Online streaming stocks are hot in April of 2018 with the IPO of Spotify. But is Spotify the online streaming stock to buy? Our research shows that one forgotten stock has an amazing setup: online streaming stock Pandora flashes a buy in 2018.

The market leader in the online streaming market is Spotify, and its market cap based on the recent IPO is close to $30B. That is similar to Sirius, another giant. However, the huge volatility in Spotify is not something we are keen on. There must be better alternatives to ride this wave.

Before looking into our detailed thoughts we want to make readers aware of an important principle we wrote about recently: Why Investors Should Love Market Crashes, And How To Make Money From A Crash

Buy low and sell is what we mean. If you want to accomplish this you may need to look at stocks or markets that crashed. However, they are not very attractive, and mostly these are forgotten markets or stocks that ‘nobody talks about’, so it requires both a lot of courage to buy them but, more importantly, very good analysis to identify the ones that are ready to go higher again.

We believe we have found an outstanding stock in the online streaming business: Pandora.

Why Pandora is an online streaming stock to buy in 2018

First, fundamentals of Pandora are great. Look at the most recent quarterly financials:

- Subscribers continue to grow;

- International expansion;

- New ad-free premium subscription model launched;

- And, very importantly, costs are coming down, resulting in much better EBITDA.

Moreover, what to think of this from their recent statement:

Pandora recently announced an organizational restructuring designed to prioritize its strategic growth initiatives and optimize overall business performance. A combination of eliminated roles and other measures are expected to result in combined annualized savings of approximately $45 million to adjusted EBITDA. The savings will be reinvested into growth initiatives including ad-tech, non-music content, device integration and marketing technology, toward which the company will redeploy existing employees and hire for new positions.

For more details about the growing revenue / declining costs / increasing EBITDA combination we refer to this detailed results page on MarketWatch.

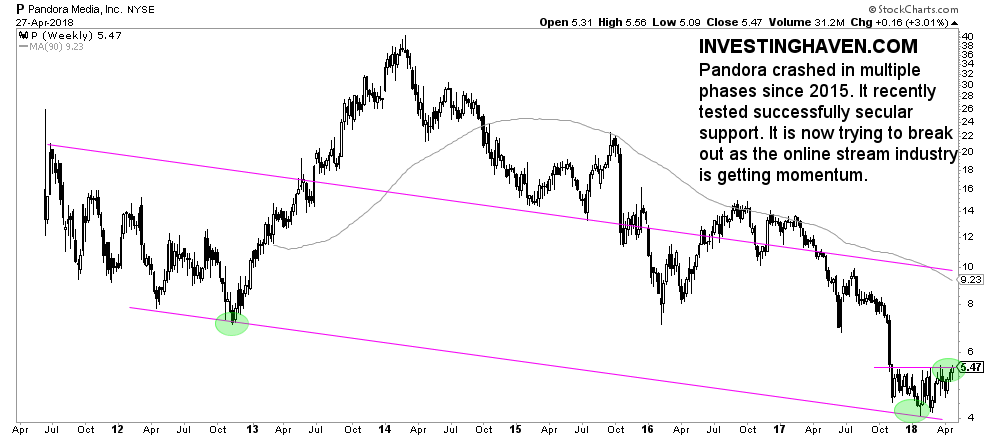

The chart is even more impressive.

Pandora took a series of dives in the last 3 to 4 years. It peaked exactly 4 years ago at a time when it was trading at $40, with a market cap of $8B. Compare this to today: stock price of $5 and market cap of $1.3B. Still, their revenues continued to rise, so did their subscriber base. And now we see a new trend of declining costs and losses.

The two things that stand out of this chart, according to Tsaklanos his 1/99 Investing Principles (1% of price points on a chart truly matters): the successful test of secular support early 2018 combined with the breakout attempt last week (two green circles in 2018).

Is is clear why Pandora is a very attractive stock flashing a buy signal in 2018?

One note of cautiousness: the short float ratio is very high, 30% at the time of writing. It requires a lot of conviction to buy this stock with such a high short float ratio. Given momentum in the industry, decent fundamentals, great financials and an amazing chart setup we are comfortable going against this veyr high number of shorts. Always consult your financial advistor though.