One of the major themes underlying InvestingHaven’s market forecasting methodology is intermarket based. In plain simple terms: how does a (new) trend in one market influence one or more other markets. You may call it intermarket correlations, we tend to call it intermarket dynamics. One such ongoing correlation is between emerging markets (EEM) and commodities. They suggest that both emerging markets and commodities will be very bullish in 2018 and 2019.

We have said repeatedly to investors should look in an unbiased way to markets. This, however, seems to be one of the hardest things for the vast majority of investors. Most investors are biased, and sometimes even they are unaware unbiased. That may have many reasons, including:

- Emotionally tied to a market: e.g. working in a specific sector or company or another reason for having a (emotional) preference.

- Luck in the past, or lack thereof: e.g. lost lots of money in a past trade in a market or made a huge profit.

- News: e.g. tends to follow the news in a specific market.

- Fundamentals: e.g. too much focused on the fundamentals while the market is not reacting on fundamentals.

- Social pressure: e.g. influenced by some gurus or family or friends.

There are many more reasons to be biased than to look at things in an unbiased way.

One of the key success factors in markets is to be unbiased, at any given time, both towards your own holdings (very hard) as well as all markets in general.

If you are able to do so you will see the value of your portfolio increase significantly over time!

Case in point: emerging markets and commodities.

Why Emerging Markets And Commodities Will Be Bullish In 2018 and 2019

There are plenty of reasons to hate both markets. Both were very weak in the past. Some investors may have lost money by selling some of their commodities and/or emerging markets holdings because they were not moving while so many other sectors were strongly in green. That may be frustrating.

However, talking about being unbiased, for those who are open to see, there are huge opportunities in both markets, first and foremost because both suggest much higher prices are coming in 2018 and beyond.

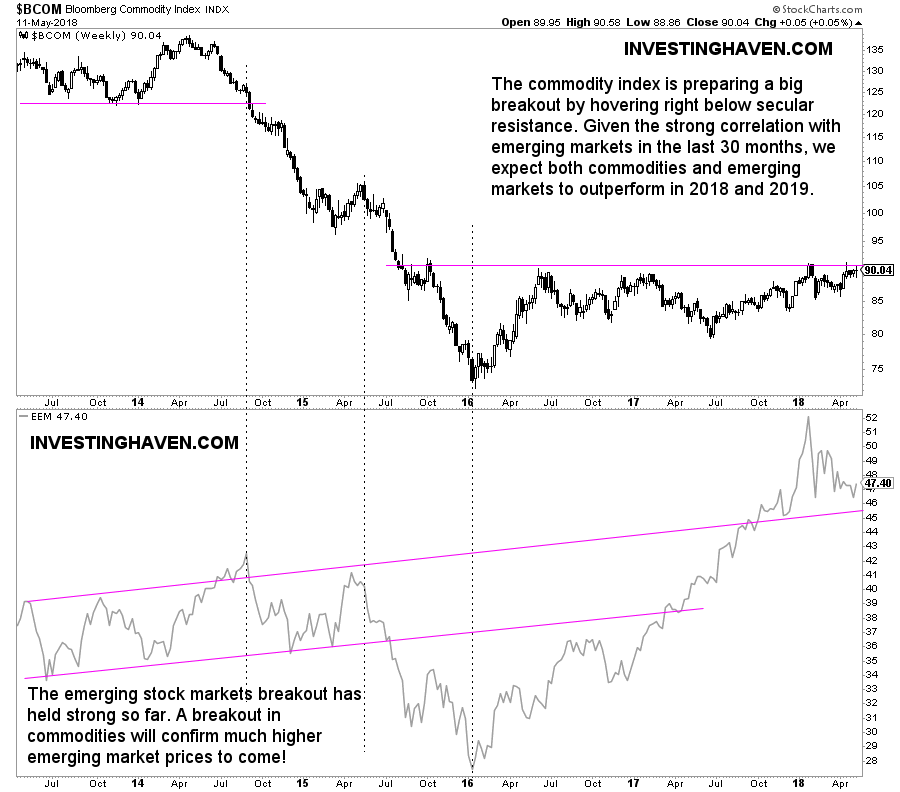

If anything, the correlation between both markets is crystal clear. The chart below makes the point.

Commodities are about to break out strongly. The pattern that is unfolding is strongly bullish. Not much will stand in the way of commodities.

Because of this, and the intermarket dynamics, we also believe that emerging markets will outperform in 2018 and 2019.

The lower pane of the chart shows emerging markets (EEM ETF). They have provided leverage on commodities prices in the last 28 months.

Given our recent observation that the Great Stock Bull Market Resumes In 2018 we are convinced that it will provide a constructive environment for emerging markets as well.

Note that we have written extensively about this: Opportunity Alert: Why Emerging Markets Will Continue To Outperform US Markets in 2018 and It’s Official: Emerging Markets New Major Bull Market In 2018 Is Now Confirmed as well as Emerging Markets Outlook 2018.

As said many times, do not get confused by mainstream financial media. Currently, sentiment is bearish for emerging markets. This article for instance talks about Chinese trade war and negative effects on commodities, while this one suggests emerging markets are in a downturn. While there may be some fundamental aspects in those articles that may be true they are not relevant for investors.

Look at leading indicators, check the important charts and the 1% price points that really matter on charts, stay focused on intermarket dynamics, remain open and unbiased, and you will see great opportunities, like the ones in commodities and emerging markets in 2018 and beyond.