We believe that graphite stocks will have a great 2023. There has not been a sector wide participation in graphite stocks since the graphite market top in January of 2021. The sector is deeply undervalued in our view. One of our 2023 forecasts is that graphite stocks will react to the upside. Our graphite stocks forecast 2023 is very bullish, getting close to our bullish lithium 2023 forecast. We are particularly interested in graphite stocks that produce Flake Graphite for the EV sector. That’s because this is one of the mega trends of this decade as explained in great detail in The Biggest Investing Opportunity Of This Decade.

What’s interesting in the graphite market is that 2022 was a highly bi-furcated year.

The start of the year was great but several graphite stocks lost momentum early on in the year. Heading into 2023, there is one graphite stock that is trading at multi-year highs while most are trading near multi-year lows.

This is happening while a supply deficit is underway and graphite prices remain solid.

Something has to give, we believe graphite stocks will react to the upside in 2023.

Graphite forecast drivers

There are a few drivers for graphite stocks:

- The price of graphite.

- The supply/demand situation in the physical graphite market.

- Broad market conditions.

The price of graphite remains solid and is up in 2022. We expect the price to continue to stay strong in 2023.

The supply deficit in the physical market is now well underway. Similar to the lithium market there is such a high demand for physical graphite that a supply crunch is inevitable.

Broad market conditions are slowly but surely improving. As said in recent posts:

Why Markets Should Resume Their Uptrend The Latest In March of 2023

The Market Will Not Move 50% Lower Contrary To What The Gurus Are Telling You

Conclusions from the Dow Jones 100 Year Chart

Graphite price forecast 2023

The graphite market does not have a spot price like most other commodities have.

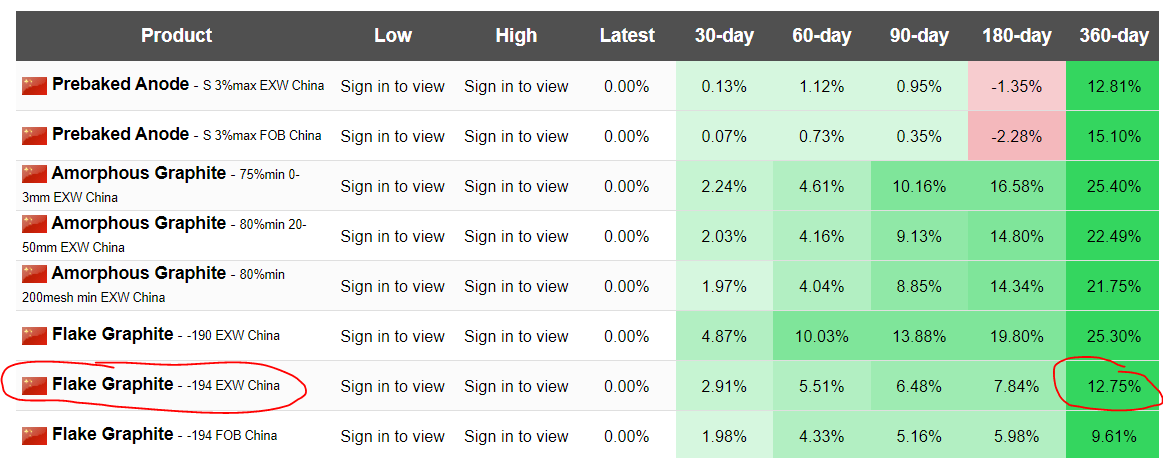

Moreover, there are multiple types of graphite. An overview of those graphite types with their prices are shown below (snapshot: Oct 31st, 2022), taken from this graphite price site.

Electric vehicles require one of the Flake Graphite types, particularly the one highlighted in red.

As seen, compared to one year ago (also 1/2 year and 1 quarter ago), the price of graphite for EVs is up.

