We have been pretty vocal about what we believe will be the most powerful investing opportunity of the decade: green battery metals. The problem is that most green battery metals stocks are worthless, it is only a handful of companies in the green battery space that are worth your time, attention, capital. As per our green battery metals forecast we see opportunities in the graphite and cobalt space as 2022 kicks off.

If anything, we find beauty in the green battery metals space, as per our investing practice explained in Investing Secrets – Beauty Results In Profitable Investments. The cobalt chart you will find in this article has everything to qualify as pure beauty. In investing terms: very high probability of a highly profitable investment.

If we look at 2021 we conclude that lithium stocks were the biggest trend of 2021. We did hit this trend in our Momentum Investing service. All our top 7 lithium stock tips went up between 100% and 300%. On one particular lithium miner we flashed a take profit alert the day before it peaked (300% from our first entry recommendation).

In the meantime cobalt and graphite stocks continued consolidating.

We said many times that profits from the lithium space would roll into cobalt and graphite, and we believe it is happening right here right now.

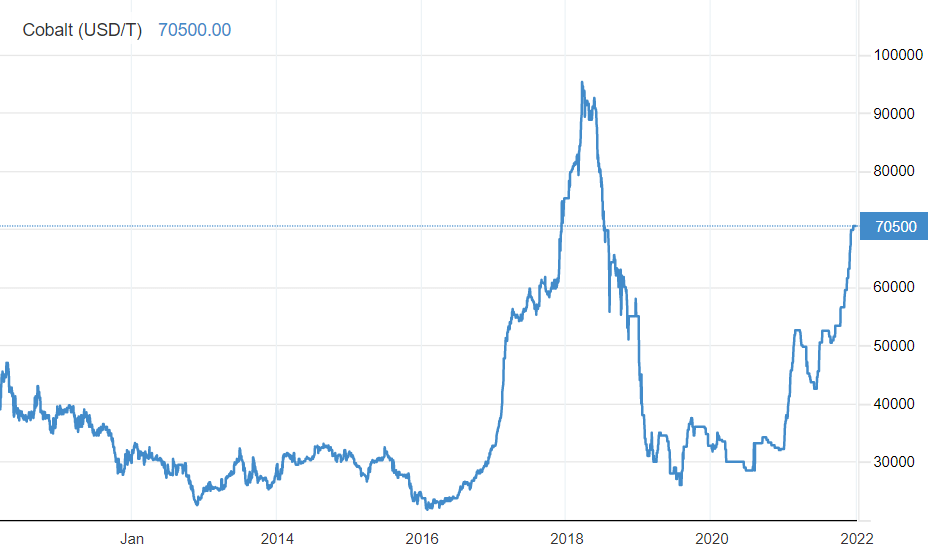

Below is the cobalt price chart which can be tracked here.

It’s a 10 year chart. What do you see? An explosion, right! It’s the same type of move that started in lithium around summer. What it triggered in the lithium market in 2021 goes into history books.

Hold on, so then why didn’t cobalt miners explode yet?

On the one hand, broad market conditions did not allow any momentum trend as of mid-November. On the other hand, ‘smart green battery metal investors’ had their capital invested in lithium.

In other words, as lithium miners came down (read: capital flowing out of lithium) and provided markets hold up the next big thing in green battery metals might be imminent.

Just to illustrate this we feature the weekly chart of our favorite cobalt miner which trades in Australia.

What do you think this cobalt stock will do as its leading indicator (price of cobalt) continues rising?

This chart is a pressure cooker, all our chart readings are flashing ‘buy’. All we need is the breakout confirmation which might come as early as next week (or it will be delayed).

Below is the weekly chart. One thing stands out: twice did Cobalt Blue Holdings explode, truly explode, and it did so in a period of 4 weeks. Please check December of 2017 and December of 2020: 4 green candles which pushed its stock price 3x higher.

This is in no way a solicitation to buy this stock because we believe it is too late. We recommended a first in January around 0.25 AUD, and a second entry two weeks ago. This stock is in our top green battery stock list (reserved for Momentum Investing members) since July of 2021. The only purpose of this article is to show one of the most powerful reversals we currently see, but also how strong this sector is compared to most other stocks/ sectors that are truly struggling even with indexes at ATH.