Many are waiting for an epic stock market crash to start. As said, our 2022 forecasts suggest there will not be a crash in 2022. We certainly predict some good retracement(s), maybe a flash crash, but not an outright crash (not yet). In the first trading week of the year we got an early confirmation of our prediction. Bond yields up, Treasuries down, Financials confirming an epic secular breakout. This is not a recipe for a crash, on the contrary! This is in line with our Dow Jones forecast based on the impressive breakout on the 100 year Dow Jones chart.

The ongoing narrative is probably that banking or insurance stocks are not worth holding, presumably because the meme theme and quick returns (post Corona crash trends) are still the overarching theme. As explained in 7 Secrets of Successful Investing we recommend to be self-aware when it comes to narratives. It is narratives that create bias which lead to missed opportunities.

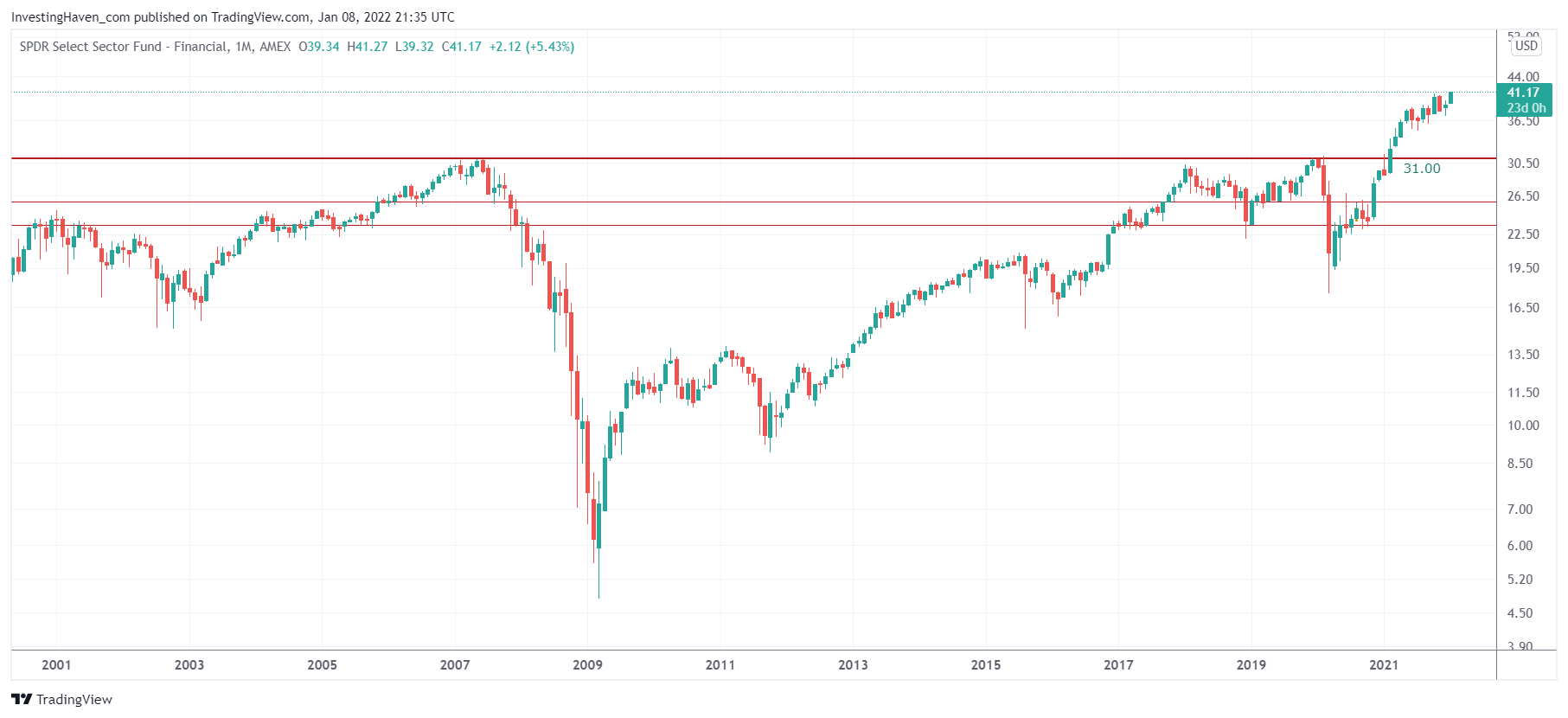

Below is the Financials ETF, monthly (!) chart.

A big breakout is what we see, it is confirmed, we are above the 2007 highs. Remember, the 2007 highs marked the top before the global financial and banking crisis hit the world.

