When, oh when, will silver stop falling? One week ago, is our answer! Admittedly, we did not expect the 20 USD level to be breached, but then again, in the bigger scheme of things, what is a 10% violation of a key level IF that particular market eventually resolves higher? Here is one silver indicator that suggests silver is a SCREAMING BUY. No, we are not out of our mind, we are 100% conscious and responsible in making this call. Although our silver forecast 2022 may not entirely materialize this year, it certainly will do soon after!

If we go back to Is The Silver Price Breakdown Official Now? These Charts Tell A Story you can see how all charts have a pretty significant structure right at 18.50 USD, exactly where silver closed this week and last week. Weekly closing prices matter most.

- On the daily chart: the lowest, stretched, support level comes in at 18.50 USD.

- On the weekly chart: the long term moving average comes in right at 18.50 USD.

So, in a way, silver went to the lowest possible support level. While it clearly is in a breakdown area, let’s not sugarcoat it, we can also reasonably say that a recovery from here would qualify as a failed breakdown.

Yes, silver has a track record of scaring off investors. It’s a very emotional market and asset. That’s why you need (a) a long term view when investing in silver (b) be able to stomach wild swings in BOTH directions!

With that in mind, we have two really interesting insights.

First, we made the point that the USD topped. As per our 7 Secrets of Successful Investing identifying turning points is, by far, the toughest challenge. We were on record, in our premium Momentum Investing research service, calling for the top one day before it happened. The market has to prove us right and we work with 107.72 as the ultimate turning point confirmation (only closing prices matter, max 3 consecutive days above it can be allowed).

Second, IF (that’s a big IF) our USD turning point analysis was right, then silver bottomed last week.

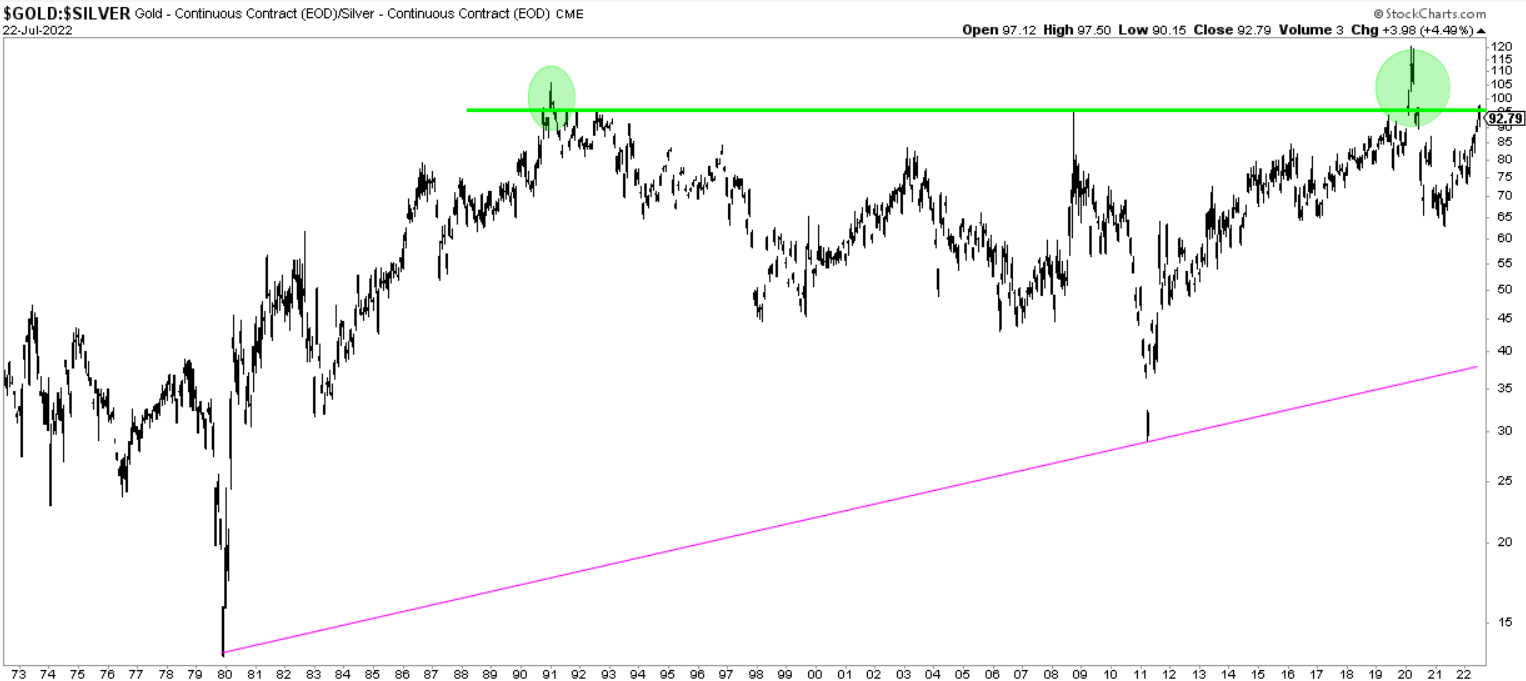

Below is the indicator that says that silver is a screaming buy: the gold to silver ratio over 50 years! Take a look at the green line: any time, in history, silver achieved a ratio of 92:1 when compared to the price of gold, it started an epic turnaround. In some cases it took a few years, in other cases a few months, for silver to become explosive!

Will this time be different? We don’t think so!

Also, check out more charts and the one super bullish silver market data point in our latest Trade Alerts weekend analysis. Also, in our Momentum Investing shortlist (last update on Sunday, July 24th), we track 5 silver miners that will outperform whenever the silver price turns around.