A recent silver market report confirmed the growing physical silver shortage. This is a strong silver price catalyst for 2024 and 2025.

Ed note – the silver price chart and commentary were updated on March 15th, 2024.

In this article, we simplify the complexities of the silver market. We focus on the physical silver supply deficit, the silver price chart, and what it might mean for the silver market going forward.

RELATED – Our detailed silver forecast for 2024.

The silver shortage topic has been center stage in recent months, particularly after the Silver Institute released its later physical silver market data (source). It evoked a lot of reactions as evidenced by data driven posts on social media (here and here).

Let’s review the facts, and add commentary about the market dynamics that go a step further than the data points served by The Silver Institute.

Understanding the silver market shifts

The Silver Institute’s update reveals a decrease in total silver supply due to production losses at major mines, notably the Penasquito mine. On the flip side, non-investment demand has surged, primarily driven by industrial use, reaching an all-time high. Despite slight dips in jewelry and silverware demand, the crux lies in the booming industrial demand, particularly for photovoltaic solar cells.

Do the numbers reveals a silver shortage story?

Total silver mine production is now at its second-lowest in a decade, pointing to an undeniable undervaluation of silver. The fascinating twist lies in the fact that as mine supply shrinks, industrial demand skyrockets, echoing a clear message: the current silver price is too low to match the market realities.

Investor’s perspective

Looking at supply and demand, we find a mere 123 million oz left for silver investors after accounting for non-investment demand. In a world where trillions circulate in investment markets, this limited silver pool, valued at less than $3 billion, raises eyebrows. The reality is that the pool available for investors is a fraction of the total silver produced.

Silver’s dual nature drives a silver shortage

Silver’s unique dual demand as both an industrial commodity and an investment asset plays a crucial role. While industrial demand remains relatively stable, investment demand, driven by market sentiment and price movements, holds the key to the silver market’s future.

An even more up to date report confirmed the silver shortage in 2023:

Global Silver Demand to Reach 1.2 Billion Ounces in 2024: The forecasted global silver demand for 2024 is an impressive 1.2 billion ounces, potentially the second-highest level ever recorded. This growth is primarily driven by strong industrial demand.

We recommend reading more details in the report we wrote in February of 2024: Silver Market Anomaly – Silver Demand Outpaces Supply With A Flat Silver Price.

The road ahead

The COMEX silver price setting persists. Many tend to call this the “silver price manipulation by commercials.” Amid such short to medium term oriented price influences, there is a deepening physical shortage unfolding.

The clock is ticking, and the silver market is at a crucial juncture. The Silver Institute’s bullish data adds weight to the argument that higher silver prices are not a matter of if but when.

In the meantime, ‘Silver becomes the new gold’ for Egyptians who are trying to protect their savings. Could this be one of the many ‘events’ that will trigger a tipping point?

More evidence of an unfolding silver supply shortage

The latest data point to more evidence of the unfolding silver supply shortage:

Demand for silver is greater than new supply. Will it matter?https://t.co/ahi00mfCoO

— The Silver Institute (@SilverInstitute) November 21, 2023

What this article brings up, as a question, is why the price of silver has not exploded to $50 at this point in time. There are likely two answers to this question:

- What has not happened yet, is about to happen sooner rather than later.

- Dynamics of price are completely distorted. It is clearly not supply/demand that is determining price, but something else. This ‘something else’ is futures trading, because it is futures market positioning that is clearly determining price more than supply/demand dynamics. This is what many tend to call ‘silver price manipulation’, i.e. the dynamics of positioning between commercials and managed money traders.

Sooner or later, dynamics in the physical market, driven by a supply shortage that is getting out of hand, will ensure that the price of silver will reflect the supply shortage.

Silver price vs. physical silver market dynamics

While some may point out that last week’s silver price action was abysmal, we would recommend to focus on what really matters.

The price of silver has been flat for 3.5 years now, since August of 2020. However, we recommend to focus on long term trends, not short term price moves.

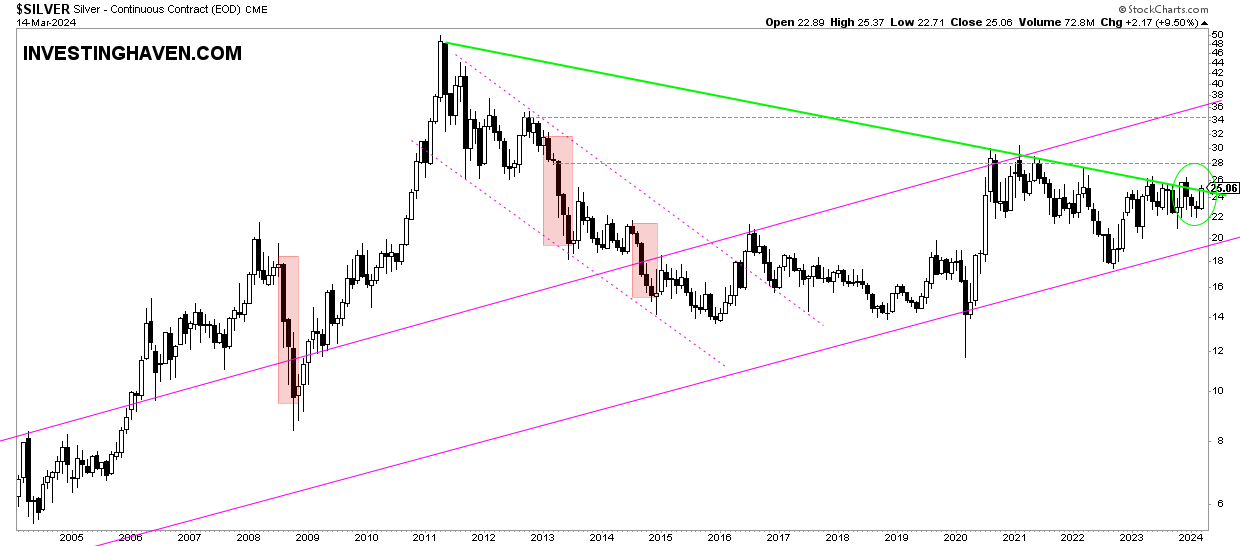

Below is the monthly silver price chart, the current monthly candle is not complete (halfway the month of March 2024). What we can clearly see is this month’s candle currently moves in breakout territory. In fact, an epic secular breakout may be starting, in March/April of 2024.

This is in contrast to the physical silver market where a silver supply shortage is already here. It simply did not reflect in price, not yet. Remember, commercials desire less participation of speculators before driving price higher.

We recommend not being influenced by the games being played in the paper market. Let the physical market do its work. As small investors, we should give time and space, eventually the price of silver will reflect the physical market situation. Moreover, the silver price chart, below, has a very clear and outspoken secular bullish setup, it is a matter of time (WHEN, not if).

Conclusion

Within these silver market dynamics, the looming silver shortage stands out as a ticking time bomb. Despite COMEX silver price setting, the law of supply and demand will eventually prevail. As we approach a true silver supply shortage, the silver market’s true potential awaits, ready to reshape the price setting dynamics and elevate silver to new heights.

In a nutshell, the silver shortage narrative is not just about market data; it’s a story of a market poised for a significant shift. The question now is: when exactly will this translate into the long overdue silver surge?