Our sugar price forecast is bullish for 2023, 2024, 2025, provided two conditions are met (1) the long term sugar price trend channel remains intact (2) no sudden supply increase or drop in demand. We look at sugar as a buy-and-hold investment between 2023 and 2025, provided the long term channel on the sugar price chart is respected.

Before we look in the details we want to note that doing a sugar price forecast is a challenge. There are multiple factors that determine the price of sugar, one of which being supply/demand. Moreover, sugar is subject to the volatility which is typical for commodities markets.

- 1. Sugar price between 2014 & 2023, with a 2024 forecast

- 2. Global Sugar Market: Supply Demand Forecast 2024

- 3. Supply Demand Factors In The Global Sugar Market

- 4. Sugar Market: Supply Forecast 2024, 2025 and beyond

- 5. Inflation as a Catalyst For Sugar Prices In 2024 & 2025

- 6. Unpredictability of the Sugar Market, How It Affects Sugar Predictions

- 7. Price Trends on the 2023 Sugar Price Charts

- 8. Sugar Price Targets For 2024 & 2025

- 9. Sugar Price Forecast for 2023, 2024 and 2025

Sugar Price Between 2014 & 2023, a 2024 Forecast

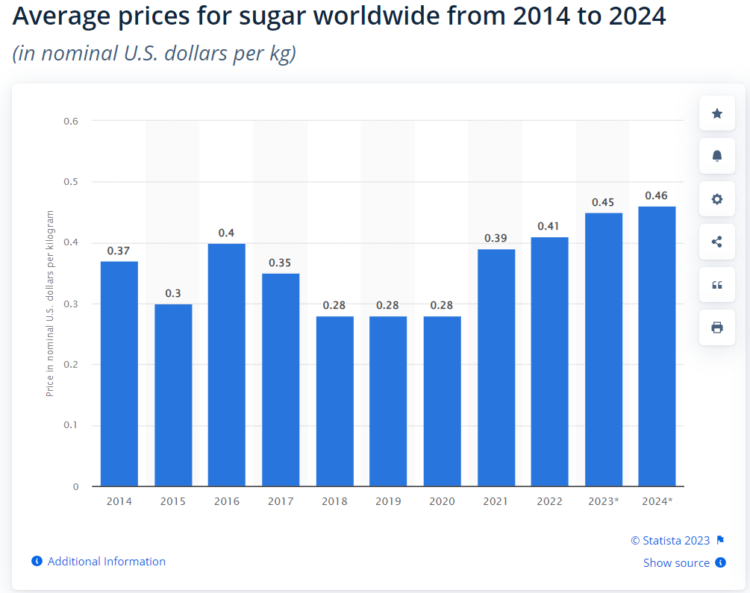

This table depicts the sugar price, in U.S. dollar per kg, between 2014 and 2023. It also adds a sugar price forecast for 2024 which is very similar to the sugar price 2023. Source: Statista.

As seen, average prices were slightly declining between 2016 and 2020. Since 2021, sugar prices are on the rise again, although the sugar price rise is rather soft. Still, the forecasted sugar price for 2024 is slightly above the price of 2023. This creates a favorable dynamic for sugar investments.

Global Sugar Market: Supply Demand Forecast 2024

We wrote our first sugar price forecast in 2019. Back then, supply and demand factors in the sugar market were not favorable. Below is an extract of what we wrote in our 2019 forecast.

As per this article on sugar supply/demand factors “sugar’s supply surplus will eventually push prices so low that production takes a hit. Sugar prices may see a rise to around 15 cents sometime in 2020 as the cost of production for efficient producers such as Brazil and Thailand stands at roughly 12 cents to 14 cents a pound. Prices will, of course, go up as producers go bankrupt, but that is a very slow process.”

The point that stands out from our 2019 forecast: “a global supply surplus.”

That’s also how it went, since then, as evidenced by the dip in sugar prices between 2018 and 2020.

Given the highly accurate correlation between supply/demand factors and the price of sugar, the question then comes up what supply/demand looks like going in 2024. The sugar supply/demand dynamics can help us understand what the expected future sugar price trend could be, directionally.

