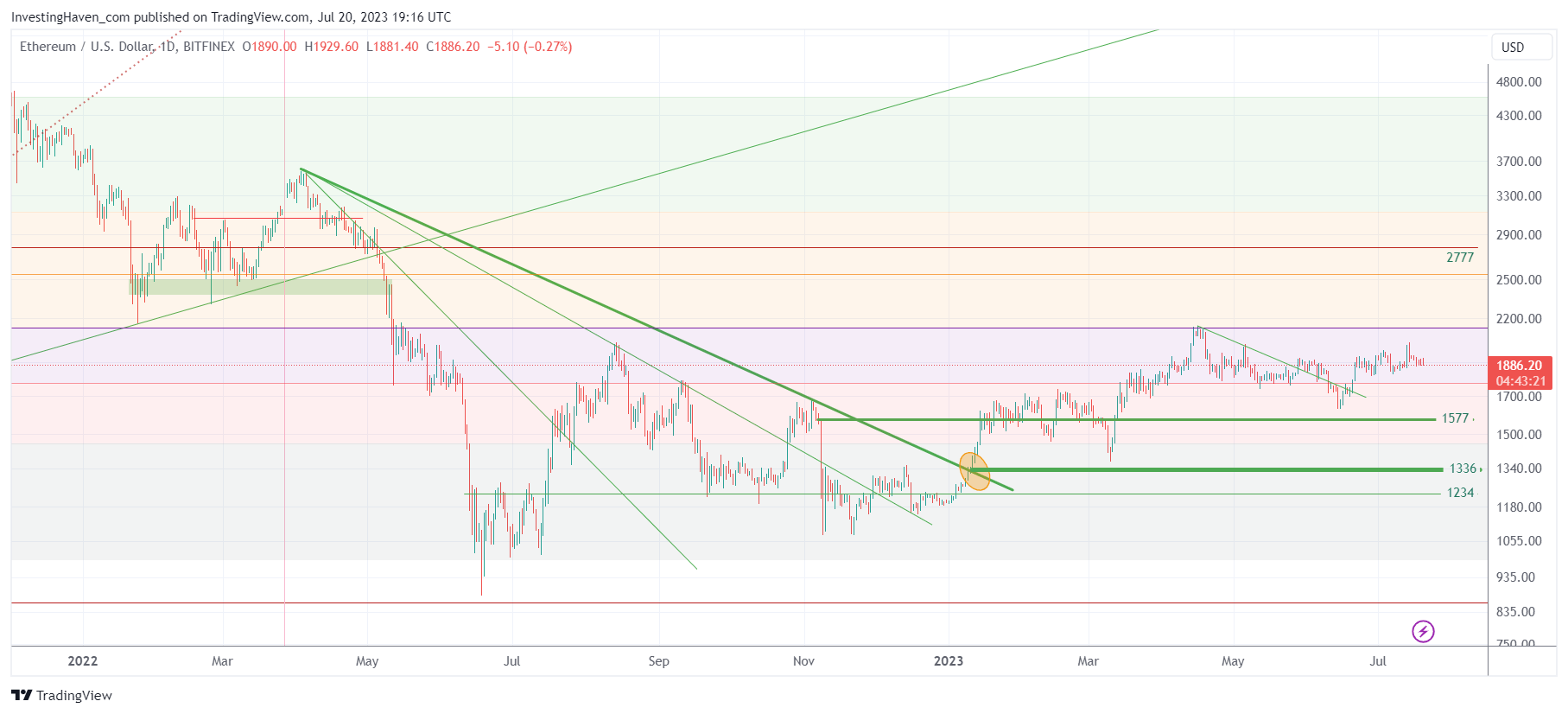

The price of Ethereum is now consolidating for 6 full months, in a narrow range between 1550 and 1950. In crypto terms, a consolidation of 6 months in a range of some 25% is pretty unusual. ETH is now even less volatile than BTC, which is also pretty unusual. Moreover, so far in 2023, ETH did not really participate to the crypto ‘golden weeks’ momentum trend(s). Crypto is known to be hyper-volatile. Consolidations tend to occur in a wider range, they also don’t tend to last for long. Is this good or bad?

Well, it’s not about the consolidation that is good or bad, overall the longer the consolidation the better… it’s really about the chart setup and structure.

Truth to be told, the chart setup of ETH is very different compared to, for instance, XRP. It’s no secret that the long term profile of XRP is amazing, as explained in XRP The Most Beautiful Long Term Crypto Chart Of 2023, and more recently in Our XRP Price Forecast Of 10 USD Is Now Confirmed. On the other hand, XRP holders had to wait for 2 full years to recover from the destructive impact that the SEC had created.

If we carefully look at the ETH chart, since it hit its ATH, we observe a few things:

- The 6-month consolidation is orderly. We see a series of slightly higher lows, in fact it’s a process that started around year-end. This is good, looks like ETH is gathering energy to create bullish momentum at a later point in time.

- In terms of resistance, it is blatantly clear how powerful resistance is right at the 50% retracement level (between its ATH and June 2022 lows), see the fine purple line on the chart. In August of 2022 as well as April of 2023, the 50% retracement level was tested. In the former situation, it resulted in a big drop. In the latter situation, we got a much softer drop.

- Overall, selling pressure is fading. That is, by far, the most important conclusion from this chart.

The last point is key, as it aligns with the overall rotational dynamics that characterize markets in the last 18 months. Rotation is huge, unusual, across all markets. Crypto is part of this dynamic, whether we like it or not.

We sense that both BTC and ETH are consolidating, right below their 50% retracement level, waiting in the queue of global markets, until its their turn to create bullish momentum.

We explained the ‘golden weeks’ concept in this article Crypto Investing Strategies Should Focus On Timing The ‘Golden Weeks’. In fact, the ‘golden weeks’ is the basis for our strategy in our premium crypto investing research service. ETH seems to be waiting, patiently, diligently, gathering steam, for its ‘golden weeks’ to come.

The only question, top of our mind, is from which level ETH will start a breakout and when exactly. The downside seems contained. Will ETH be able to break through 2000 USD this summer or this fall? We believe it will be either/or.

In the meantime, crypto enthusiasts can check out the crypto segment that is set up for outperformance whenever bullish momentum hits the crypto sector. Read our latest in-depth crypto report 30 cryptocurrencies in 7 segments: which tokens are ready for a move?