There is no path for Ethereum to hit 100k before 2030, it’s impossible. ETH can realistically hit $10,000 in the coming years, either in 2025 or in 2026.

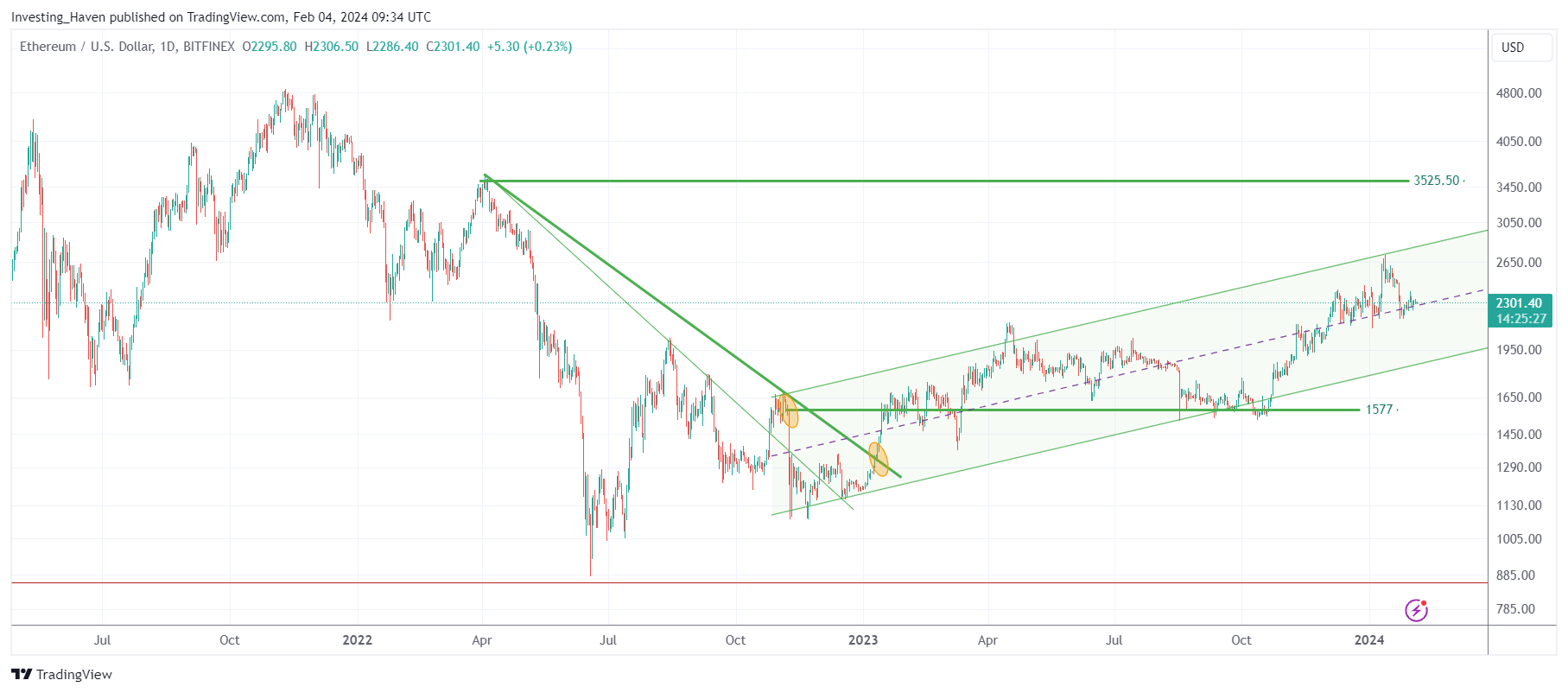

We are confident with our current 2024 ETH prediction, in which we forecast ETH to hit $3,525.50 before summer of 2024. We are equally confident that our must ETH target of $10,000 will be hit in the coming 3 years.

However, what’s impossible, in our view, is for Ethereum to hit $100,000 in the coming 7 years. While, eventually, it could get there, it is simply not justified to forecast ETH to 100k at this very point in time, with the info currently at hand.

‘What If’ analysis: Can Ethereum hit $100,000

The possibility of Ethereum reaching a valuation of $100,000 per unit is a scenario that is often discussed on the web. We see all sorts of opinions and ‘analysis’, from decent to speculative.

Such a monumental rise, equating to approximately a 50-fold increase from Ethereum’s current value, requires a deep dive into the implications. To understand the magnitude and feasibility of this scenario, we must analyze it through various lenses: market capitalization, comparison with Bitcoin, and the temporal aspect of such growth.