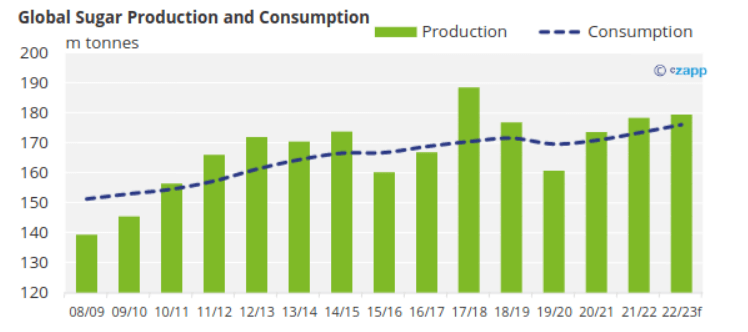

This next graph comes from czapp, it suggests that sugar production in 2024 will stay on par with 2023 production levels. The dotted line on the next graph represents expected consumption which continues to slightly rise in 2023 and 2024.

We can reasonably expect that supply/demand dynamics, even though difficult to forecast for the sugar market in 2024 and 2025, will avoid a bigger price drop. On the contrary, it is safe to conclude that, directionally, the sugar price in 2024 and 2025 will be higher.

Supply Demand Factors In The Global Sugar Market

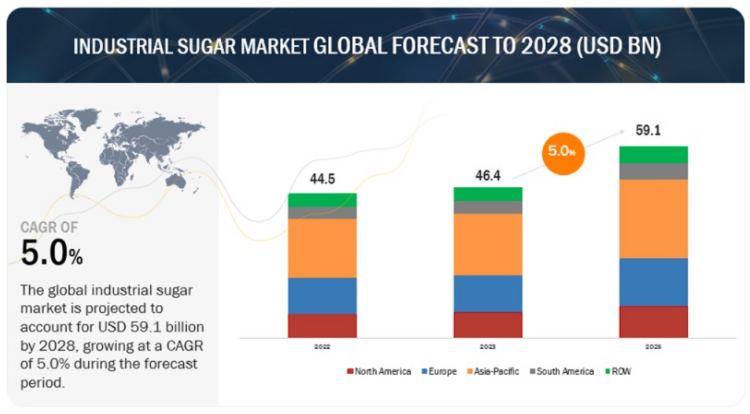

Courtesy of Markets & Markets, we can factor in the following global sugar market dynamics for 2024 and 2025. Below are the key highlights from the global sugar market:

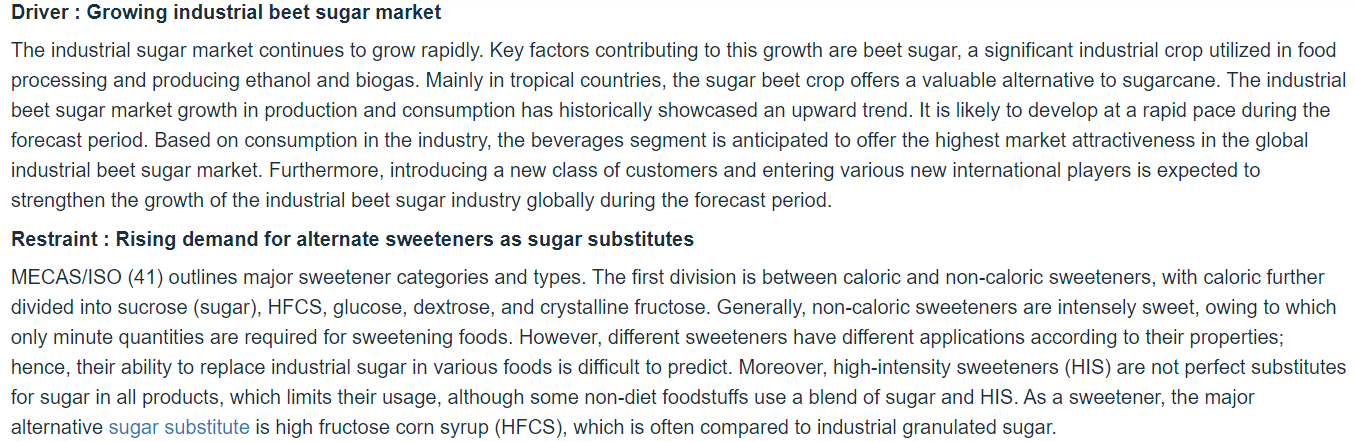

- Driver: growing industrial beet sugar market. This is a growth driver specifically for the beet sugar market.

