The U.S. Dollar has been not only a safe haven in 2022 but also the root cause of all damage in markets, metals, commodities. We shared some illustrations of the damage that the USD created in 3 ugly breakdowns. How much higher can the USD go, how much more damage can it create?

The rise in the U.S. Dollar is the result of a restrictive monetary policy especially by the U.S. Fed.

It is not just the Fed but also all other central bankers applying restrictive policies in 2022. Consequently, currencies are competing against each other with the USD clearly winning this race.

But how much more upside is there in the USD?

We will answer this question purely based on chart structures, not based on data points like central bank balance sheet changes nor expected monetary interventions.

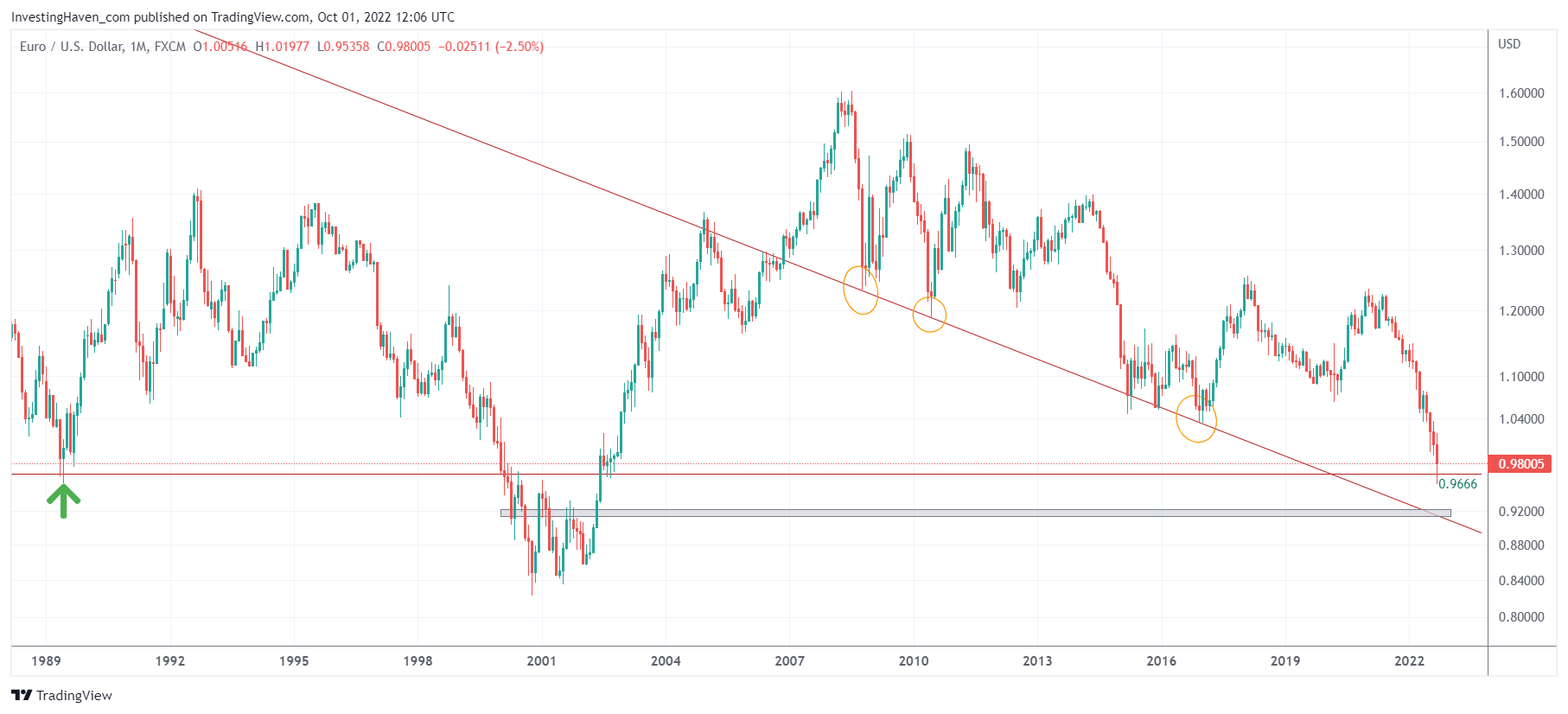

Particularly, we look at the EURUSD chart which often is an easier read than the USD chart. Moreover, we want to zoom out.

On a very long term basis, the EURUSD pair gives us 2 really important price points:

- 0.9666

- 0.9200

As seen on below chart, the first price point of 0.9666 was hit last week. No surprise, the USD hit resistance right at that same moment in time (114.4 in the USD index). In fact, the EURUSD pair bounced right at 0.9666 because it was strong support back in 1989/1990.

Is this the end of the fall in the Euro and rise in the USD?

It might be, but there is one area that might be the ultimate target of the EURUSD: 0.92 (approx.). It is support of a long term downtrend but also support from the period 2001-2003. IF this level is hit we expect the USD to find ultimate resistance at 119 points.

We believe either of the two price points will be the ultimate target of the EURUSD.

This implies that the USD is not far away from its ultimate goal (it might have hit it already although the jury is still out). It also implies that opportunities will start arising soon. In our lengthy weekend update in Momentum Investing we feature several indicators to watch in order to understand opportunities vs. risk. We also feature several stocks and sectors that will be explosive once markets calm down.