Can Ethereum hit $100,000? Market cap implications of ETH and BTC.

Should Ethereum reach the $100,000 mark, its market capitalization would soar to an astounding $13.7 trillion, based on the current circulating supply. This figure is not just monumental; it is transformative.

For perspective, this would dwarf the market cap of many of the world’s most valuable companies combined and even surpass the GDP of several major economies. Such a valuation would signify Ethereum’s transition from a digital asset to a global economic powerhouse.

The implications of a $13.7 trillion market cap are vast:

- First, it would reflect an unprecedented level of adoption and utilization of the Ethereum platform, far beyond what we see today. This could mean that Ethereum has become the backbone of a new digital economy, underpinning everything from finance to supply chains, and even governmental systems.

- The technical challenges of scalability, security, and sustainability would need to be fully addressed to support this level of adoption, necessitating groundbreaking advancements in blockchain technology.

A $13.7 market cap which will be the result of a scenario in which Ethereum hits $100,000 seems really unrealistic.

Comparison with Bitcoin

In this scenario, ETH to 100k, Bitcoin’s market cap would be projected at $42 trillion, assuming it maintains its current dominance, also assuming no change in the current BTCETH ratio.

This places Bitcoin in a league of its own, but it also highlights the relative growth potential of Ethereum.

While Bitcoin is often seen as digital gold, a store of value, Ethereum’s positioning as a platform for decentralized applications offers a different kind of value proposition.

Ethereum’s growth to a $13.7 trillion market cap suggests a broader range of use cases and a deeper integration into the fabric of the digital economy.

Temporal Considerations

Predicting such a significant increase in Ethereum’s value before 2030 presents a considerable challenge. The impact of technological innovations, regulatory developments, and global economic conditions over this period is highly uncertain because this scenario is so far out in the future.

Thus, while not impossible, the data points suggest that Ethereum to $100k is an unlikely outcome in the mid to long-term.

Looking beyond 2030, the forecast becomes even more speculative. The rapid pace of change in technology and society makes long-term predictions notoriously difficult. However, if we consider the potential for blockchain technology to revolutionize multiple sectors, the ongoing evolution of Ethereum, and its ability to address current limitations, the prospect, while still ambitious, cannot be entirely dismissed.

ETH to $100k chart implications

Let’s chart out the hypothetical scenario in which Ethereum hits $100k in the coming years.

This is the current daily ETH price chart, with $3250.50 our projected target for 2024. It’s also the acceleration point, or tipping point.

