Most investors are getting nervous by this market, seemingly not understanding that the current market setup is almost designed to make its participants nervous. Many do expect a market crash. If anything, leading indicators do not expect a market crash, on the contrary. They are improving. One of the most reliable leading indicators is the Euro. Guess what, the Euro is improving which favors risk assets like stocks. This is in line with our 2022 forecast, especially our Dow Jones forecast based on the impressive breakout on the 100 year Dow Jones chart.

No, the Euro in this context has nothing to do with European investments, on the contrary.

The Euro is a leading indicator. The direction of the Euro can help understand how other asset classes will be trending. In reality, there is much more than the Euro, for instance bond yields and the volatility index should be considered as well. But the Euro is one of the most important leading indicators!

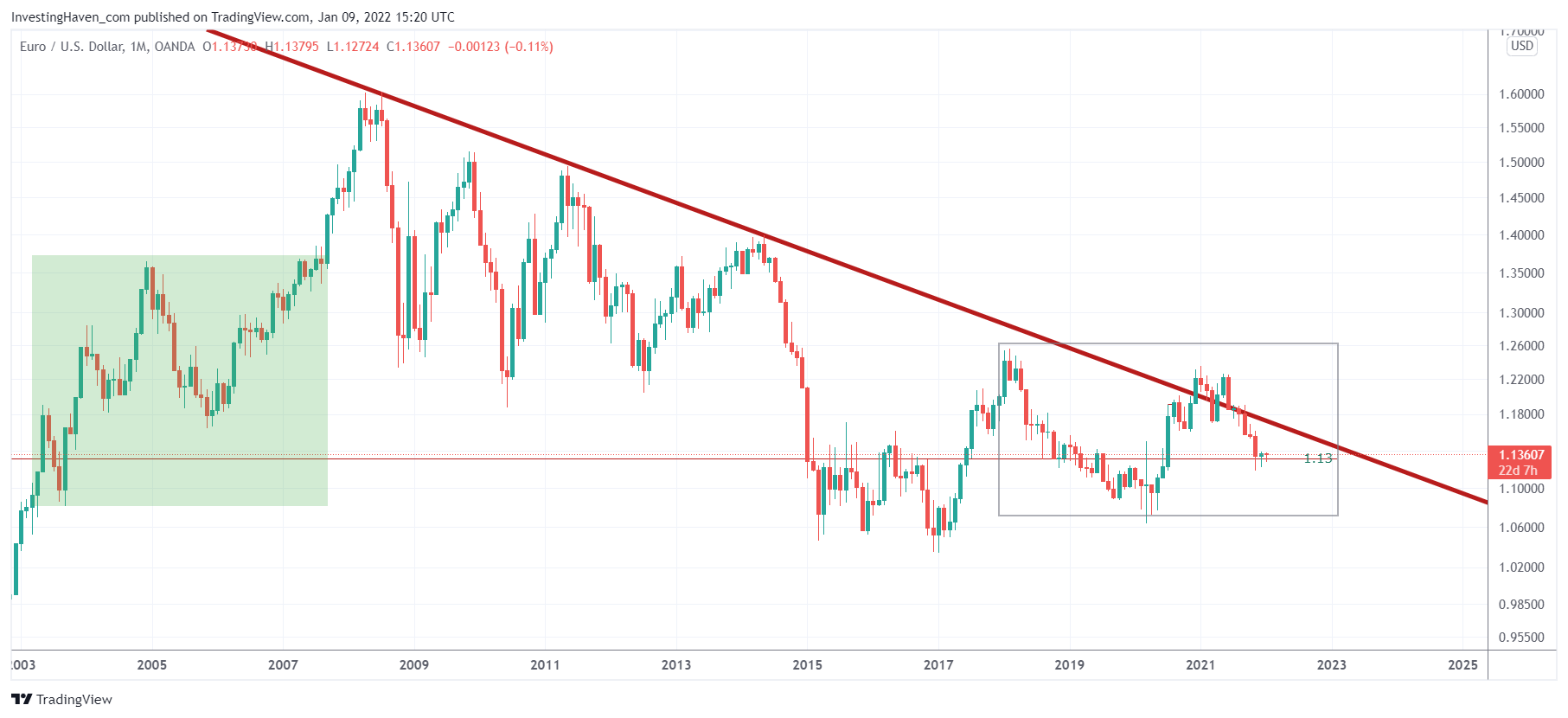

The longest timeframe, the monthly Euro chart, has a pretty interesting setup.

The red thick falling line represents a bear market trendline. Since 2008, the Euro had only tactical bounces in the context of a long downtrend.

This started changing post-Corona crash.

In fact, the period May 2020 – January 2021 marked a strong tactical bullish trend. We need to zoom out to understand what this did with the big picture trend. The grey box represents the point we are trying to make: a bullish reversal on the monthly chart.

Arguably, the grey box could have been extended to 2015, prior to the start of the big crude oil crash. Interestingly, today, we see the potential start of a crude oil breakout, almost 7 years after the big crude oil crash. It’s in this same period that the Euro has been working on a long bullish W reversal.

The Euro has to hold 1.12 on a monthly closing basis. IF it does so, that’s a big IF, we expect a break above the falling trendline. All this is bullish for risk assets like stocks (not just in the U.S. but in global markets), and also commodities (even gold/silver).

In our Momentum Investing weekend updates we cover all leading indicators like the Euro and bond yields, week by week, as they help us understand trends in stocks and commodities. In our Trade Alerts service we introduced auto-trading on the S&P 500, we concluded several successful trades for our members while they continued focusing on other things in their life.