Tech stocks, especially big tech, was really hot in 2021. If anything, as outlined in our 2022 forecasts, every year tends to be really different. We can reasonably expect big tech to underperform in 2022. One of the outperforms will be graphite and cobalt as explained in great detail in our green battery metals forecast, another outperformer will be financials which probably is confirmed by the Dow Jones 100 year chart.

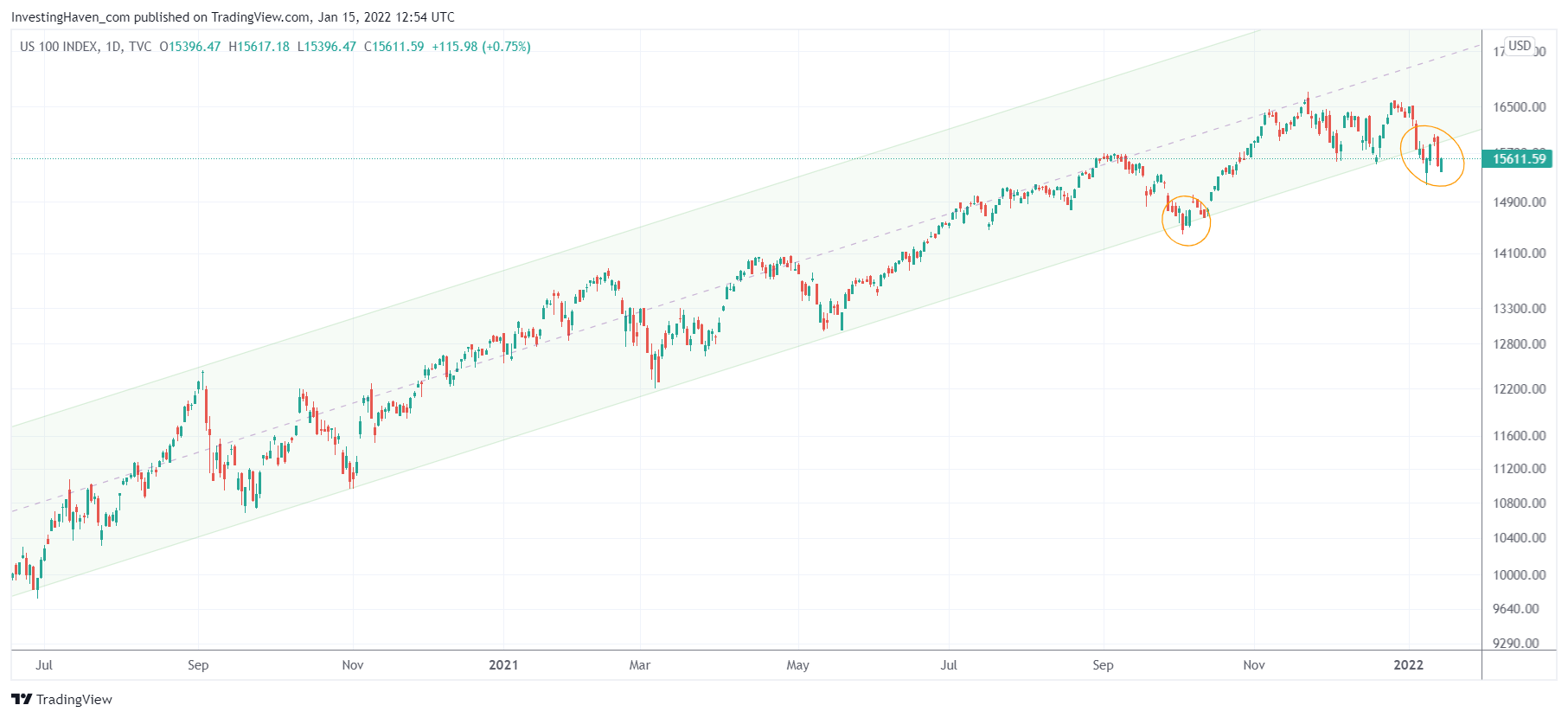

The one index that is really concerning right now is the Nasdaq. It is in a breakdown area as we speak. It might recover, if not it will probably move to 14.850 points as a first bearish target. It would invalidate the long rising channel, post Covid crash, and start a wide consolidation.

