Our followers do know by now the relative weight of the Euro as a leading indicator in our forecasting method. There is a strong correlation between the direction of the Euro and the direction of markets, as the Euro is a ‘risk on’ indicator. Our 2021 forecasts are overall bullish, but short to medium term we see the Euro hitting some resistance which might spell some hesitation of markets (read: volatility) early 2021.

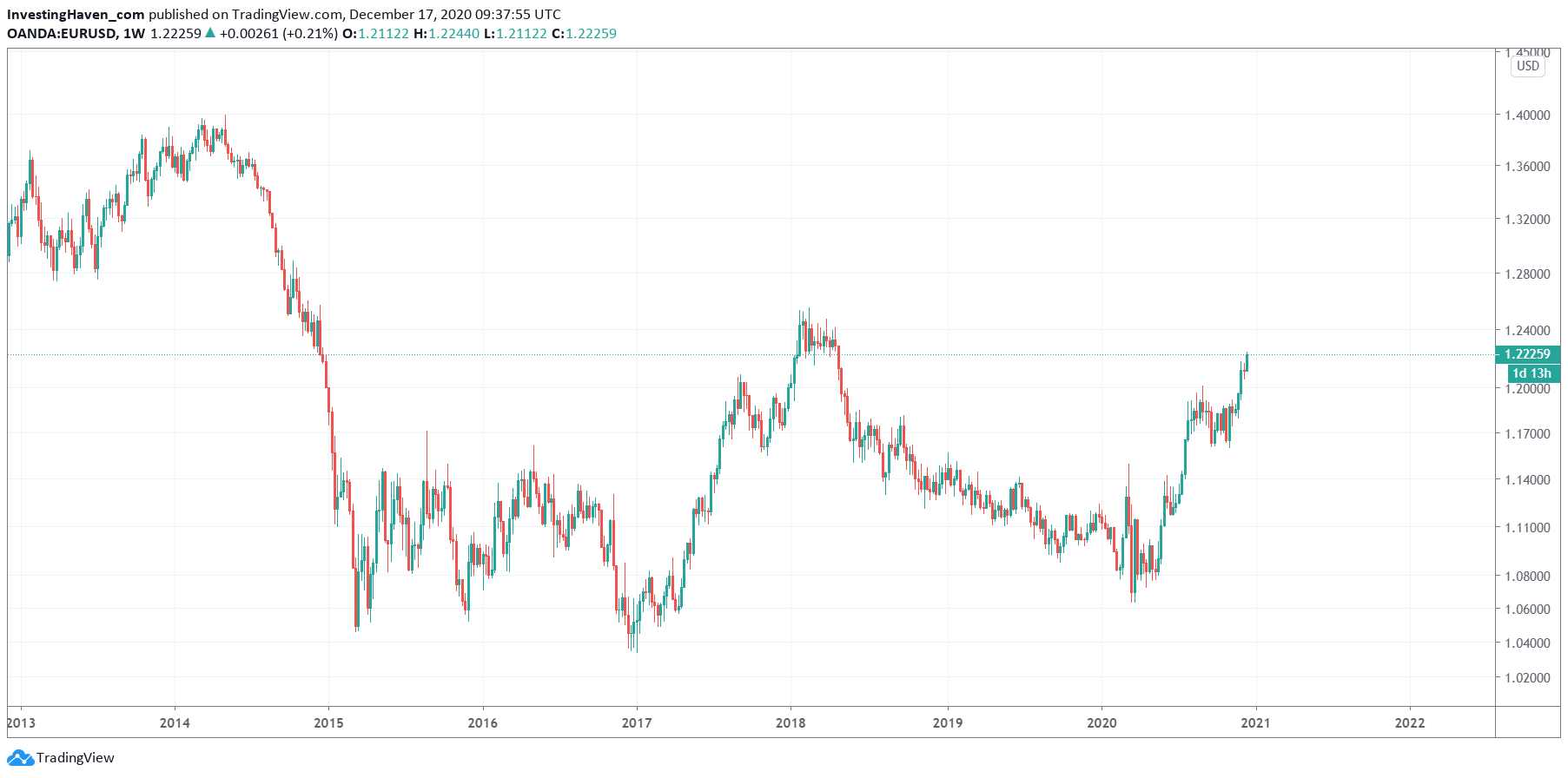

We are including a non-annotated chart.

We did adjust the chart settings to have a clear picture.

The Euro, weekly chart, since 2013, shows a giant reversal pattern. This is a good long term indication for global markets: we expect 2021 to be a bullish year.

However, and here is the caveat, the Euro is not far away from 1.25 points. Needless to say, this is an area that will come with volatility and hesitation.

For now, combined with our crash indicator readings outlined in Crash Indicator Gives Up … For Now we expect markets to continue to march higher. Either Jan 4th, 2021 or Jan 15th, 2021 are the dates to watch for buying exhaustion and a short to medium term retracement … before markets become ultra bullish in 2021!

Enjoying our work? We invest in broad stocks as wel as commodities in our Momentum Investing portfolio. In our Trade Alerts premium service we focus on SPX trading in the short term. In 2020 the combined portfolio delivered +100% (one month before 2021 kicks off). We are on track to double our capital annually, as per our Mission 2026.