- Restraint: rising demand for alternatives, particularly sweeteners, competing with natural sugar.

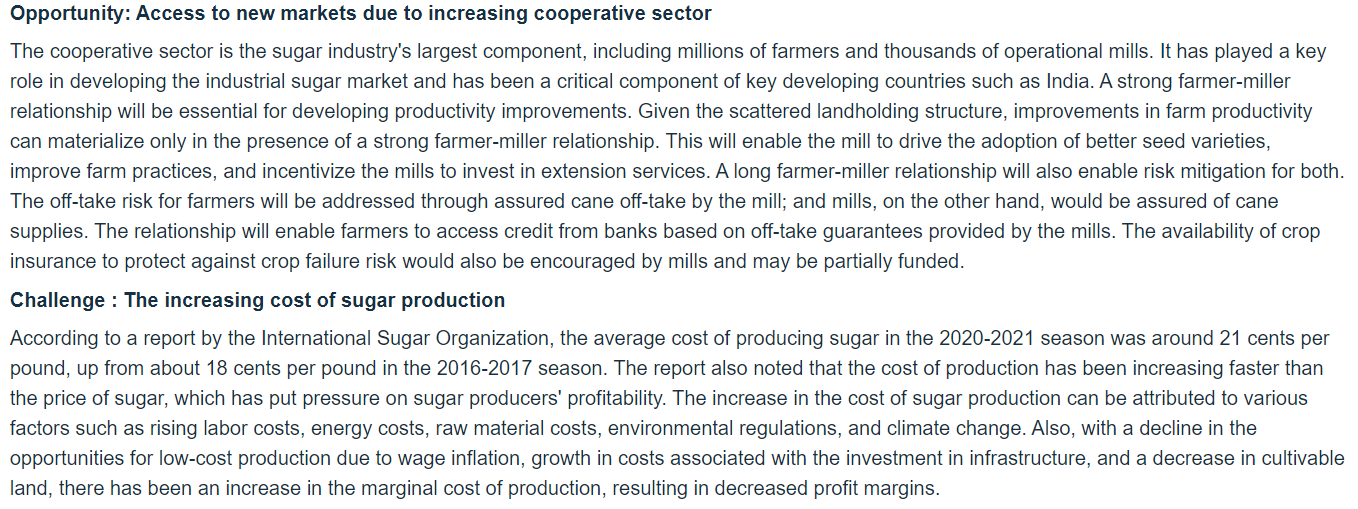

- Opportunity: access to new markets due to increasing cooperative sector. The cooperative sector is the sugar industry’s larges component of key developing countries. As explained by Markets & Markets, this is a driver to professionalize the sugar industry in key producer markets.

- Challenge: increasing cost of sugar production. This is a factor that will put pressure on profitability of producers. However, they may decide to only offer their end product at a higher price to the market, which is a logic consequence from producer price inflation, resulting in a higher consumer price.

Below are the points provided from the sugar market analysis provided by Markets & Markets:

Sugar Market: Supply Forecast 2024, 2025 and beyond

The global sugar market is forecasted to grow at CAGR of 5%. Given the reliable correlation between supply and the price of sugar, we believe that all supply & demand data points in the sugar market confirm that the sugar price in 2024 & 2025 will move higher.

As explained on below infographic, the global industrial sugar market is projected to account for USD 59.1 billion by 2028, growing at a CAGR of 5.0% during the period 2023 to 2028. That’s a lot, it certainly justifies a directionally bullish evolution in the price of sugar.

Inflation as a Catalyst For Sugar Prices In 2024 & 2025

Interestingly, the price of sugar has provided a really strong leverage during inflationary periods in the last 2 decades.

If we take 2016 as an example there was a giant rally in the price of sugar. However, this came after a major bottom in inflation expectations which largely may explain the strong rise in the price of sugar. Moreover, there also was a supply deficit more than a supply surplus back then.

The years 2010 and 2011 were somehow similar in nature when it comes to inflation expectations.

Our most important inflation/deflation indicator does not seem to indicate rising inflation, especially as long as The Single Most Important Chart Of 2023 respects its long term channel.

