Throughout 2023, and in all our writings this year, we’ve been fixated on two primary subjects. First, rotational dynamics, followed by giant consolidations. None of the two is bad, both are good, provided support structures are respected. While chartists will tell you that this market cycle is creating really powerful bullish reversals, many investors do experience it very differently. Investing in 2023 has proven to be very challenging for the majority of investors even though our 2023 forecasts have been accurately predicting most of the trends.

The Tesla analogy is the only one we can use to illustrate what investing in 2023 feels like.

Investing in 2023 feels a lot like investing in Tesla before the breakout

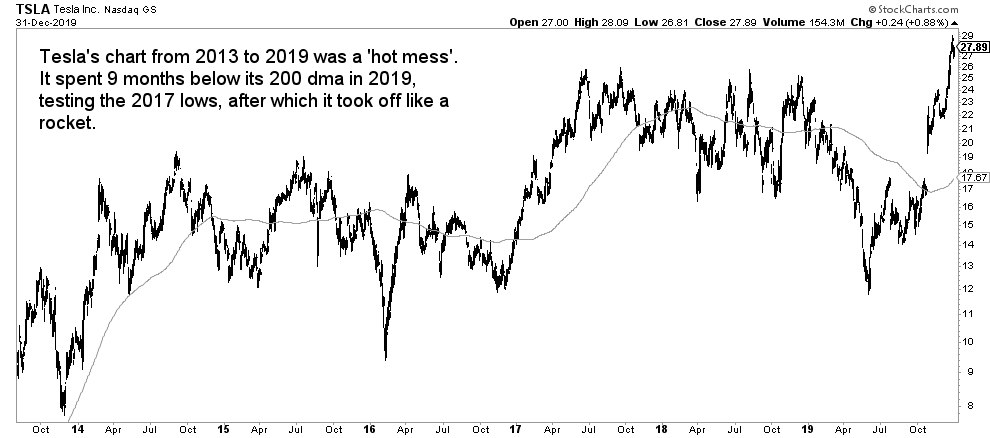

Let’s go back 5 years in time. We want to make the point by looking at Tesla, back in 2017 and 2018. This is the Tesla chart:

A few things to note here:

- Investors who held Tesla between 2014 and the summer of 2019 likely experienced disappointment.

- For those who bought Tesla based on recommendations, such as those from financial advisors or analysts, the ride might have been far from smooth. When emotions take over due to a “non-performing” position, investors can make irrational decisions.

- They might have used a variety of reasons to justify their belief that Tesla was a terrible investment: a significant short position, Elon Musk’s emotional interviews, perceived lack of focus by CEO Elon Musk (due to his involvement in SpaceX), legal disputes between Musk and the SEC, and so on. You name it, and the financial media probably covered it. People tend to find the reasons they need to blame a “non-performing” investment and pivot to another position, potentially restarting the cycle.

Now, 5 years later, in hindsight, what do investors tell about the Tesla opportunity back in 2018 and 2019? They will tell you: better had bought and not looked back for a few years, right?

Isn’t it interesting how investors experience a bullish reversal when it’s happening vs. how they think about it in hindsight? It’s clear: you cannot get a strong bullish trend (feels good) without a long consolidation (feels boring).

Investing in 2023 – patience in a select few sectors & stocks will be rewarded

The Tesla analogy is the only one we can use to illustrate what investing in 2023 feels like: fearful, boring, nerve wracking.

This is how investors should navigate the current market cycle:

- by selecting the right sectors and stocks, practicing patience;

- understanding that not all portfolio positions will surge simultaneously;

- and allowing time for consolidations to run their course.

However, those who conducted thorough due diligence, maintained their faith in electric vehicles and Tesla, were handsomely rewarded within a span of 12 months, from November 2019 to December 2020. Even if they had to wait for three years for Tesla to take off, the patience paid off.

Interestingly, the number of investors who remained patient was likely less than 1%. We can’t provide hard data to support this, but it’s an educated estimate based on our experience.

All that was required for a Tesla investor in 2017, 2018, and 2019 was to do nothing. Simply keep researching the charts and fundamentals, reaffirm the enormous growth potential, and give it time.

Top sector tips & stock tips for investors in 2023

In the Momentum Investing weekend edition, we presented charts that demonstrate why our sector picks and top selections resemble Tesla in some aspects. Perhaps not with the same 10x upside potential, but they share the characteristic of being “give time, be patient, refrain from complaining, don’t overexert, and let the market work for you” investments.

Investing in 2023 has proven to be the most challenging “easy” thing to do. Patience is an unusual virtue for investors, especially in a world inundated with information. Brokers, incidentally, thrive in such an environment; they are the primary beneficiaries.

Check our must-read weekend analysis, full of great charts and stock picks, in sectors that are starting to create bullish momentum: The Market Is Coming Our Way >>