Lots of markets came down in 2022. We pick out 3 different markets (stocks) which illustrate what 2022 was all about: looking for shelter and the absence of safe havens. The only safe havens, noticed so far in 2022, are: big lithium stocks and the U.S. Dollar.

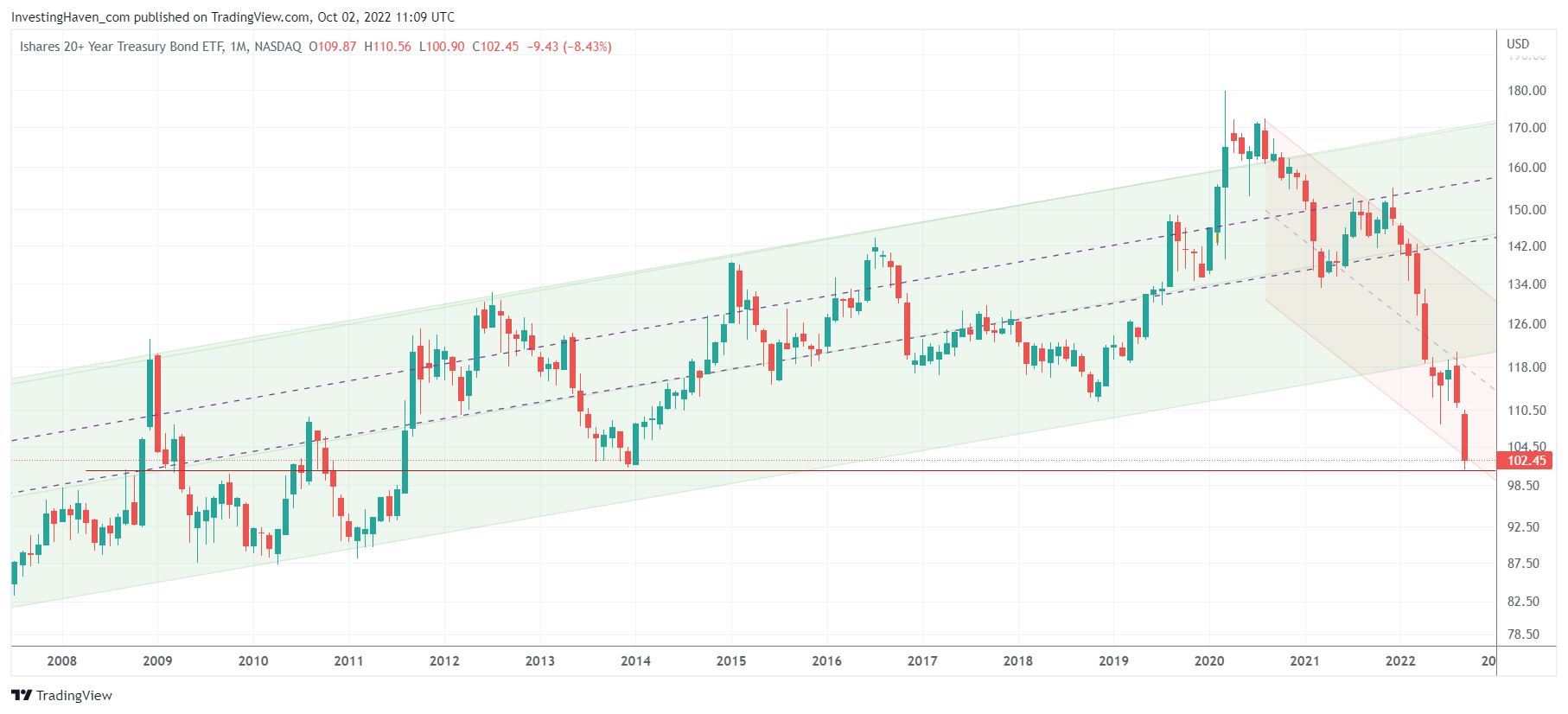

The first market that broke down in 2022 is 20 years Treasuries (TLT).

The traditional safe haven did not survive, it broke its 15 year channel. Particularly September was horrible for Treasuries. As seen on below chart, there was a touch of 15 year support in August but September confirmed the breakdown.

Although TLT might get back in its channel in 2023, it illustrates the absence of safe havens in 2022. It might have never happened before that both stocks and bonds came down, heavily, in one and the same year.