So, based on our flat inflation indicator we believe commodity prices will remain largely suppressed. Sugar cannot expect a bullish boost from the commodity sector.

Unpredictability of the Sugar Market, How It Affects Sugar Predictions

According to Jack Roney, director of economics and policy analysis for the A.S.A., the global sugar market is the most distorted commodity market in the world because of subsidies. “Today’s low prices are a result of these subsidies, and any bullish signals can be quickly undone by government intervention.”

Mr. Roney said the extreme volatility of the world market is the reason the United States has a sugar policy, and he urged governments around the world to put an end to competing subsidies.

“U.S. farmers are highly efficient, and we want to operate in a free market, but that cannot happen until all countries set aside their subsidies and let a real market form,” he concluded.

This obviously is a hugely important factor to take into account in the context of our sugar price prediction. Supply demand factors in the global sugar market are certainly a leading indicator for the price of sugar. But an unpredictable sugar market that can change fast, where weather can turn the market upside down, or a country suddenly can influence market dynamics makes a reliable prediction challenging.

In other words, we need to build in guardrails into our sugar price forecast for 2024 & 2025.

Price Trends on the 2023 Sugar Price Charts

We look in a top-down fashion to trends on the sugar price charts. We are particularly interested in where the sugar price in 2023 stands, on higher timeframes.

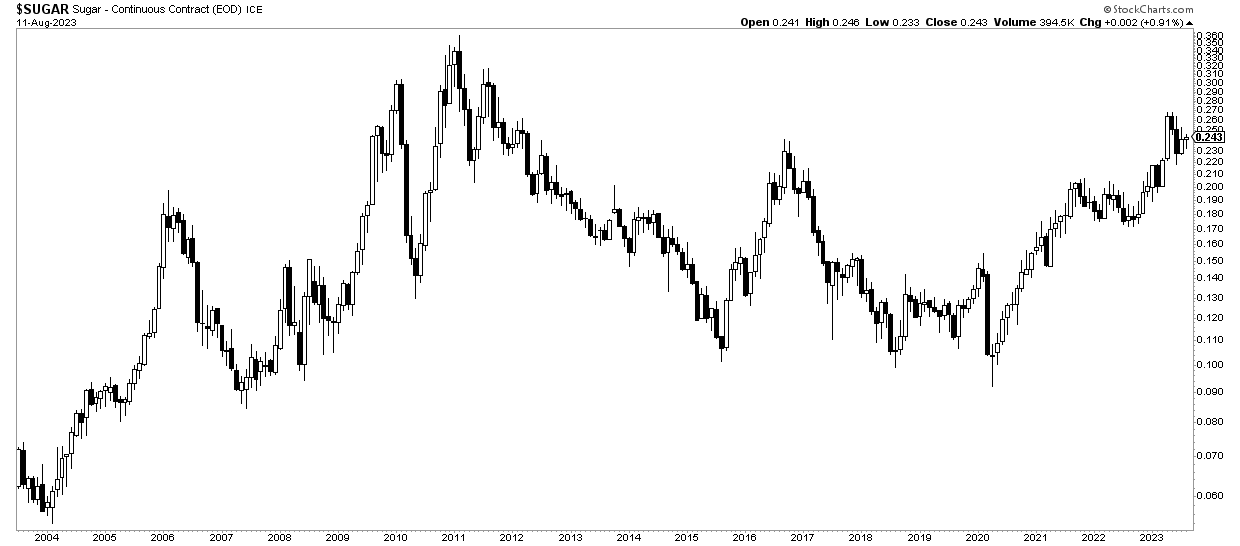

The monthly sugar price is registering a giant W-formation. This is a long term bullish chart structure, with its ATH as a longer term price target in 2024 or 2025.

These type of W-formations take years to complete a part of their structure. As seen, the right-hand side of the W-structure is now complete. A back-test of the 2016 highs (also the W mid-point highs) occurred in 2023. This monthly chart is partially helpful in understanding future price direction. The key take-away: the previous ATH is ultimately going to be hit, it’s a logical longer term target, part of the W-dynamics.

