The technology sector has been one of the hottest areas of the stock market in 2023, in line with our 2023 forecasts. It looks like there is a renewed interest by investors to pour money into tech stocks, after the cataclysmic tech bear market last year. The Dow Jones may have done well towards the end of last year, but this year, so far, has been the year of tech stocks. But with tech stocks rising nicely in recent months, many investors are wondering what’s next for this sector.

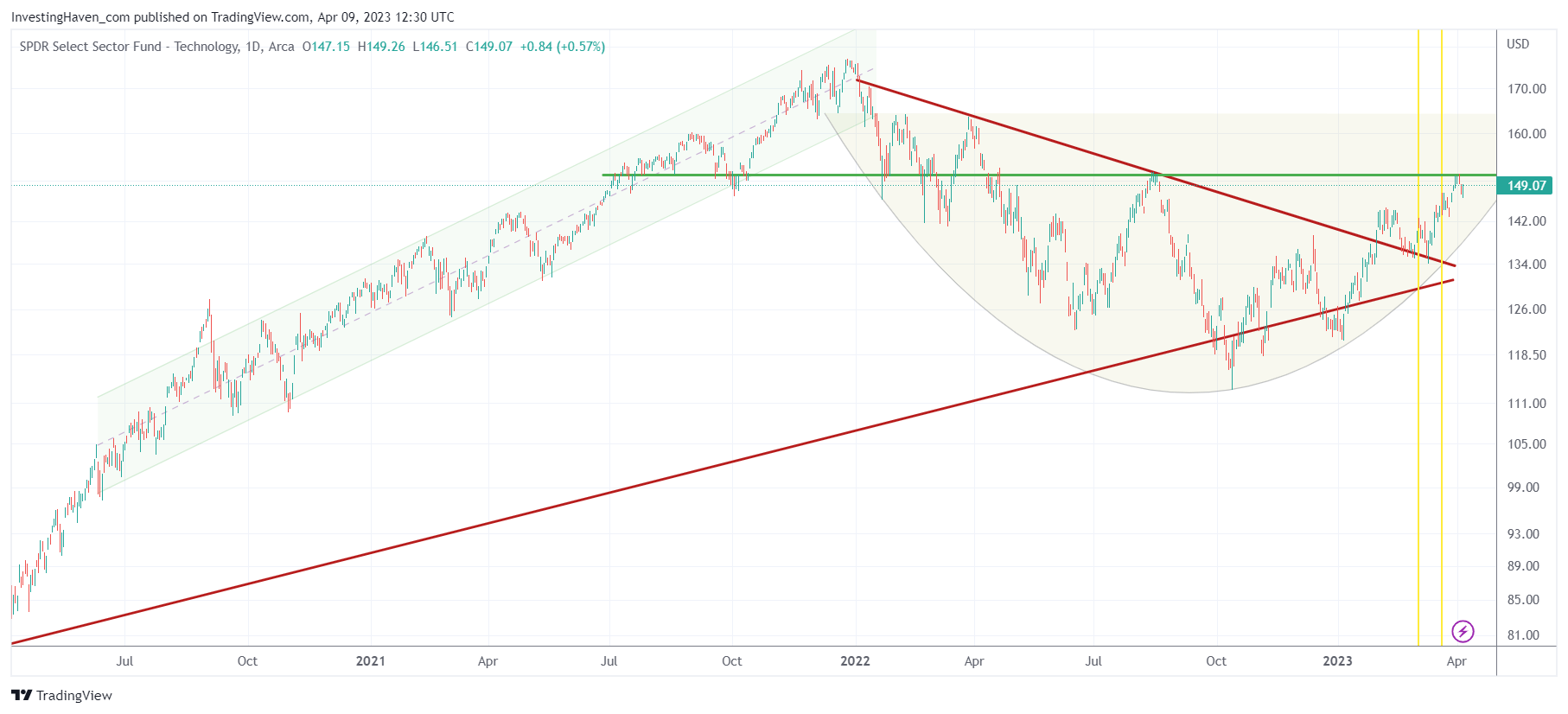

To answer that question, let’s take a closer look at the XLK ETF, which tracks the performance of the technology sector. Looking at the longer-term, three-year chart of XLK, we can see that the ETF recently broke through a falling trendline that had characterized the 2022 bear market. This bullish reversal took the form of a rounded pattern, indicating that the trend may be reversing from bearish to bullish.

Additionally, our predicted volatility window ended on March 24th, the day XLK successfully tested the falling trendline. The yellow lines on the chart represent our predicted volatility window. Note, also, how our March 5th contrarian buy signal for long term investors worked like clockwork. Currently, XLK is hitting the exact same level that was hit in August as resistance, at around 150 points.