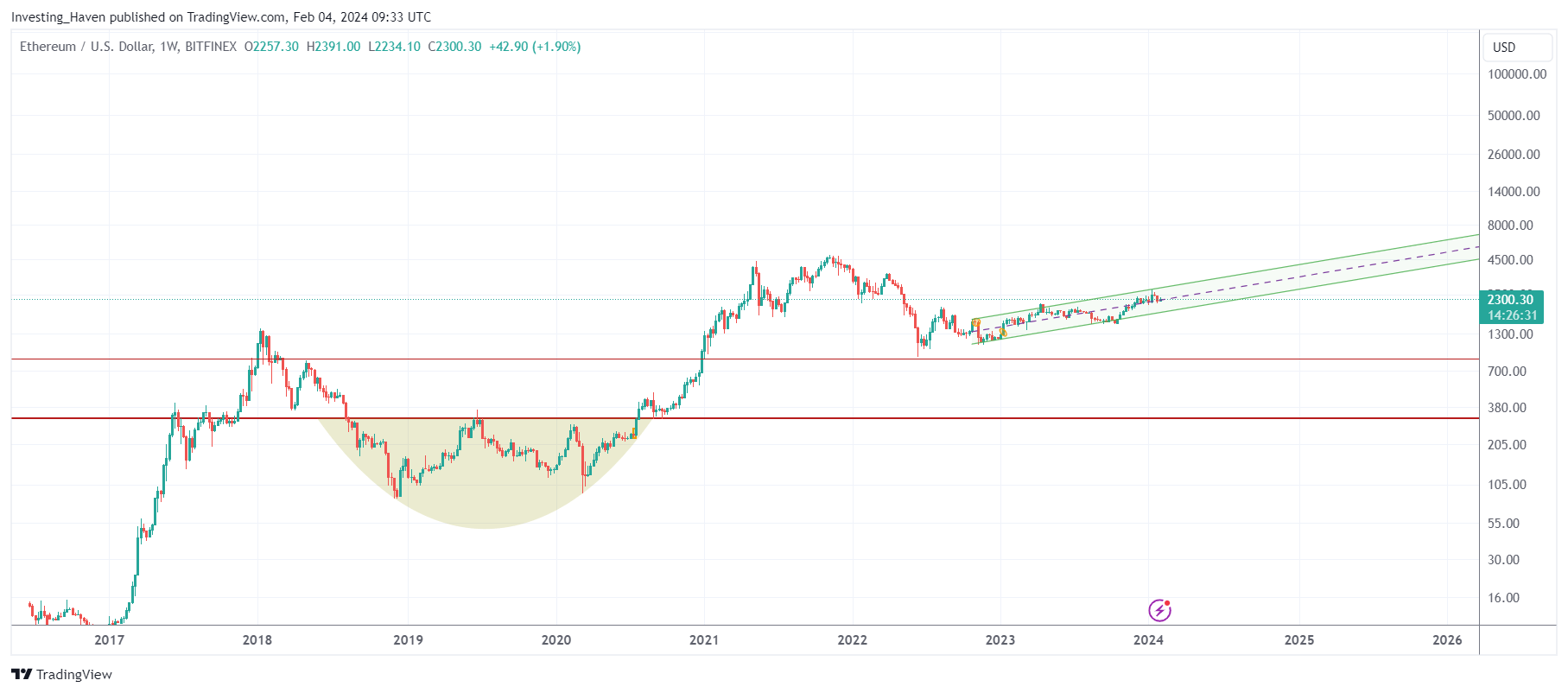

Now, we use the same rising channel, as seen on the above daily chart, and adjust scale to see where Ethereum’s $100k mark comes in.

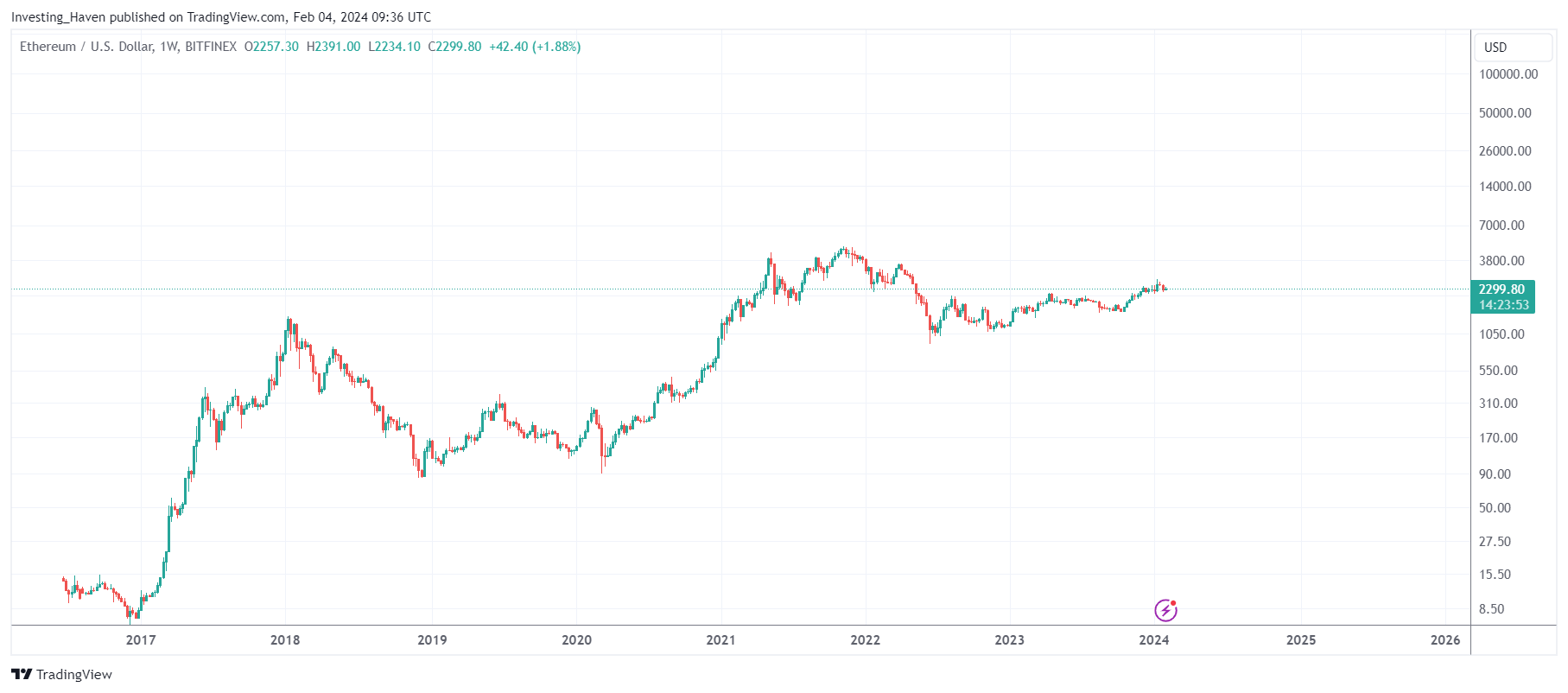

The same chart, but now without annotations:

