This is episode #7 from our exclusive 16 series Investing Opportunities articles. We will be very blunt this week: the vast majority of investors is about to make the same old mistake which as been made over and over again. The gold and silver market is heating up, and instead of buying low and selling high … the majority of investors will continue to flow into the precious metals market at relatively high prices. Note that over here at InvestingHaven we were shouting from the roof to buy silver miners, especially in our First Majestic Silver Stock Forecast. Prices were depressed back then. Prices are fast getting over-heated now. This is the time to plan the exit, and rotate profits into the sector that is depressed now and will be over-heated in 6 to 9 months from now! All this thinking and planning is part of our MOMENTUM INVESTING method and our mission to turn 10k Into 1 Million In 7 Years.

Let’s ground ourselves again. What exactly are we trying to accomplish?

We want to catch the 3 top opportunities per year. The ones that bring 50 to 200% returns in a short period of 3 to 9 months.

We did hit 2 of them in 2019, being Bitcoin as well as First Majestic Silver. We want to prepare now for the 3d major opportunity of 2019.

In doing so we want to apply the recipe similar to silver miners 6 months ago: buy the sector when literally nobody has any interest in it.

Let’s look back to our precious metals forecast. On May 3d, 2019 we were featured with InvestingHaven’s research team on MarketWatch and Barron’s with this headline: Why gold’s a ‘bargain’ at less than $1,300 an ounce (MarketWatch) and How Gold Could Stage a 20% Rally This Year.

There was no interest whatsoever in precious metals back then. Now, suddenly, everyone is interested in precious metals. We now see, out of the blue, the uber-bullish forecasts popping up everywhere.

As per our 100 investing tips we believe media is playing a crucial role here. Not only are the precious metals charts awesome …. financial media is all about the bull market in precious metals!

That was really different 6 months ago.

Overly relying on media however is the worst idea ever for any investor!

The (number of) sources of information to make decisions are _not_ social media nor financial media. They are not meant to make you a better investor, they are meant to bring lots of content, that’s a big difference! Pick your sources according to the principle less is more.

This plays an important role in perception of reality as well as which emotions are triggered.

As said in 10 Tips To Master Investing Without Emotions the biggest enemy of any investor is … his/her own emotions!

What’s the most important thing for success is not reading a lot on social and financial media. Developing the right investing method with a solid research framework is what is crucial. This should allow to understand the market, and most importantly time the market for great entry points.

A month ago we said this: “One of the pitfalls is is selling too early. Strangely, we already heard 4 weeks ago investors thinking of taking profits. Sooo early in this new bull market?”

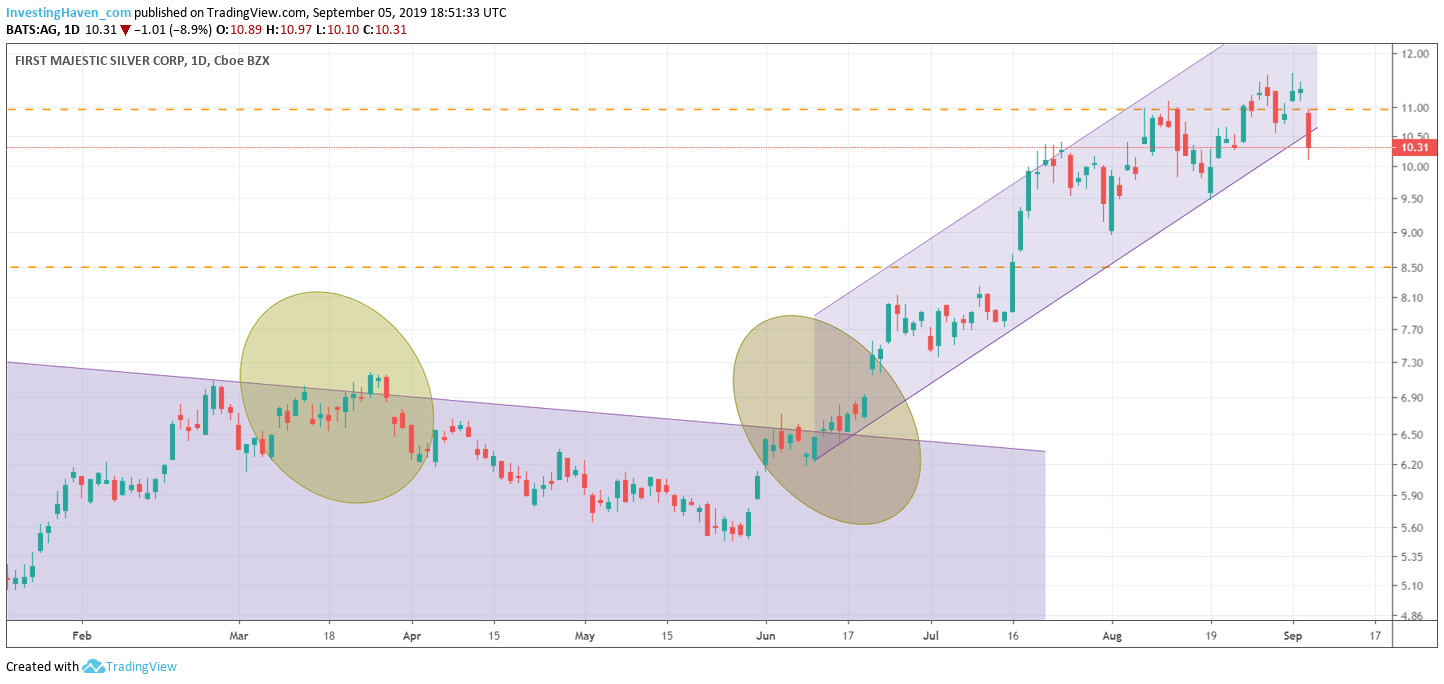

If there is one thing that below chart (featuring AG on the daily timeframe) reveals is the upside potential, certainly long term!

However, shorter term, there may be some pain before there is more gain. So why not take the gains, or at least a part of the gains?

We believe the precious metals bull run has legs (long term), but we also want to secure profits (short term). Let’s face it, our favorite silver miner AG doubled in less than 4 months. Why leave the profits on the table?

Depending on every individual’s profile it might be good to take 50% profits off the table, or 75% profits, or 100% profits. This is an individual call, we cannot and are not allowed by Law to influence anyone. It’s tied to preference, risk profile, personal portfolio, etc.

All we can do is observe that an 80% profit in less than 4 months suggests it is time to take action.

Moreover, and this is clearly a first warning sign, AG fell through its rising channel yesterday. This breakdown may be invalidated, this breakdown may be short lived, this breakdown may be whatever it will be … it’s another reason to take some profits.

Let’s be crystal clear: long term we strongly believe there is lots of upside potential in AG. Short term we believe taking profits is a wise thing to do because other sectors will be heating up in the next 3 to 9 months.

Which sector will be hot in the next 3 to 9 months?

We see 2 sectors, one in the U.S. and another one in Canada, that might become as hot as precious metals are today.

Because of the high value of this we reserve this for subscribers to our ‘free newsletter’. This is premium content that we give away for free, but only after signing up to our free newsletter. Subscribe to our free newsletter and get premium investing insights in 2019 for free. Sign up >>