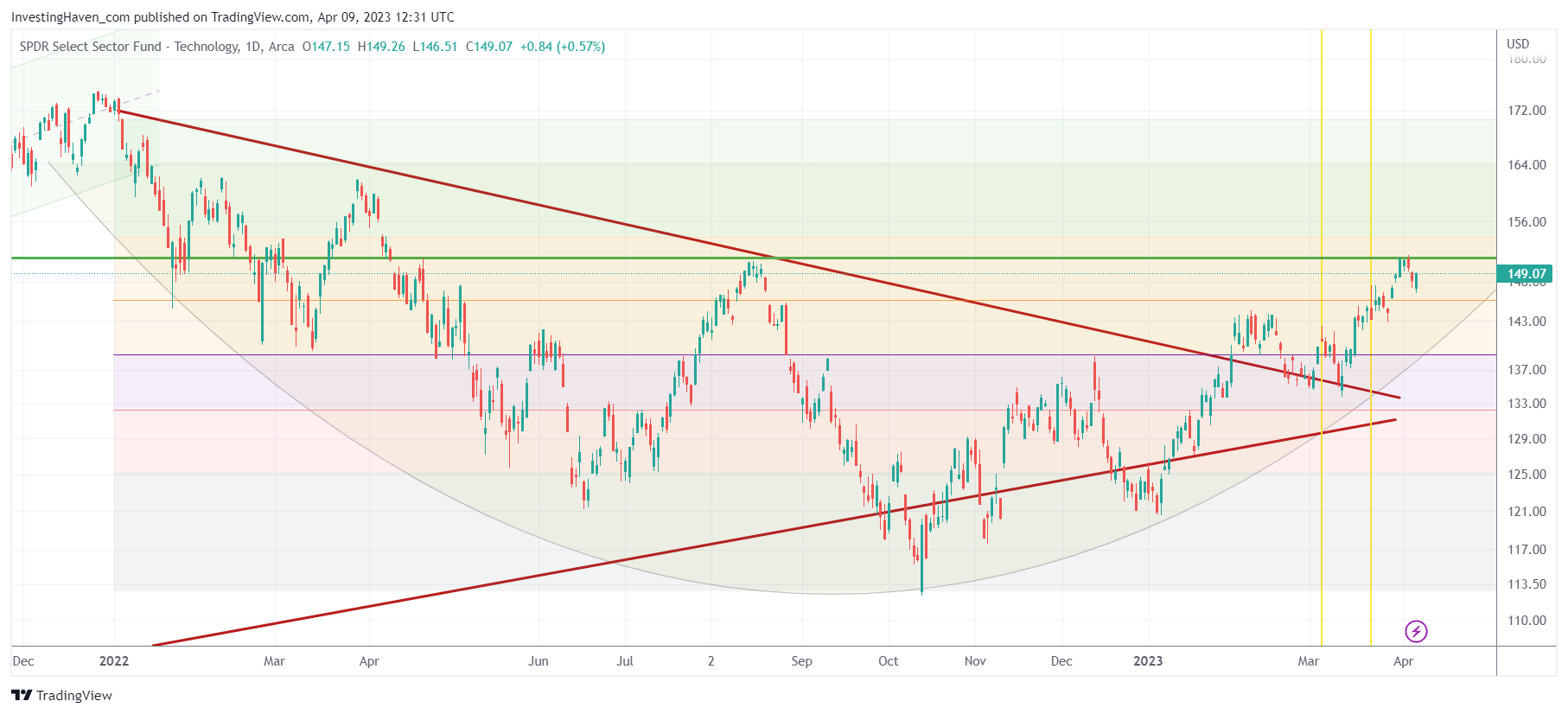

Moving to the shorter-term, one-year chart of XLK, we can see that the ETF is now trading around the 38.2% retracement level, marked by a fine orange line on the chart. Readings above the 50% retracement level can be considered bullish, and the probability of a bull run is much higher once the 50% retracement level is cleared.

There are several key takeaways from these charts. First, XLK is currently trading between the 50% and 38.2% retracement levels, which is within the rounded pattern and therefore, bullish. The probability of a steep drop is low in this scenario. Second, a short-term consolidation is a likely outcome, with a continued rise before the next volatility window starts in June. Finally, given current dynamics in the markets, a slow rise with a bullish bias is very likely. We don’t expect big bullish momentum to hit the markets, but instead, a steady rise in the technology sector.

In summary, while there may be some short-term volatility in the tech sector, the overall trend for XLK is bullish. Investors who are looking to invest in the tech sector may want to consider adding this ETF to their portfolio, but they should be prepared for potential short-term pullbacks and volatility.