TLT might be finding support at its 2013 lows, right at 100 points.

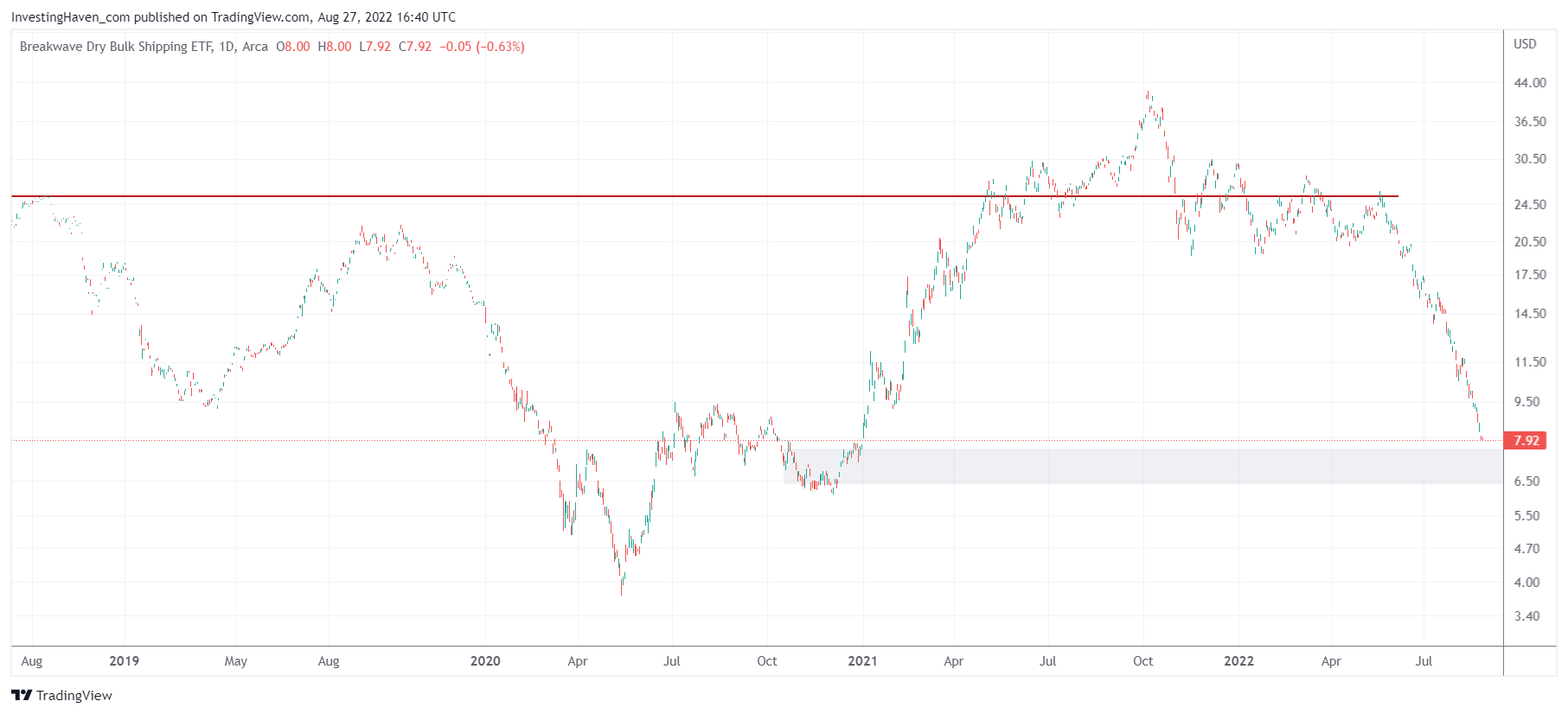

The dry bulk shipping ETF is another such illustration.

We mentioned last month how Covid Momentum Stocks Are Back To Ground Zero with Moderna and dry bulk shipping stocks as the primary illustration(s). What to make out of this next chart which represents dry bulk shipping rates. Indeed, a softening of the Covid supply chain issues.

