Energy stocks might be one of the hottest sectors right now. We would argue that lithium and cobalt are much hotter, and it shouldn’t come as a surprise that we tipped the very best lithium and cobalt stocks in our long term Momentum Investing stock tips (yes, we are hitting many multi-baggers because green battery metals are crushing each and every other sector). Still, it’s interesting to find out whether energy stocks in the crude oil and gas space are worth buying now, holding, or exiting.

If we simplify the answer to this question, we believe we should focus on the leading indicator for the energy sector which is crude oil.

Note that when we talk about ‘energy stocks’ we really refer to traditional energy (crude oil and gas primarily). We discussed uranium a few weeks ago, it’s a different category. Similarly, new forms of energy, primarily green battery metals, are not what we refer to if we talk about ‘energy stocks’. If we compare ‘energy stocks’ with green battery metals it looks like we were 100% right, about a year ago, when we published our forecast that green battery metals would qualify as THE biggest opportunity of this decade: they are outperforming energy stocks, by far, and our premium members are really happy with this of course.

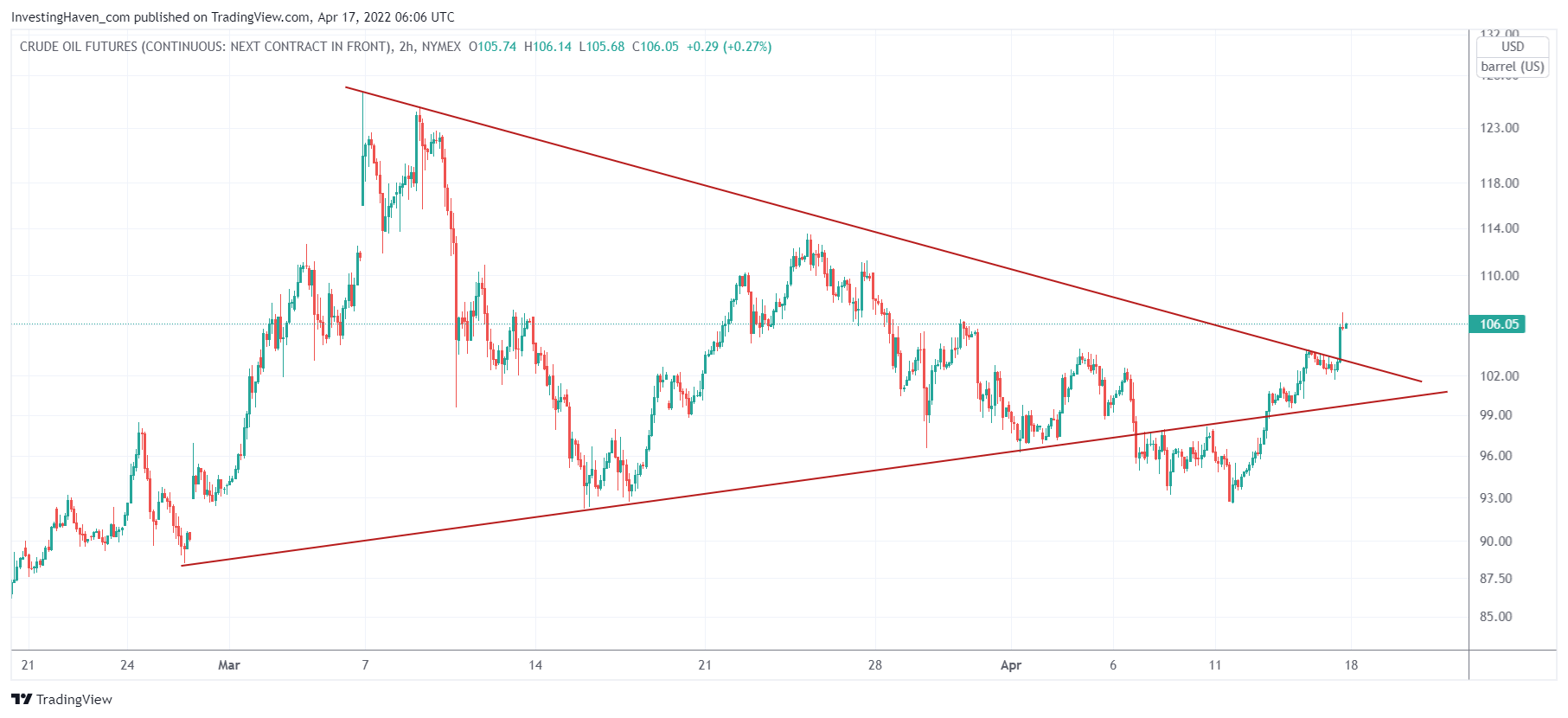

The crude oil price, short term timeframe, has a bullish breakout of a triangle setup… after a bearish breakdown two weeks ago. This really characterizes the crude oil chart: volatile, failed moves, fast moves.

