Gold is rising, silver is catching up (slowly but surely). It is crystal clear that our bullish 2022 gold forecast and silver prediction are underway! What about gold and silver miners? There is not a lot happening in that space, does it mean that this is a bullion party and precious metals miners are not worth considering?

Yes and no, is our answer to that question.

Yes, because betting on bullion prices is clearly proven to be very profitable. Note that this is the start of a bullish trend, there is a long way to go, especially in spot silver. So, betting on higher bullion prices is a safe bet.

No, because precious metals miners should be following, they are lagging for now but their chart is improving.

Let’s not forget that we started our bullish calls for gold (and silver) back in December. This is what we wrote back then, and the article was published in the public domain (our premium members got more detailed information and guidance to start positioning especially in silver bullion) Gold: An Amazing Long Term Reversal To Watch In 2022

The reversal, at this point in time, is really promising. And the most interesting finding is that this does not match the perception and feeling of investors. They have a bad feeling with gold and silver currently;

It’s not justified, says the chart. It might take more time for a good gold bull run, and we cannot reasonably expect any fireworks until 2000 USD/oz is cleared. We also cannot reasonably expect any acceleration between now and then.

But this chart looks really promising going into 2022, and we believe we see early signs on the chart that confirm our bullish gold stance for 2022 and beyond.

We continued:

And then you zoom out, to the longest timeframe. You ask yourself: what an amazingly bullish chart. Admittedly, this is a very long term timeframe, and a few quarters (even an entire year) represent a few tiny candles on this chart. But what a bullish long term setup, what is one year for such a long term bullish setup, right?

Today, some 3 months later, it’s clear that our chart observations were spot-on.

What about precious metals miners?

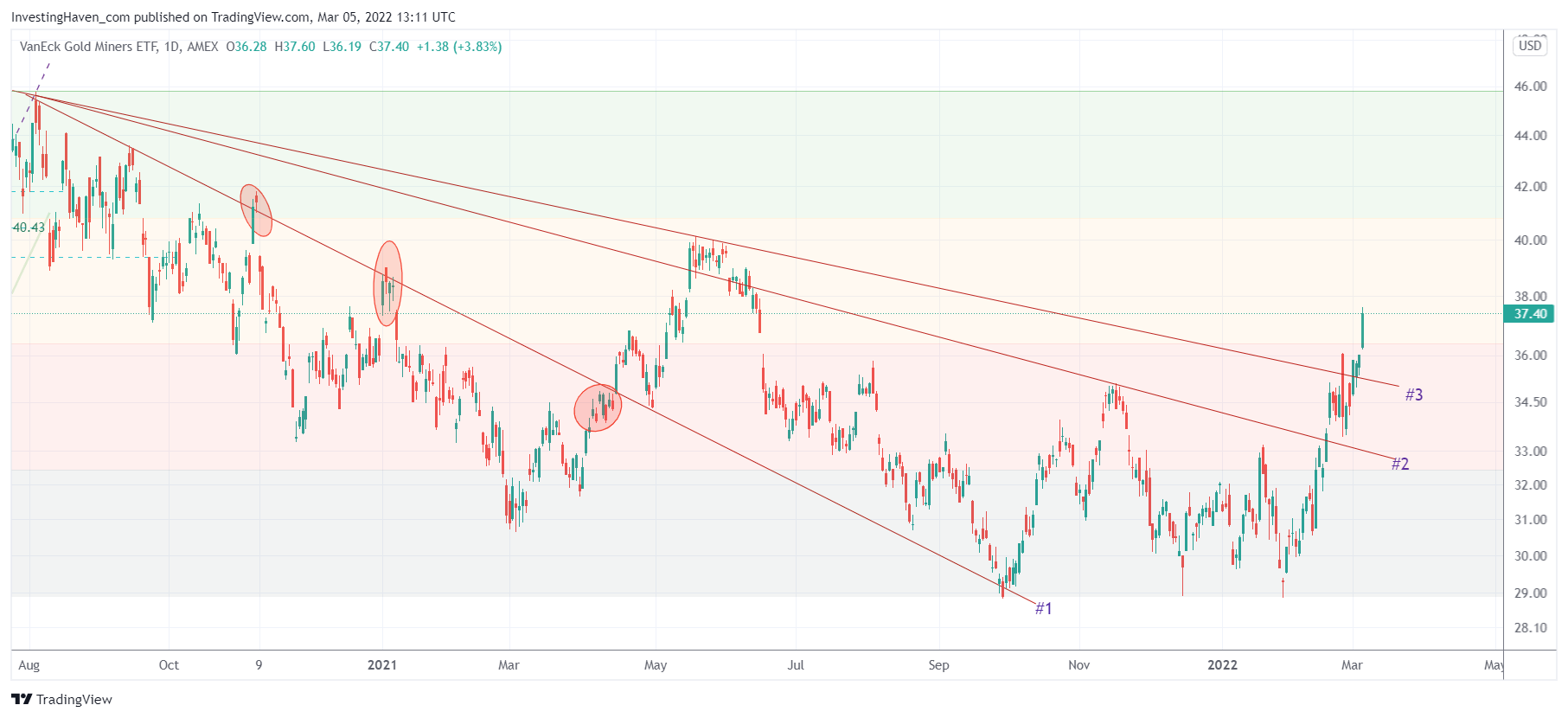

The problem with gold, currently, is that most gold stocks are not following gold’s path. Stated differently, most gold miners are lagging. That’s maybe related to the nature of the gold rise (fear) combined with struggling stock markets. Sooner or later, though, we expect gold miners to catch up.

