The price of Bitcoin will test its former all-time highs in 2024. We forecast that the price of Bitcoin will exceed $60,000 USD in 2024, testing the area $66,000 to $69,000. Whether BTC will set new all-time highs will depend on its leading indicators in the first two quarters of 2024.

Bitcoin is on an upward trajectory as we enter 2024. It should not come as a surprise that our Bitcoin price forecast for 2024 is directionally bullish.

Recently, we answered the question: How high can Bitcoin go in 2024? The answer to that question: “Our base forecast for Bitcoin in 2024 is $45,600 with a bullish forecast being $66,000. We expect Bitcoin to move to all-time highs in 2025.”

As explained in great detail in 7 Secrets of Successful Investing the best opportunities in markets are the ones that are unexpected. Who expected 2023 to be a good year for Bitcoin? We did, and we documented it extensively in many writings, even in the public domain but more so in the premium crypto service.

In another article we answered the question whether Bitcoin will go to $100,000 in 2024 or later. The answer to that question, according to our analysis “Bitcoin has the ability to rise beyond $100,000 in 2025 or 2026” which is a conclusion based on long term W-reversal chart structure that is nearly complete on its long term (weekly) chart.

Hard to believe, but crypto may qualify as an epic investment opportunity, maybe even one of the most epic investment opportunities.

With that said, we look specifically at a realistic Bitcoin price target for 2024 by covering the following topics:

- Bitcoin prediction fatigue

- Summary of our Bitcoin price forecast 2024

- Bitcoin forecast 2024: leading indicator Euro

- Bitcoin forecast 2024: correlation Nasdaq

- Bitcoin forecast 2024: secular Bitcoin price chart

- Bitcoin forecast 2024 invalidation

- Bitcoin forecast 2024 conclusion

We consider Bitcoin a leading indicator for the entire crypto market. Remember, when Bitcoin is bullish, altcoins have much more leverage to the upside. That’s our focus in our premium crypto investing service, even in what was considered a ‘crypto winter’ in 2023 we hit many multi-baggers.

Bitcoin prediction fatigue

Back in 2017, InvestingHaven’s research team was the first to publish Bitcoin price forecasts in the public space. They are still available in our archives.

It was not just Bitcoin forecasts but also Ethereum forecasts, XRP forecasts, Litecoin forecasts.

We pride ourselves, not just being the first ones, but also among the most accurate predictions.

Since then, especially in recent years, the web is full of useless and irrelevant Bitcoin price predictions. We see them in many forms, think large tables, generated by AI, with price calculations for the next days / weeks / months / years. What we also see a tendency to focus on Bitcoin predictions on the very short term which obviously is complete non-sense, and only meant to grab the attention and win Google rankings.

Summary of our Bitcoin price forecast 2024

In essence, the introduction of this article contains the summary of our Bitcoin price forecast 2024:

The price of Bitcoin will test its former all-time highs in 2024. We forecast that the price of Bitcoin will exceed $60,000 USD in 2024, testing the area $66,000 to $69,000. Whether BTC will set new all-time highs will depend on its leading indicators.

As we will see in the remainder of this article, the leading indicators influencing Bitcoin’s price are bullish. We will need to continue to track them, as Bitcoin moves to our bullish targets, to understand the upside potential of Bitcoin in 2024, especially as it approaches our bullish targets.

Moreover, as said, we see Bitcoin move to 45.6k USD, our first higher target. If leading indicators remain bullish, we expect 66k USD to be hit. We expect Bitcoin to find resistance in the 66-69k USD area.

That’s why, anyone interested in a Bitcoin related investment, should not wait for higher prices. Once BTC goes to 45.6k as well as 66-69k USD, both of them being Bitcoin price targets, it will come with increased volatility. This implies much more difficult to get an entry price right.

Bitcoin forecast 2024: leading indicator Euro

One leading indicator for Bitcoin is the EURUSD pair.

