It seems that the Brexit impact has run its course. Or have markets already taken a Brexit scenario into account? Or did they initially overestimate the Brexit impact. Or is the financial situation looking bright in the coming months (as markets typically ‘look’ 3 to 6 months ahead in time)?

Actually, we do not know the answer, and, to be honest, we do not care. Nobody will ever know exactly the rationale of a market trend. The only thing we can identify, however, is the trend itself, and, as a precursor, indicators which point to the formation of a new trend. So why speculate if the only thing you have to do as an investor is to simply follow market movement(s)?

This, dear reader, is a huge trap to 90% of investors. They try to read as much as they can, and, based on news / events / opinions, anticipate what that means to markets. The big problem with this is that the investor has to ‘interpret’ the ‘meaning’ of news and events. Moreover, the market entails a large group of people which have much more information at their disposal (as a group).

Investors should take a different stance against collecting and interpreting information. They should rely less on news and opinions from others. The right path is to read the messages of the market, which is available throughout a collection of charts. That is why, at Investing Haven, we have developed a chart based methodology which delivers all the messages an investor needs to have at his disposal.

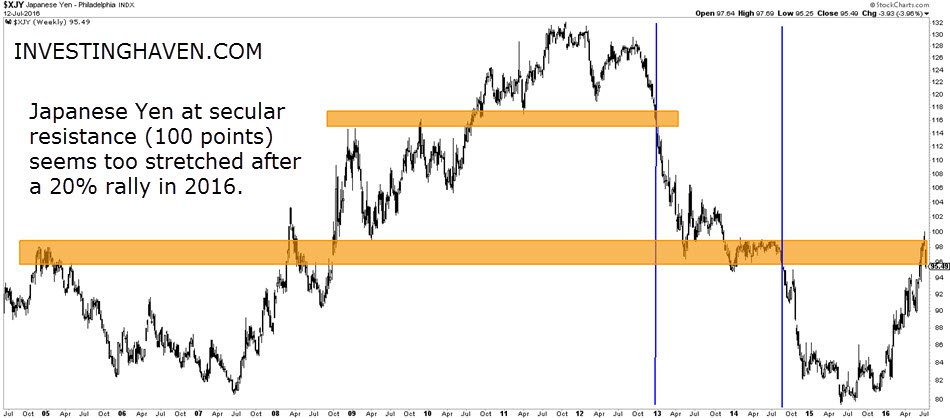

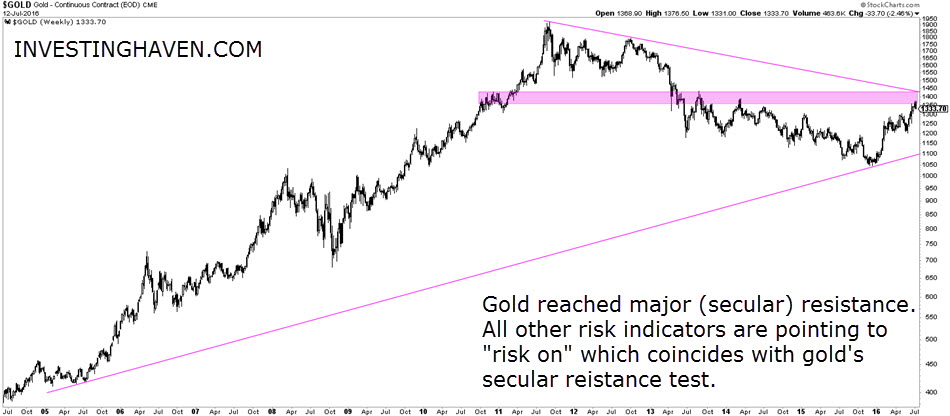

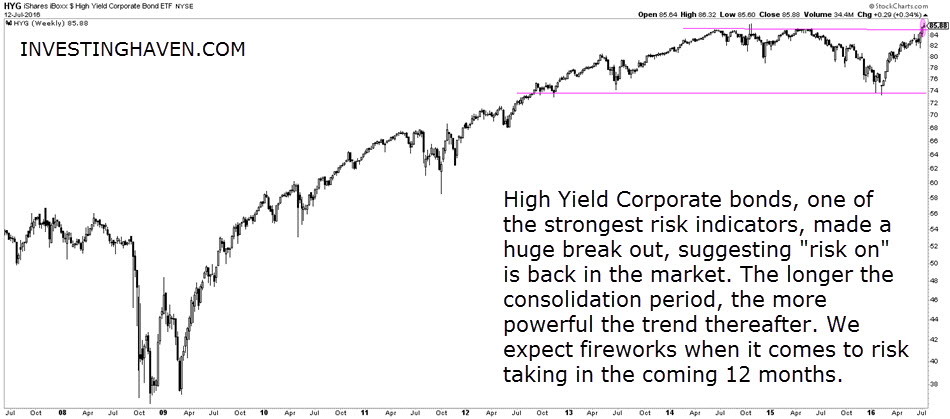

As for developing market activity, we see a clear and concise pattern, which suggests that the start of a new trend is upon is. We derive this conclusion from our 4 fundemantal risk indicators, i.e. the Yen, Treasury Yields, High Yield Bonds and Gold. In particular, their chart patterns are all lined up and point to the same conclusion.

First, the Yen at 100 points has an important meaning. The Yen chart shows how this safe haven currency has arrived at secular resistance. True, the rally in 2016 has been impressive, and it probably has more legs at a certain point in the future, but for now, the rally has most likely run its course. The Yen at 100 points is, as shown on the chart, resistance area. A retracement from here is the most obvious path.

Second, yields on Treasuries has sold off big time in the last few weeks. Such a significant drop has always preceded a sharp medium term rally.

Third, gold, the ultimate safe haven, has rallied sharply in 2016 similarly to the Yen. It was an impressive comeback of the yellow metal. However, as the secular gold chart shows, the metal arrived at double secular resistance (1) the trendline which connects the 2011 and 2012 peaks (2) as well as the peaks after the 2013 collapse. It is not likely, given the setup of the other risk indicators, that gold will simply break through this in 2016 (probably also not in the first part of 2017).

Lastly, High Bond Yields are breaking through to all-time highs on their chart with a secular timeframe. That should not be ignored!

CONCLUSION:

All risk indicators are lined up, and suggest that RISK ON is entering the market. That was confirmed by prior analysis, as documented in this article 4 Risk Indicators Suggest U.S. Stocks Could Be Breaking Out which we wrote back in May.

The Yen and gold are likely to retrace, yields will most likely rise from here as high yield bonds have made their way to all-time highs.

To us, the message of the market is that RISK ON will the key theme of the second half of 2016.

As for gold and the Yen carry trade, we don’t see any opportunities there for the remainder of 2016, but, the soonest, in 12 months from now. We do realize that our conclusion is counter-intuitive, and some of our readers would firmly disagree because ‘everyone and his dog’ is predicting higher gold prices in 2016. We simply try to read the message from the market, and do not care about opinions (not our opinions, not from media, not from any guru on this planet).