The GDX ETF broke out only on Friday.

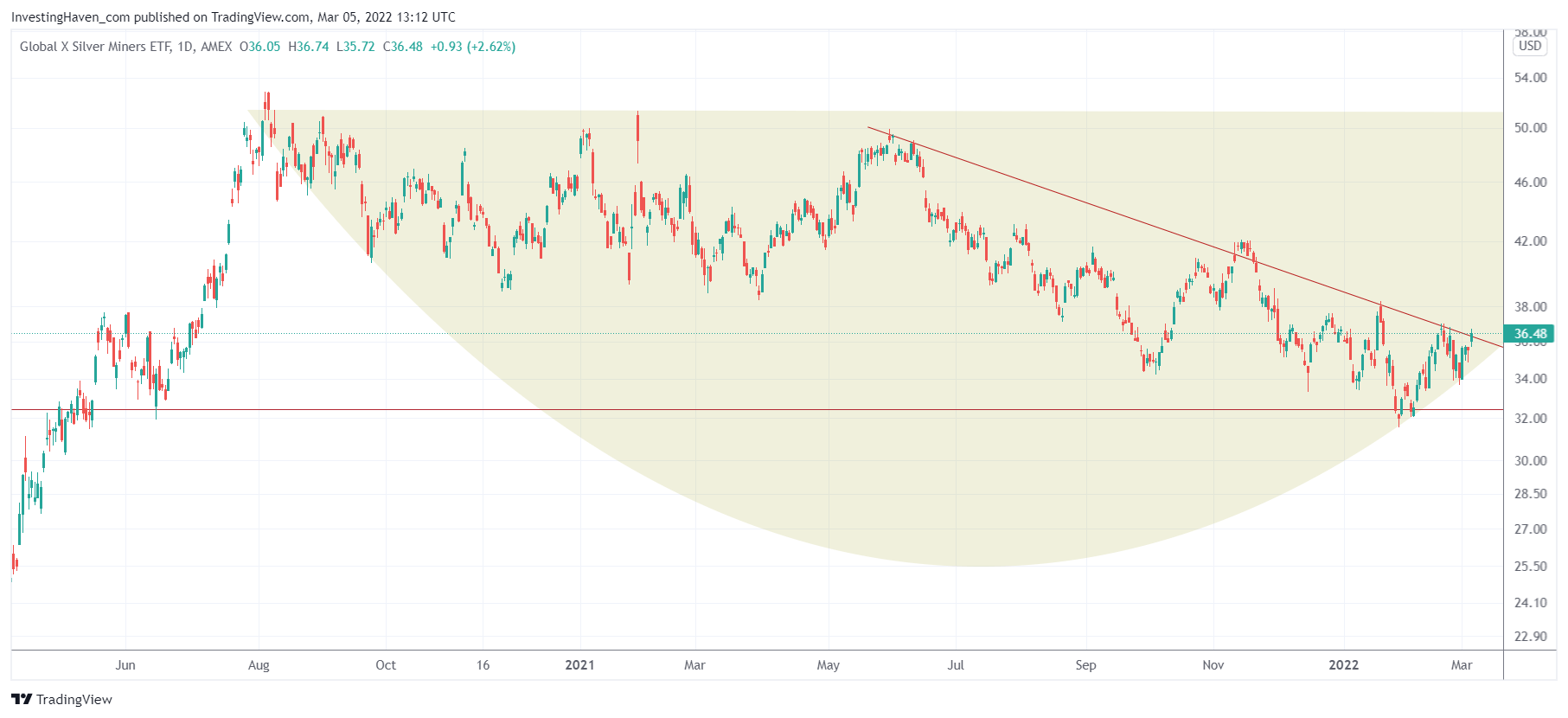

Silver miners are really lagging.

Does this sound as an opportunity?

An amazing opportunity, and we are going to be frank: the only commodity, other than green battery metals, that we are really interested in is SILVER. We love the fact that silver spot as well as silver miners are lagging: it gives us time to get organized, also in our portfolio. Moreover, it gives us time to get really aggressive on the next silver dip!

There is only one silver miner that really broke out. There are a few that are ready to break out. They are all in our shortlist stocks in our Momentum Investing research area. Our weekend analysis sent earlier today, accessible in the restricted area for (new) members, has lots of details on how to play the coming silver boom! Moreover, a few weeks ago, we published a ‘special silver edition’ in our Trade Alerts weekend alert which lays out 3 ways to play the precious metals trend (ranging from low risk to high risk / high rewards outcomes).