BTC is positively correlated with the Euro.

BTC is negatively correlated with the US Dollar.

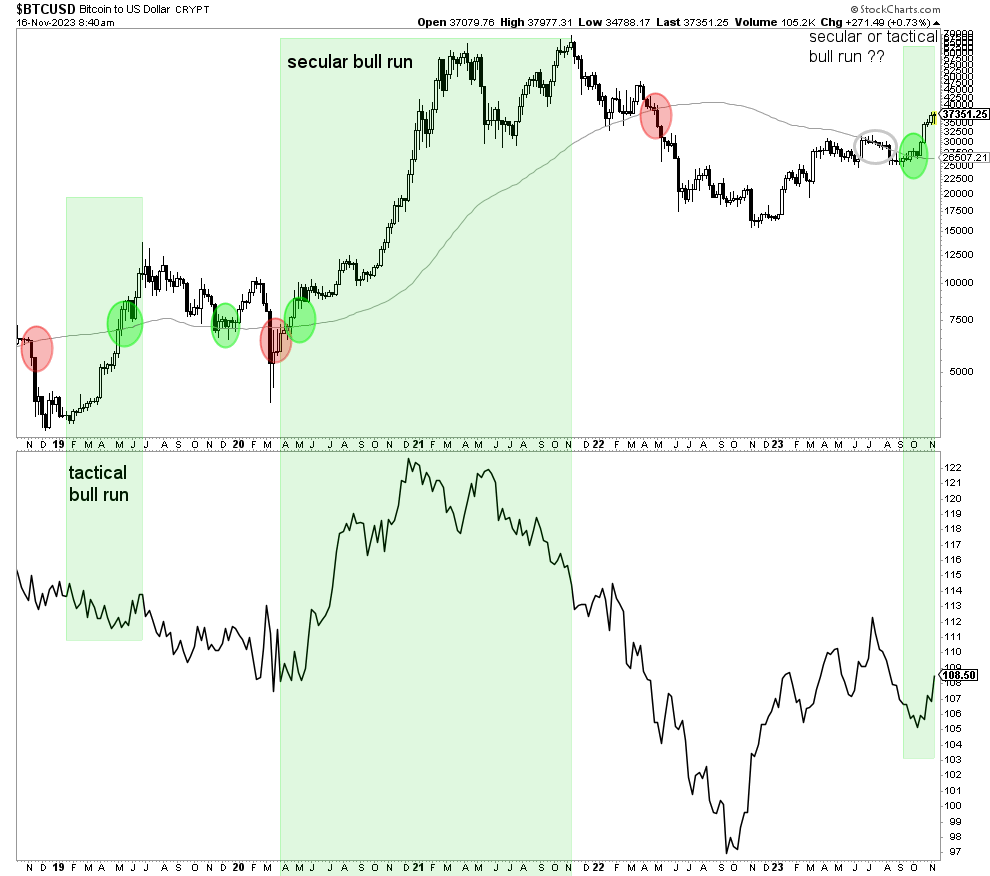

If we look at a secular chart of Bitcoin, compare it with the USD, notably the chart shown below, we can clearly see this correlation.

Moreover, what’s really interesting, to observe, Bitcoin’s 90 week moving average, representing the long term trend of Bitcoin’s price, tends to be pierced to the upside when Bitcoin stages either a secular or a tactical bull run. This tends to happen when the USD is falling.

For 2024, it is clear that, for sure the first part of the year, Bitcoin will continue to be bullish, as it just recently pierced its 90 week moving average on a falling USD. This is one of the reasons we believe Bitcoin’s forecast for 2024 is directionally bullish.

Bitcoin forecast 2024: correlation Nasdaq

Moreover, we observe a strong correlation between the Nasdaq and Bitcoin.