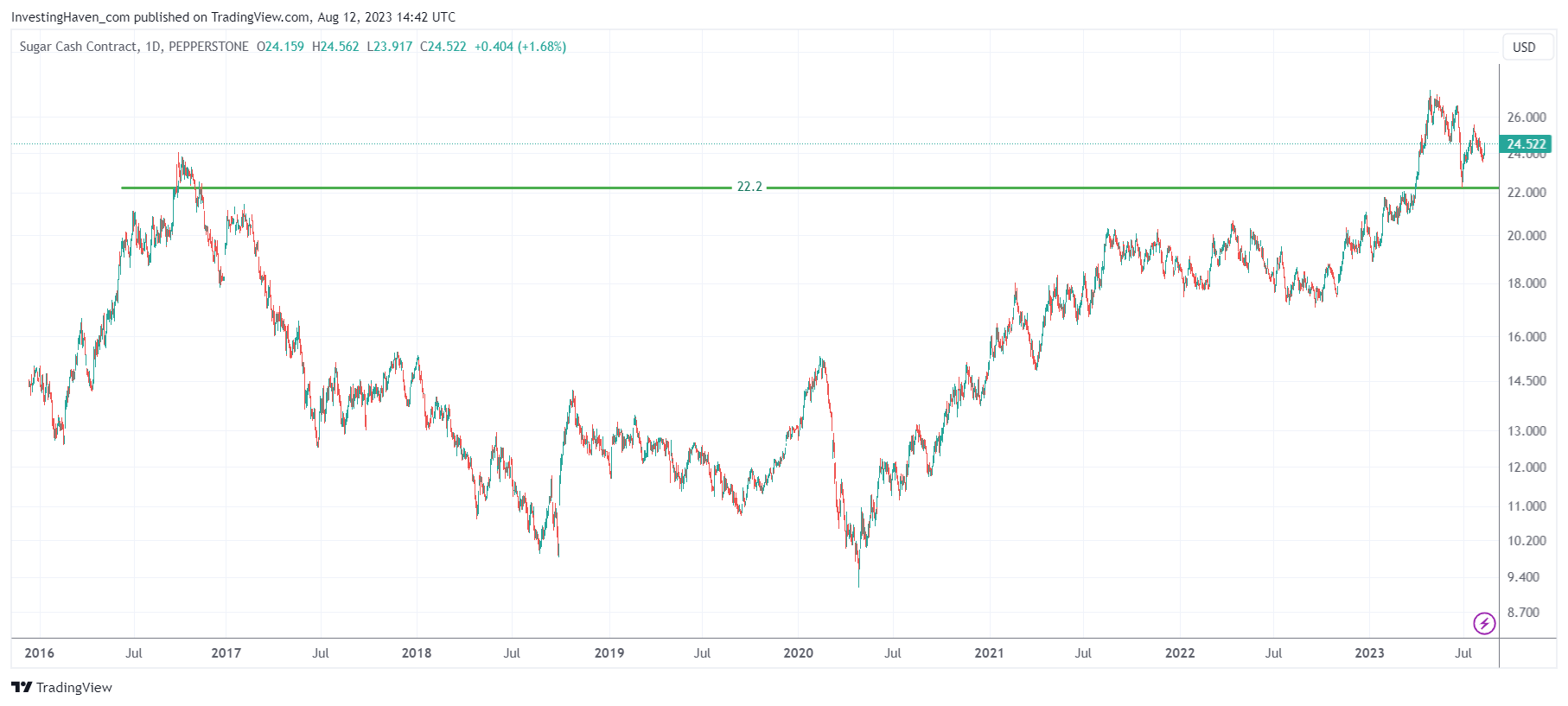

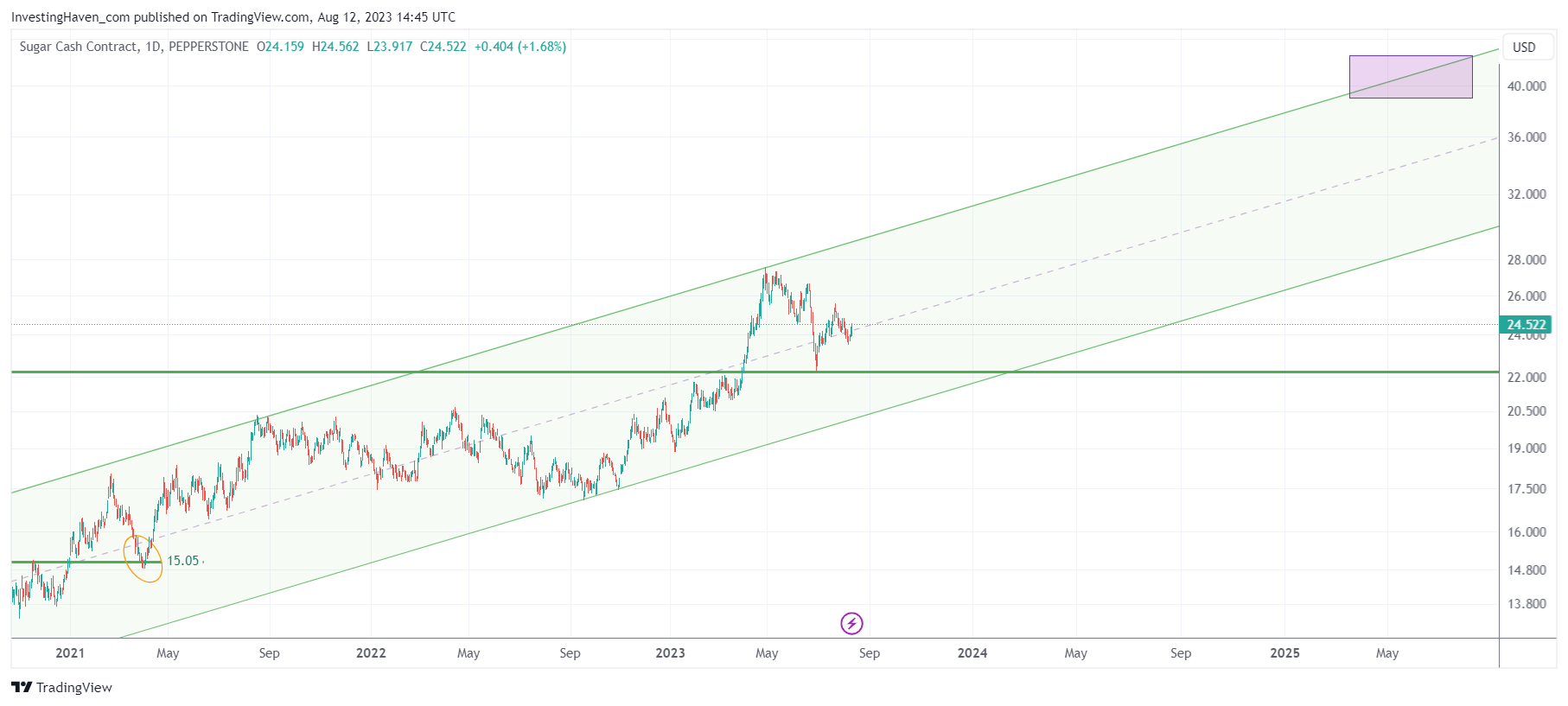

The daily chart over 7 years features the right part of the W-structure. Visibly, 22 points is some sort of breakout level. This was ‘tested’ in June of 2023. Readings above 19-20 points confirm a secular breakout, readings below 18 make a bullish structure questionable.