You don’t need a PhD to see, with your own eyes, that ETH to hit $100k is very, very unlikely in the coming years.

You don’t need a PhD to see, with your own eyes, that ETH to hit $100k is very, very unlikely in the coming years.

Conclusion: can Ethereum hit $100,000?

The scenario of Ethereum reaching a $100,000 valuation and achieving a market cap of $13.7 trillion is a fascinating “What If” analysis. It stretches the boundaries of current thinking around cryptocurrency and blockchain technology’s potential.

This hypothetical scenario underscores the transformative impact Ethereum could have on the global economy, should it overcome existing challenges and fulfill the promise of widespread adoption and utility.

The crypto market simply is not ready for such a stretched valuation.

Ethereum’s chart does not support moving to the $100k in the coming years.

While ETH to $100k might happen at a certain point in time, it won’t happen before 2030, is what we confidently can say.

Ethereum: fundamentals supportive of a $100k scenario?

The analysis discussed before was essentially a ‘What If’ analysis.

While we had clear conclusions from the ‘What If ETH hits $100k’ analysis, we still want to understand a scenario in which Ethereum rises 50x from current levels.

Ethereum is not just a cryptocurrency; it’s a platform for decentralized applications (dApps), smart contracts, and decentralized finance (DeFi) projects. The recent transition to Ethereum 2.0, moving from proof-of-work (PoW) to proof-of-stake (PoS), aims to improve scalability, security, and sustainability – key factors that could boost Ethereum’s adoption and value.

Technical Advancements and Scalability

Ethereum’s ability to scale and meet the growing demand for its platform is critical. The success of Ethereum 2.0, including the implementation of layer 2 solutions like Optimism and Arbitrum, could significantly reduce gas fees and increase transaction throughput. These advancements are essential for Ethereum’s long-term viability and its potential to increase in value.

From a technological perspective, it looks like Ethereum is not ready to reach a $13.7 trillion market cap, not yet.

Regulatory Environment

Regulation poses a significant risk to all cryptocurrencies, including Ethereum. Positive regulatory frameworks could pave the way for institutional investment and wider adoption, while stringent regulations could limit growth or even pose existential threats.

In the medium to long term, however, the lack of regulatory clarity, certainly as it relates to exchanges and trading/investing cryptocurrencies, will hold a massive inflow of capital back. This is subject to change over time, but much more time will be needed to justify Ethereum to rise to a $13.7 trillion market cap token.

Economic and Market Dynamics

Cryptocurrency markets are very volatile, influenced by factors like investor sentiment, market liquidity, and macroeconomic trends. Ethereum reaching $100,000 would not only require technological success and widespread adoption but also favorable economic conditions and market dynamics.

With so much uncertainty post-Covid, driven by inflationary fear and tight monetary policies, it is unlikely that economic conditions will ignite a tremendous bullish momentum wave in markets and crypto to justify a 50x rise in ETH.

Potential Pathways for ETH to hit $100,000

For Ethereum to reach a valuation of $100,000, several factors would likely need to converge:

- Massive institutional adoption: Large-scale investment from institutional investors could drive significant demand.

- Mainstream use cases: Ethereum becoming the backbone for major applications in finance, supply chain, and beyond.

- Technological success: Successful implementation of Ethereum 2.0, leading to widespread adoption due to improved scalability and efficiency.

- Favorable regulatory environment: Supportive regulatory frameworks that encourage innovation while providing clear guidelines.

Conclusion: ETH to $100k

While the potential for Ethereum to reach $100,000 exists, it is likely many years out, at least 7 years (if not more).

With a $13.7 trillion market cap of Ethereum, if and when it hits $100k, massive changes need to occur, first and foremost fundamental, technological, regulatory. Moreover, institutions will need to be buying massive amounts of Ethereum.

We prefer to stick to our ETH to $10k target, that’s already a big one. It will happen in the coming 3 years. Let’s enjoy the ride, and not be too concerned about wild targets like ETH to $100k.