The evidence is growing. Silver miners are attractively priced for the long term. Stated differently, select silver miners deserve a position in a long term portfolio. 2023 will come with volatile periods, very differently compared to 2022 though, as explained in our annual forecasts. Yes, the US Fed will continue to create havoc but not for endless and forever. The silver price chart looks great, long term, we have confidence in our silver forecast 2023. All this implies that we expect a few ‘pumps’ in silver miners in 2023, justifying long term positions even in a year which will come with volatile periods. Please continue reading about our silver stocks analysis in this comprehensive article: our silver stocks outlook for 2023.

This post builds up on the insights we shared in An Epic Test Ongoing In Silver Miners To S&P 500 Ratio. It also builds up on the silver price posts in recent months: the silver price chart, the physical silver market and long term buy signal on silver.

In our most recent post in which we featured the silver mining to S&P 500 ratio chart we concluded:

The silver mining chart should help us with a buy signal on the sector while individual silver mining stocks might already be in a ‘buy’ area. The ultimate confirmation comes from the SIL to SPY chart convincingly clearing 0.08.

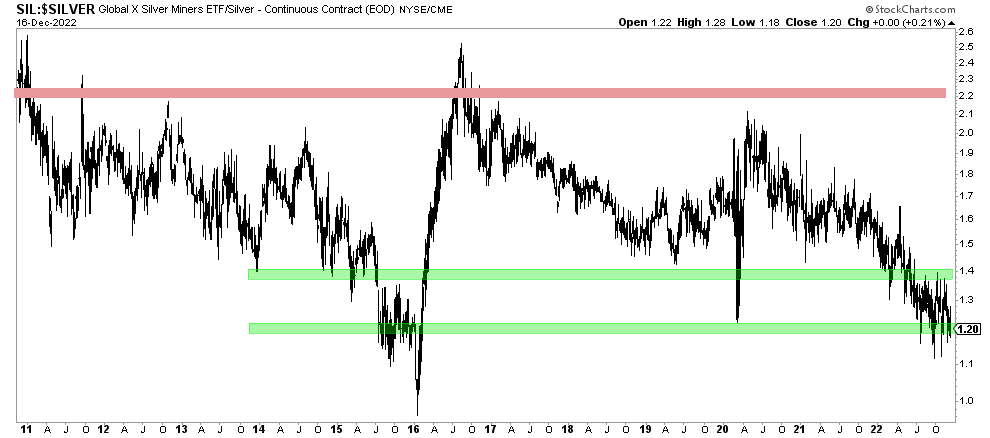

Below is the ratio chart of silver miners expressed in the price of silver, as a complementary view on the silver mining space. We use SIL ETF to represent silver miners.

Every time this ratio dipped to the 1.20 area it marked the start of a big run in silver miners.

In fact, there are 2 important levels to watch in the SIL to Silver price ratio chart: 1.4 and 1.2. Both are indicated in green. More specifically, once this ratio chart falls below 1.4 it is time to keep eyes and ears wide open as silver miners start entering a very attractive area.

Note that ratio charts are not timing indicators. They are more stretch indicators. The red line on below chart, for instance, is an area in which it’s time to take profits as silver mining prices are stretched.

That’s what we are doing in our Momentum Investing service with a special edition on silver and silver stocks shared on Dec 2nd The Silver Market Long Term Very Bullish. Our Silver Mining Top Picks. which is accessible to Momentum Investing members.