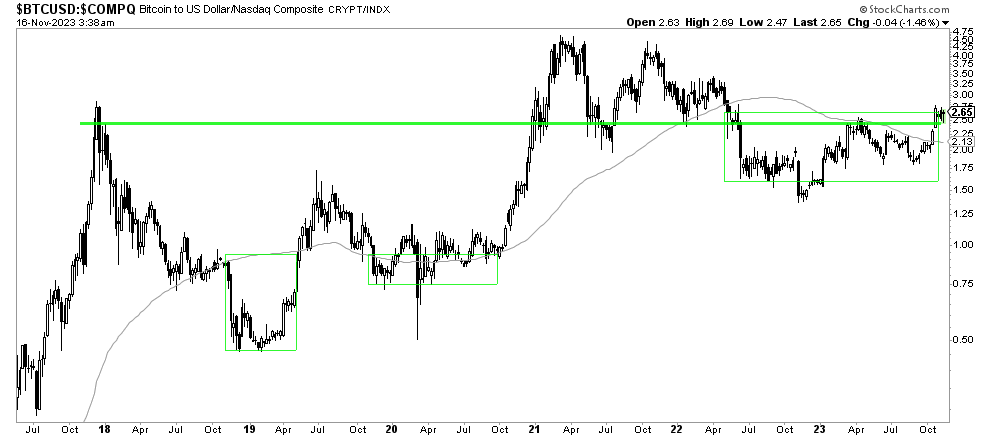

Below is the BTC chart expressed in Nasdaq terms.

What is very interesting, to say the least, is that a strong uptrend in Bitcoin tends to occur when the ratio between both assets crosses its 90 week moving average (fine grey line on this chart). We did annotated the periods in which this ratio traded below its 90 week moving average with a green box. As seen, in all 3 occurrences the periods below the 90 week moving average marked bullish reversal patterns, and resulted in an uptrend in the price of Bitcoin.

Our bullish Bitcoin price forecast for 2024 is largely based on the recent completion of the basing pattern on the ratio chart BTC/Nasdaq.

Bitcoin forecast 2024: secular Bitcoin price chart

All of the above made it blatantly clear to us: Bitcoin wants to move higher, much higher, in 2024 and beyond. This does not mean there will not be period of selling, of course volatility and selling will pick up from time to time.

However, the primary trend will be higher, and our higher targets as per our Bitcoin price forecast 2024 will be achievable. We see 45.6k being hit, pretty easily, in the first months of 2024. Moreover, depending market conditions including the Euro and the Nasdaq, a ride to the 66-69k USD area should be next.