Graphite deficit underway

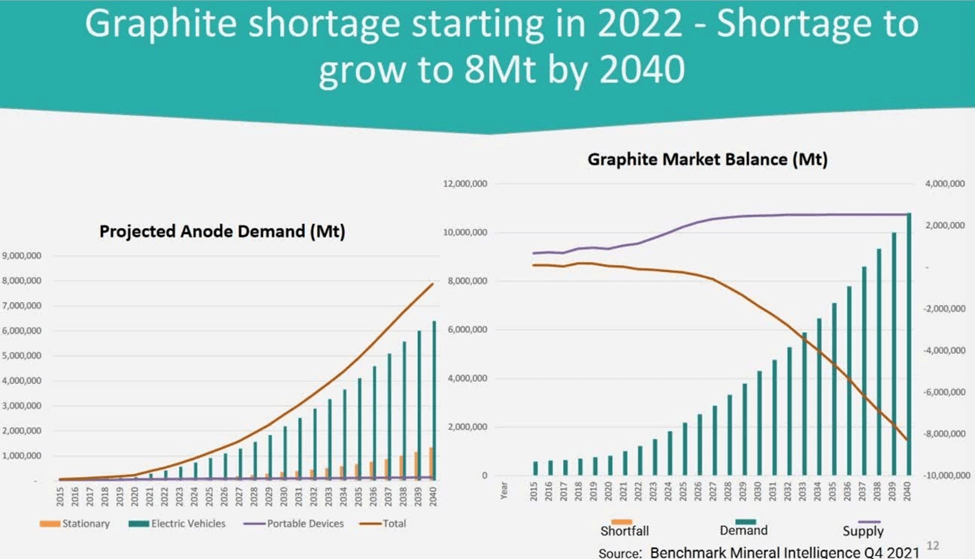

A supply crunch in the graphite market is well underway.

While it is not possible, also not desired, to forecast when exactly the supply shortage will hit, it is clear from the trend that demand is accelerating.

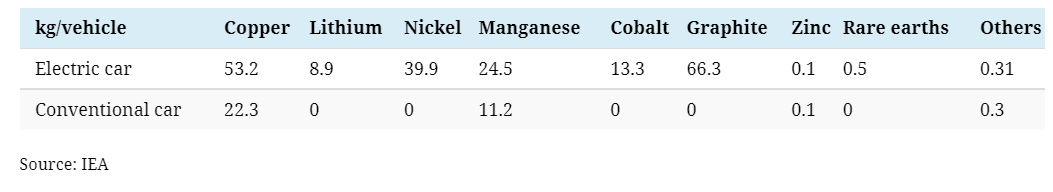

This is particularly important given the weight of graphite in the production of electric vehicles compared to conventional cars. Knowing that the number of EVs is going to grow 100-fold this decade you’ll understand how big this mega trend in strategic metals like graphite is going to be.