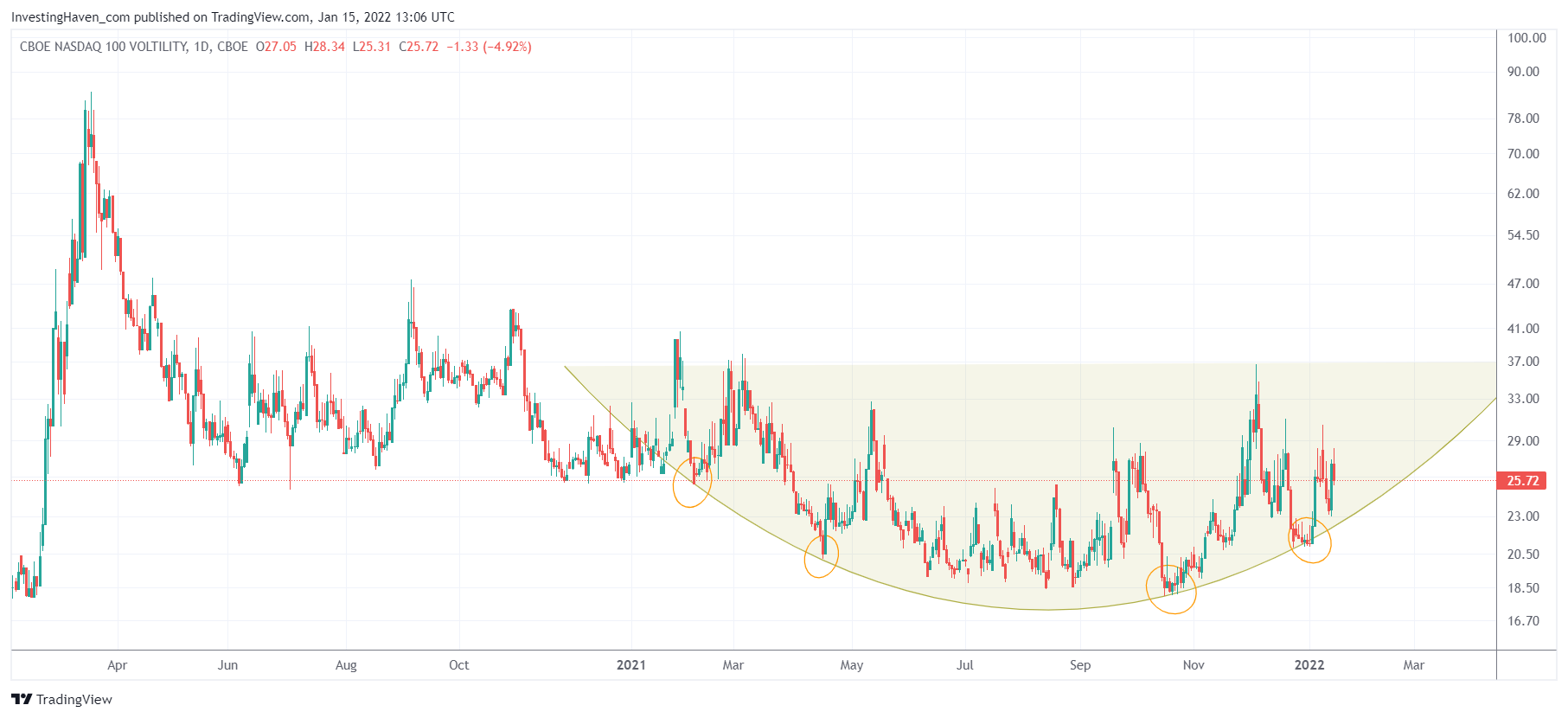

If anything, the volatility index specific to the Nasdaq (VXN ETF) has a bullish setup. It has a confirmed reversal setup. It suggests selling is not over.

The only question is IF and HOW the Nasdaq will drag down the rest of the market. There is not a lot of risk for the S&P 500 (not yet) nor in the Dow Jones, but there certainly is breakdown risk in the Russell 2000.

Pretty fascinating how this will go, also scary to some extent.

Tired of trendless markets and constant market rotation? Why don’t you consider our auto-trading service? It has been accumulating profits in recent months, and our members don’t have to do anything for this as the trades execute in a completely automated way!