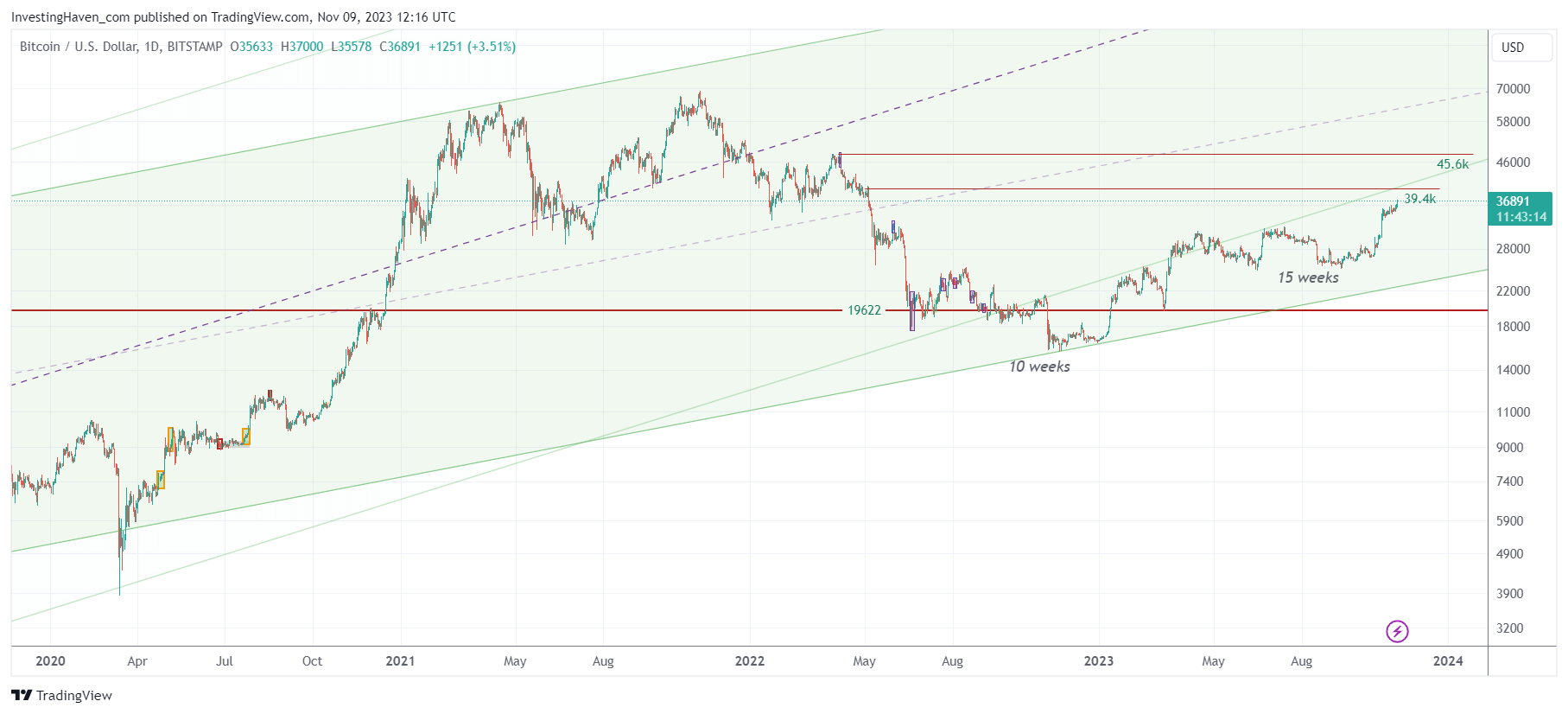

The long term Bitcoin chart, below, shows the giant reversal structure that Bitcoin went through in the last 18 months. Moreover, equally important, in doing so, Bitcoin created a rising channel, the one in green, which is a 7-year rising channel.

Bitcoin prediction invalidation

Bitcoin’s bullish price predictions will invalidate if and when Bitcoin falls below its 7-year rising channel, the one shown on the above chart. This level might be tested, when selling picks up again, but it should not give up structurally, which means on a 8 to 13 day closing basis (max. 21 days).

The breakdown area is 25k USD.

We don’t expect Bitcoin to fall below 25k USD. But we must have invalidation criteria in place for our Bitcoin prediction, like with any prediction.

Bitcoin forecast 2024 conclusion

The conclusions of our Bitcoin price forecast 2024 are very clear, also simple:

- Bitcoin will easily hit 45.6k USD.

- Bitcoin should be able to continue its upward trajectory to the 66-69k USD area.

- We expect volatility to pick up at 45.6k, but even more so in the 66-69k area. That’s why entry prices are ‘safer’ around current levels, not in the higher area.

- In order for Bitcoin to remain bullish, the USD should not stage a strong rally, exceeding 109 points.

- If the Nasdaq continues its rise, it will help Bitcoin to mover higher because of their historical correlation.

- Our bullish Bitcoin price forecast invalidates if/when BTC falls below 25k USD for more than 5, 8, 21 days.

All in all, we have a high level of confidence in our bullish Bitcoin price prediction.

Remember, when Bitcoin is bullish, altcoins have much more leverage to the upside. That’s our focus in our premium crypto investing service, even in what was considered a ‘crypto winter’ in 2023 we hit many multi-baggers.