The Nasdaq was the weakest of all stock indexes starting mid-February of this year. Many tech stocks sold off heavily, and the Nasdaq index does not reflect the damage that was created ‘under the hood’. Right now the Nasdaq might be completing a bullish reversal pattern. It might also be setting a major top. All we can do is monitor the structure on the Nasdaq chart, and forecast a bullish or bearish outcome for the remainder of 2021.

A few weeks ago we tried to learn from the unusual divergence between the Nasdaq and the S&P 500 / Dow Jones indexes. It was very hard to predict this big divergence.

So we went back in this article, and tried to get some good insights out of the current situation: In Hindsight Insights: Nasdaq’s Retracement In March Was Really Violent

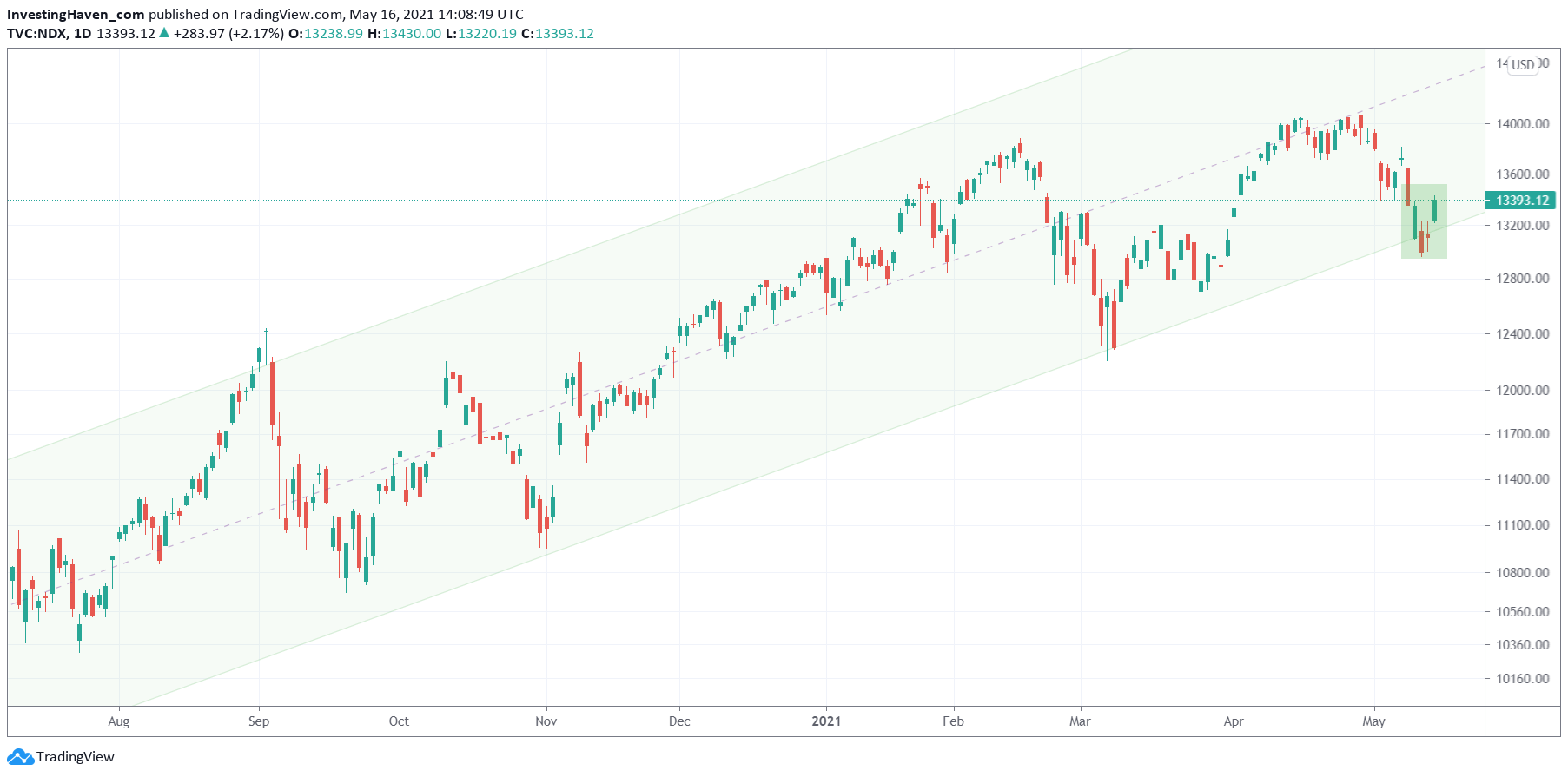

We can see on the daily Nasdaq chart how orderly it started but how unorderly it turned out. What’s really unusual is the time that the Nasdaq went below its rising channel, especially in the second half of March.

We continued:

There is not a lot we can learn from this other than waiting to open new positions on the 2nd leg of a reversal in a volatile cycle, not the first leg. It’s the one and only take-away we can find, and it requires perfect timing skills.

Last week, we observed that the rising pattern was respected: When Everyone Sells Tech Stocks We Start Paying Attention

As seen on the Nasdaq chart, IF (that’s a big IF) the Nasdaq succeeds in respecting current levels we might have a new channel that can potentially become dominant! That’s a lot of conditions, and those are mandatory conditions!

Last week we got a strongly bullish micro pattern: a reversal right at channel support.

This market might be sending a strong signal: the Nasdaq might be close to ending its wave of selling. IF this is the case we want to pay attention, so we can pick up the strongest names at discounted prices.

Enjoying our work? We invest in broad stocks as well as commodities in our Momentum Investing portfolio. In our Trade Alerts premium service we focus on SPX trading in the short term. Next to SPX trading we take a few swing trades per year. In 2020 the combined portfolio delivered +93%. Results are tracked in our trade log books, and publicly shared every 6 months on our Mission 2026 page.