The energy sector was one of the sectors that was hit hardest during the pandemic. It is one of the slowest to recover. But what a recovery is going on now. A giant bullish W reversal is complete now on the weekly chart, and in doing so this sector is setting 2 breakouts. Global stocks are bullish, and so is our stock forecast for 2021 and commodities forecast for 2021. Because of this we forecast that it is a matter of time until the next breakout in energy stocks will occur, and whenever it happens it will be THE secular breakout, this is why.

This is a short but powerful analysis with one and only one focus: the chart. We look at XLE ETF representing energy stocks, on a weekly timeframe.

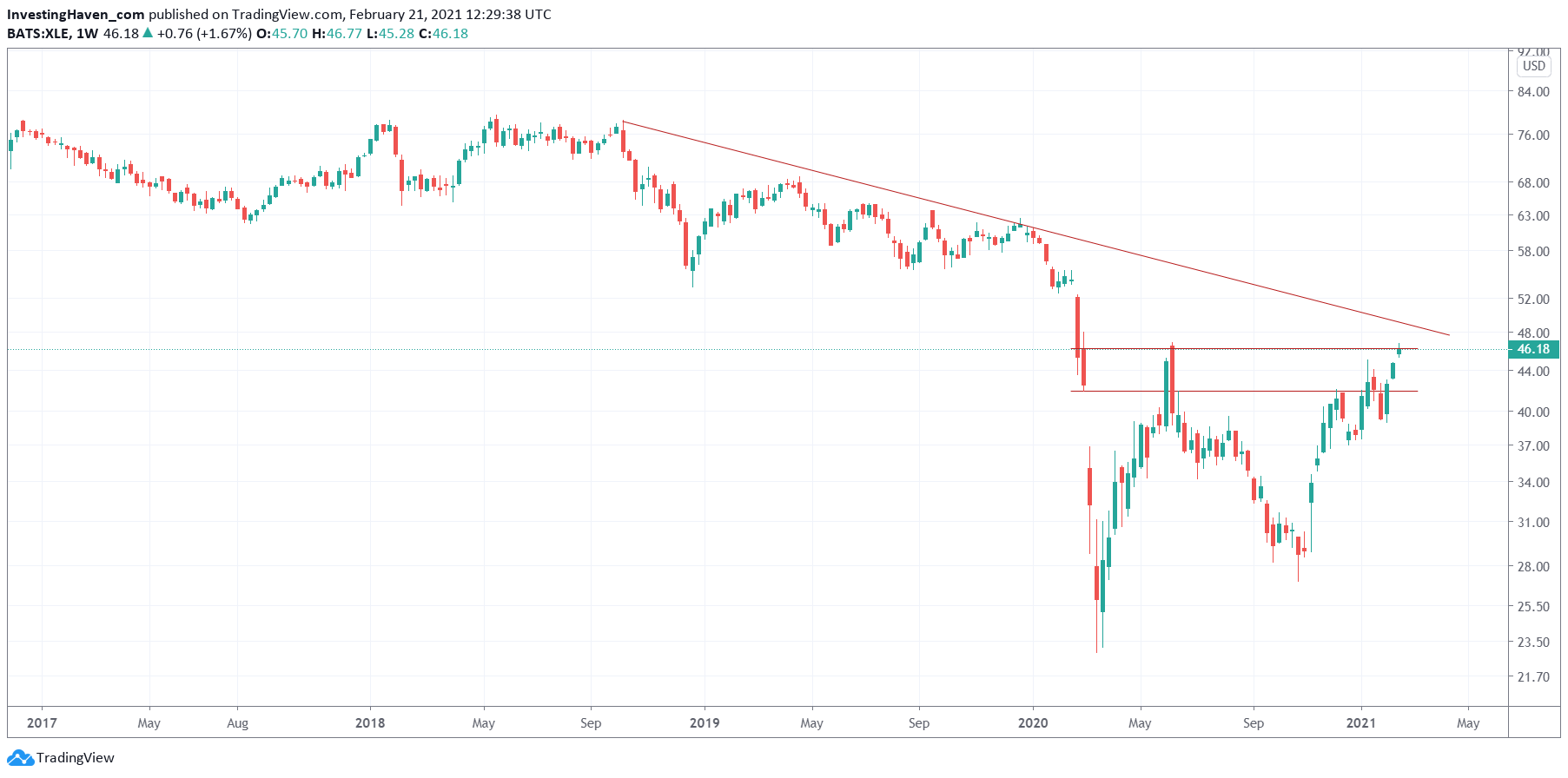

First, we focus on the 2 horizontal levels that we find on this chart, representing the higher levels of the bullish W reversal that started right after the crash in March of 2020.

Both levels were taken out recently: the lower level 3 weeks ago, the higher level last week.

That’s fast, it indicates the powerful momentum in this sector.

Next, the big moment is underway: the test of the falling trendline that started in Sept/Oct of 2018. That’s an 18 month downtrend.

What’s special about the next test, the one of the 18 month downtrend, is that once broken to the upside it will mark a secular breakout. Not a regular breakout, but a secular breakout.

And what’s even more interesting is that the pandemic somehow helped collect ‘bullish energy’ to accomplish this. In a way, the pandemic might help the energy sector by creating a solid reversal (post crash) at lower levels (crash) to end the bear market trend.

Enjoying our work? We invest in broad stocks as wel as commodities in our Momentum Investing portfolio. We didn’t take a position in an energy stock yet, but might do so in 2021. In our Trade Alerts premium service we focus on SPX trading in the short term. Next to SPX trading we take a few swing trades per year, and featured one specific energy stock in our weekend update which is a top candidate for a position in a few weeks or months. In 2020 the combined portfolio delivered +93%. Results are tracked in our trade log books, and publicly shared every 6 months on our Mission 2026 page.