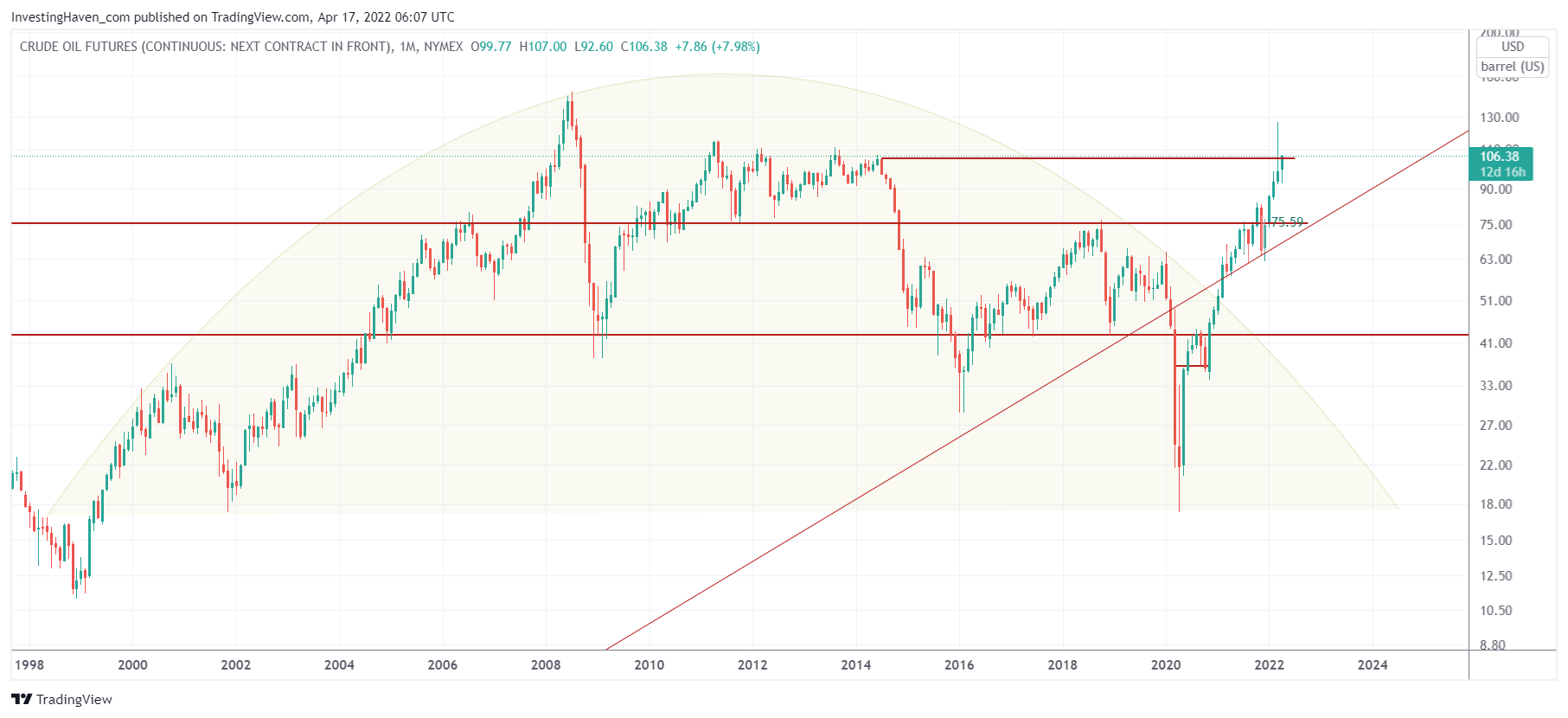

If we zoom out, on the monthly, which we also featured in Crude Oil Investors Better Take This Potential Turning Point Very Seriously we believe our focus is exactly the price point where crude oil currently trades: 106 USD/barrel.

We said a few weeks ago:

What are watching for confirmation of a ‘turning point’? Monthly closing prices: Below 116 USD/barrel it is not promising. Timing axis: Crude futures went below zero mid-April 2020, we will be looking for confirmation whether crude is completing a 24 month cycle in April of 2022.

There you have it: we are right now at a decision point in this market. After a 24 month rally we see crude oil trading below 116 USD/ barrel. The monthly closing price of April will be crucial, absolutely crucial.

April 30th, 2022, that’s the closing price we will be watching to answer the question we asked in the intro.