The reason for this strong performance in financials which includes banking and insurance stocks?

Treasuries.

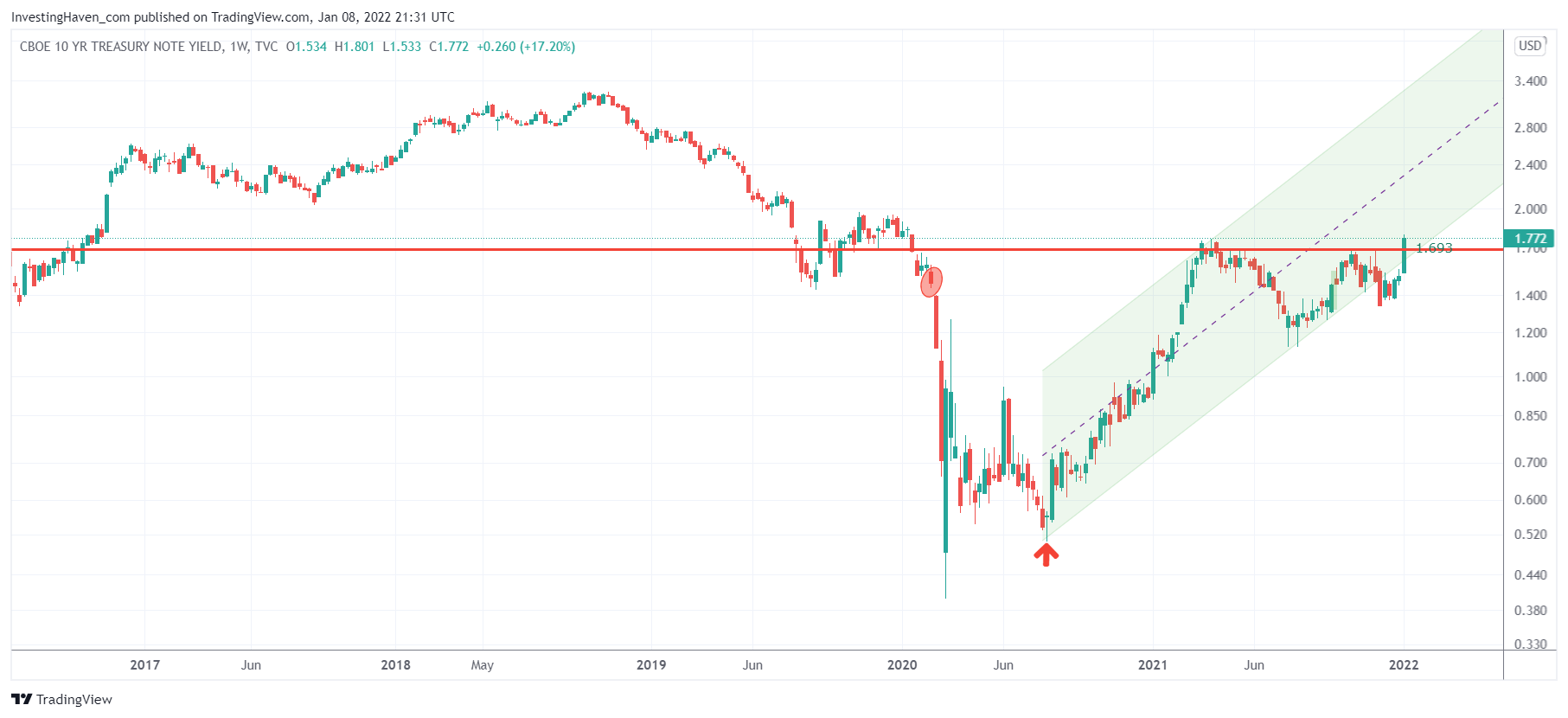

The big topic of the week was the major turnaround in bond yields. In December, we got a falling trend channel (red) that started looking really concerning for stocks in general in Q1/2022. This sudden turnaround in bond yields is supportive of stocks in general but financial stocks specifically. Intermarket dynamics 101.

Below is the weekly TNX chart: a breakout attempt is in the making. Note that TNX refused to fall below the level marked by the red circle of Feb 2020 which is where the big crash started. As said, above 1.69 it is bullish for stocks and very bullish for the financial sector!

It does make sense to have some exposure to banking and insurance stocks.

In our Momentum Investing weekend update, sent with premium members earlier today, we featured the 6 coolest bullish reversals we noticed among Financials. In our Trade Alerts service we introduced auto-trading on the S&P 500, we concluded several successful trades for our members while they continued focusing on other things in their life.