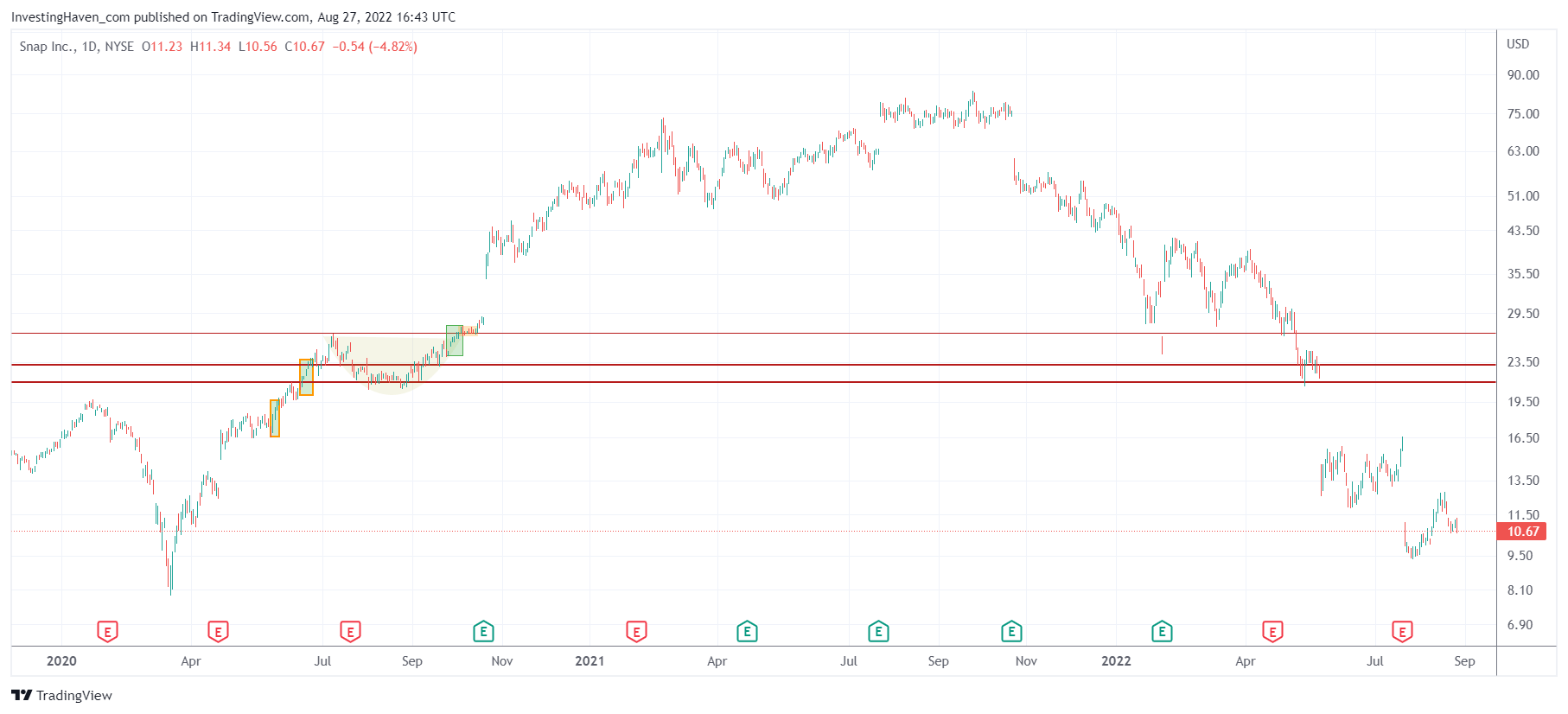

Snapchat is an illustration of how social media stocks went through the roof during the lockdowns but came up to 90% in 9 months (since November last year). Sudden shifts in usage of social media will likely never occur again.

While there are plenty more examples we thought these 3 illustrate the variety of breakdowns in 2022. It also shows the severity of the breakdowns.

While we believe that some of these breakdowns will recover over time, we also are convinced that some will never recover.

The underlying message of these breakdowns is that the market had its reset moment in 2022. What’s important to note is that the market has 2 reset moments in 2 years (2020, 2022) which is one of the most unusual events in history of markets.

Investors should try to understand which markets can recover and which ones not. It is important not to over-do it in terms of portfolio management, it is also important not to lose track of emerging opportunities and not feel paralyzed because of the overwhelming bearish price action.