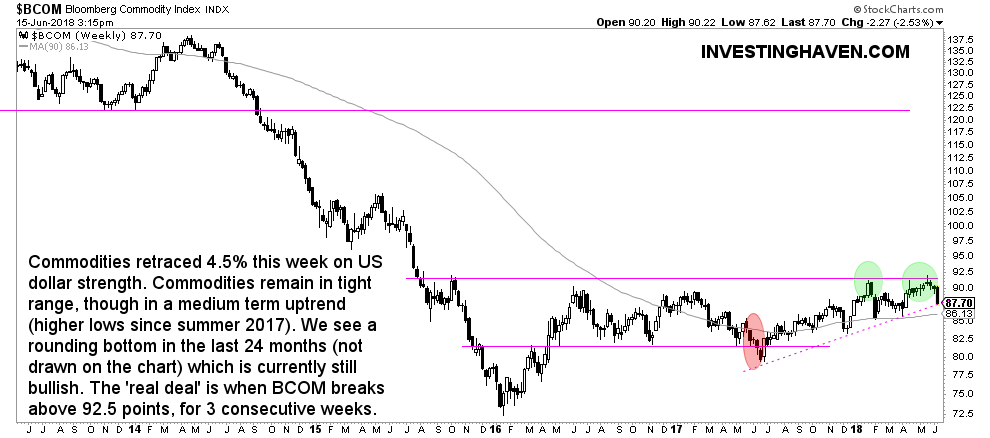

This paints a clear picture of how commodities are moving: from one breakout attempt to another one, as indicated with the green circles on below chart. Yet, not any of them has succeeded. With this week’s Euro weakness / Dollar strength commodities retraced yet another time.

What’s interesting is that the commodities index BCOM retraced this week to the medium term rising trendline (dotted line). For now, there is no damage done in the commodities complex, and the medium term uptrend (bull market) is still intact. However, commodities must show strength here, otherwise they will fall another 7 percent before they find mega support.

Summer 2018 will become very interesting for all commodities, and the next few days and two weeks will be telling!