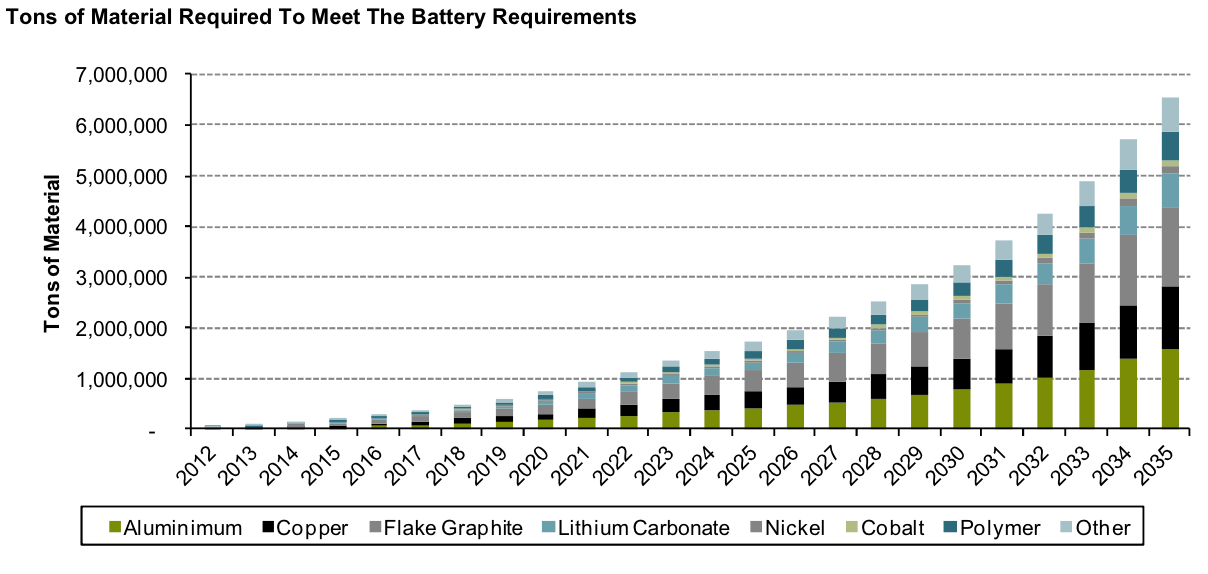

Below is one chart that forecasts that the pivot point (in terms of demand acceleration) is starting in the period 2022-2024, particularly for graphite demand for batteries, see grey part of the bars.

Here is another chart, from Benchmark Mineral Intelligence, confirm that the tipping point in terms of demand is taking place in the period 2022 – 2023.

Graphite stocks forecast 2023

Graphite stocks should react to he upside in 2023, that’s our forecast.

The leader in the space, currently, is Syrah Resources. It has an offtake agreement to deliver natural graphite to Tesla:

Under the agreement, Australia’s Syrah Resources will supply United States electric vehicles (EVs) manufacturer Tesla with natural graphite active anode material from its Vidalia production facility in the US at a fixed price for four years, starting with the first commercial production at the site. The deal is significant for Syrah since it earmarks the majority of the projected output from its proposed expansion of the Vidalia operation to a large consumer. The agreement comes with an option for Tesla to buy additional volumes from Vidalia, subject to Syrah expanding its anode capacity beyond 10,000 tonnes per year, according to the announcement.

What we see on the Syrah chart is that it is working on a breakout. This may or may not hold, but it’s the direction that matters.

Syrah Resources (symbol SYR, trading in Australia) is the leader in the graphite space.

Most other graphite stocks are either consolidating in 2022 or trading near their 2022 lows. The graphite market is highly bi-furcated as 2023 is about to kick off.

How to profit from this bullish graphite stocks forecast?

We mostly don’t feature individual stocks in our work. The reason why we featured Syrah Resources in the previous section is to make the point about the bi-furcated graphite market.

Our graphite stocks forecast for 2023 is centered around the following principles:

- We believe there is a secular bull market in graphite stocks that will run throughout most of this decade.

- On a year by year basis we expect a typical cyclical evolution: powerful bull runs which are followed by good selling. 2022 was not a good year for most graphite stocks, this comes with a buy opportunity in the stocks that are working hard on getting producers in the next 2 to 3 years.

- We believe that 2023 should come with at least one or two bull runs in graphite stocks.

- Be extremely careful picking graphite stocks.

- Most graphite stocks are not worth your time nor capital.

- The graphite stocks with prospects of becoming a producer before 2025 (well capitalized) are the ones that will be the most juicy stocks to hold.

Our Momentum Investing team published a lithium stock selection, based on a very thorough analysis of the lithium market. We bring in structure based on the logic that the lithium market is following. Our update was shared with premium members on October 21st “Lithium & Graphite top stock selection” available in the restricted area of Momentum Investing members!

Must-Read 2023 Predictions – We recommend you read our 2023 predictions as they are very well researched: