Bitcoin’s sell-off can be explained by the escalation of war. Bitcoin’s sell-off may turn into a bigger downtrend. However, at this very point in time, it may also represent a buying opportunity.

Read also – Is The End Of Bitcoin’s Bull Market Here?

In overnight trading, crypto markets sold off. Bitcoin’s sell-off was relatively mild, many altcoins experienced a stronger sell-off.

On April 13th, 2024, the war between Israel and Iran started heating up. The situation in the Middle East is escalating quickly now: Israel on alert after unprecedented Iranian attack (by the BBC).

Crypto is a high risk asset. It cannot handle uncertainty and global fear.

Middle East tensions will put risk assets under pressure. While the attack of April 13th, 2024, might not be the trigger of an imminent crash in markets, it will certainly limit the upside potential in the coming months.

Bitcoin’s sell-off

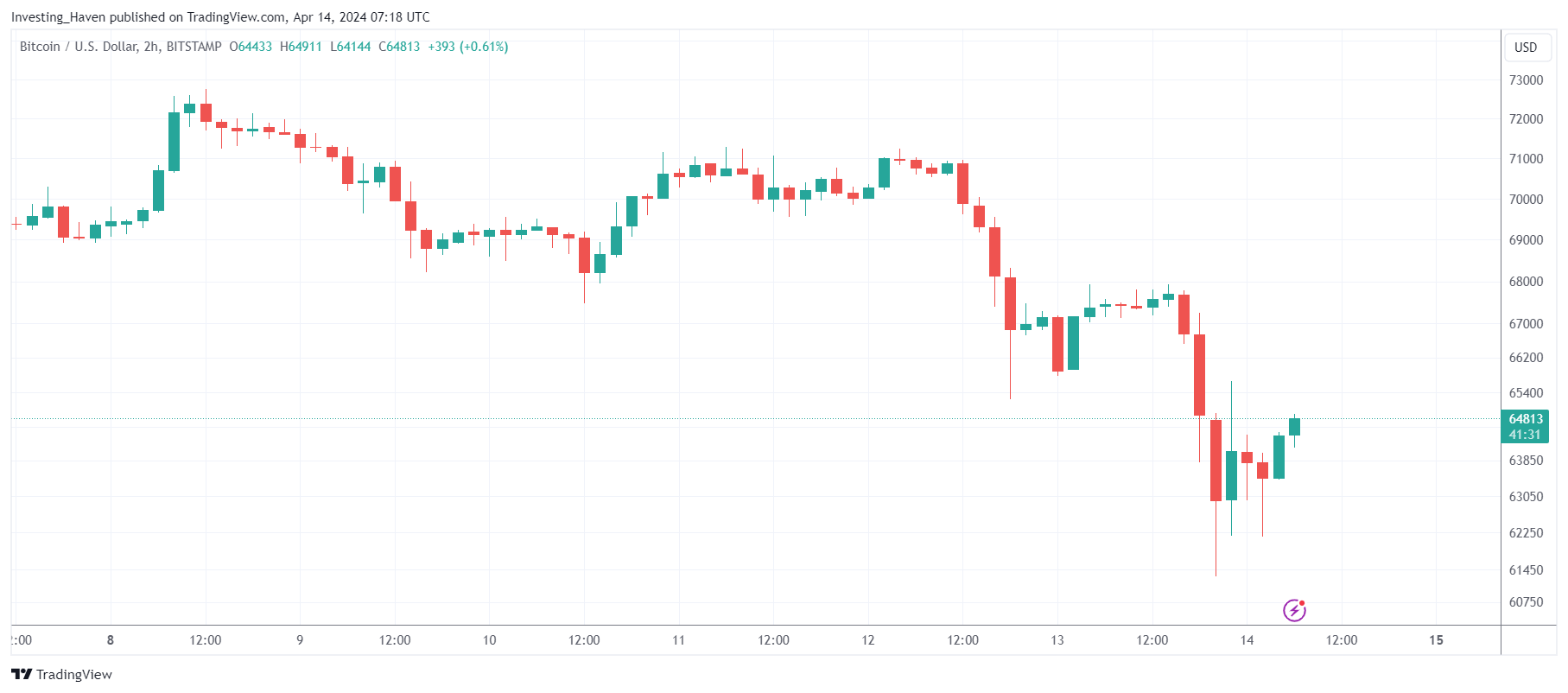

Many will show you short term Bitcoin charts. Their intention is to amplify the view of selling pressure.

Bitcoin’s sell-off, on the intraday timeframe, looks like this:

Source – TradingView

We believe it’s pointless to look at short term charts.

Stated differently, articles and social media posts you will read featuring short term oriented charts are absolutely and completely pointless.