Sugar Price Targets For 2024 & 2025

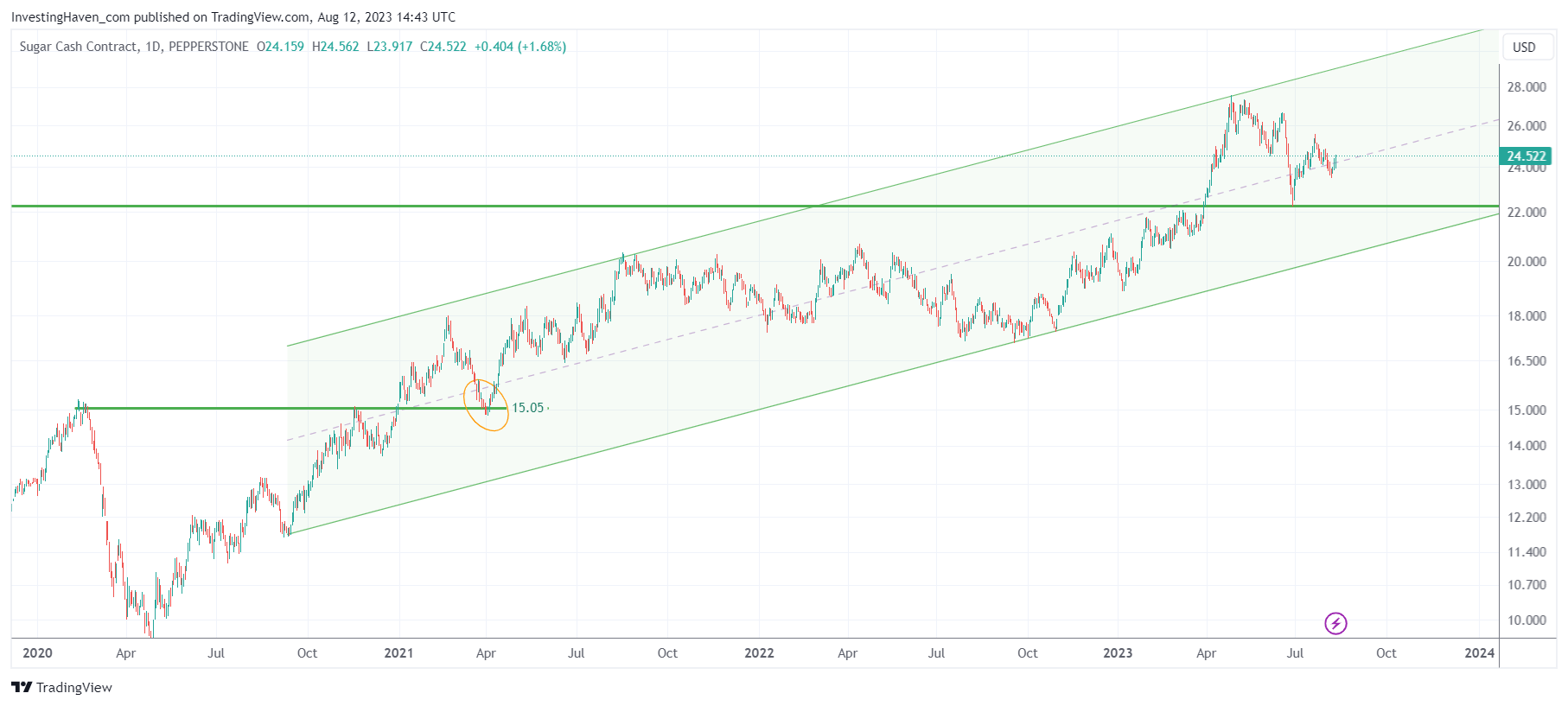

In order to do a sugar price forecast for 2024 and 2015 we look for structure on the daily sugar price chart.

The daily chart, over 3 years, clearly exhibits a rising trend channel. Our assumption, given conclusions about the global sugar supply/demand situation, should continue to move within this structure. Ultimately, in the last few months of 2023, sugar might drop to 21 points, a 15% decline from current levels, just to test the longer term rising channel, still be bullish.

The trend channel is one of the most important, if not THE single most import condition to be respected, in the context of our sugar price forecast 2024 & 2025.

Longer term, though, we could see how the top of the rising channel might be reached, say by 2025. That’s a 100% rise from current levels, as a bullish scenario which is not unimaginable.

Therefore, we conclude that our sugar price forecast for 2024 and 2025 is 40 points, a 100% increase from current levels.

Invalidation of our sugar price forecast: the multi-year rising channel is broken to the downside.

Sugar Price Forecast for 2023, 2024 and 2025

We conclude that the price of sugar will be directionally bullish in 2024 and 2025.

We believe that the price of sugar might double over the course of the next 24 to 36 months. Therefore, our sugar price forecast for 2024 and 2025 is 40 points.

The rising trend channel on the sugar price daily chart is the single most important condition of our sugar price forecast 2023, 2024, 2025. The leading indicators are directionally bullish, but ultimately the dominant dynamic will be the continuation of the multi-year trend channel on the sugar price chart 2023.

The bearish scenario will kick in once sugar falls below the multi-year rising channel, say below 20 points, for 3 to 5 consecutive weeks.

Must-Read 2023 Predictions from InvestingHaven’s Research Team

We absolutely recommend to read the following predictions as they are highly informative and very well researched.