A buying opportunity in Bitcoin if this happens

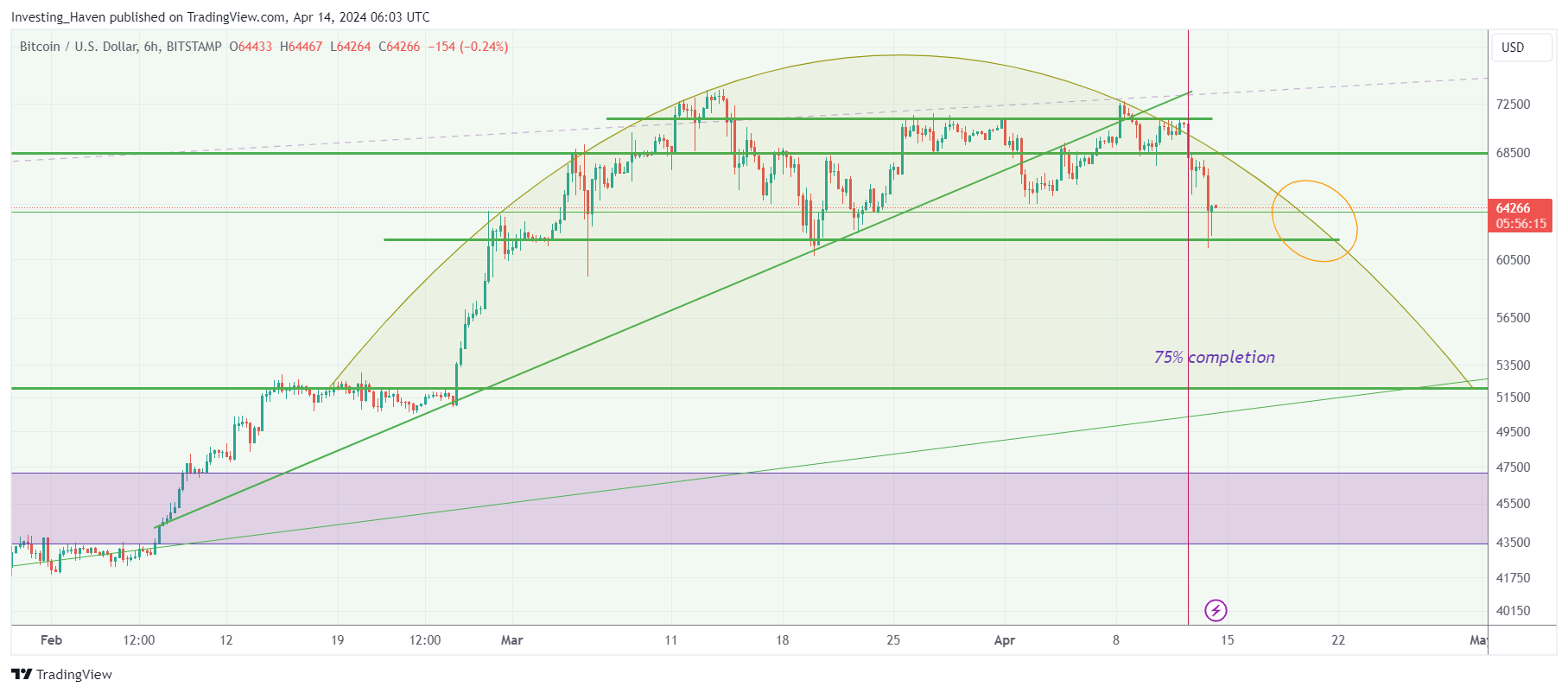

When we zoom out, get our annotations right, we get a very clear picture of Bitcoin.

The Bitcoin chart (6h timeframe) gives us the following information

- There is a rounded pattern – not bullish.

- The market had a great opportunity to push Bitcoin into a breakout, at 75% completion, a decision point – instead of a breakout, war triggered a decline.

- While not very clearly visible, the selling because of the Middle East attacks respected $62k, the March lows.

For now, it looks like Bitcoin did not break down. Buying pressure came up right at the March lows, setting a higher low. While Bitcoin may resolve lower in the coming days and weeks, it is clear that it is holding up well, at this point in time.

Bitcoin’s buying opportunity quantified

We summarize the potential Bitcoin buying opportunity scenario by looking at time/price combinations:

- If Bitcoin respects $62k, on a 3-day closing basis, between now and April 21st, it will have an opportunity to break out from its rounded pattern – this will represent a BUYING opportunity.

- If Bitcoin falls below $62k, on a 3-day closing basis, between now and April 21st, it will become concerning.

- If Bitcoin falls below $52k, between now and May 1st, it will be concerning.

The outcome is simple. The waiting will be tough.

We will follow up on the above outcomes, not in the public domain but in our premium crypto research service >>