A stock market crash? Not really, not at all, is what we are saying since many months. We confirmed that the ‘this is 2008 all over‘ stories and charts were bogus and only meant to spread fear and collect ‘likes’ in social media, we did so with this one article 2008 vs. 2022: Similarities and Differences. Yardeni Research released a market sentiment chart (source) which is additional evidence of an interesting bullish period to start in markets.

Stock market sentiment is supporting a more aggressive stance for stock market investors.

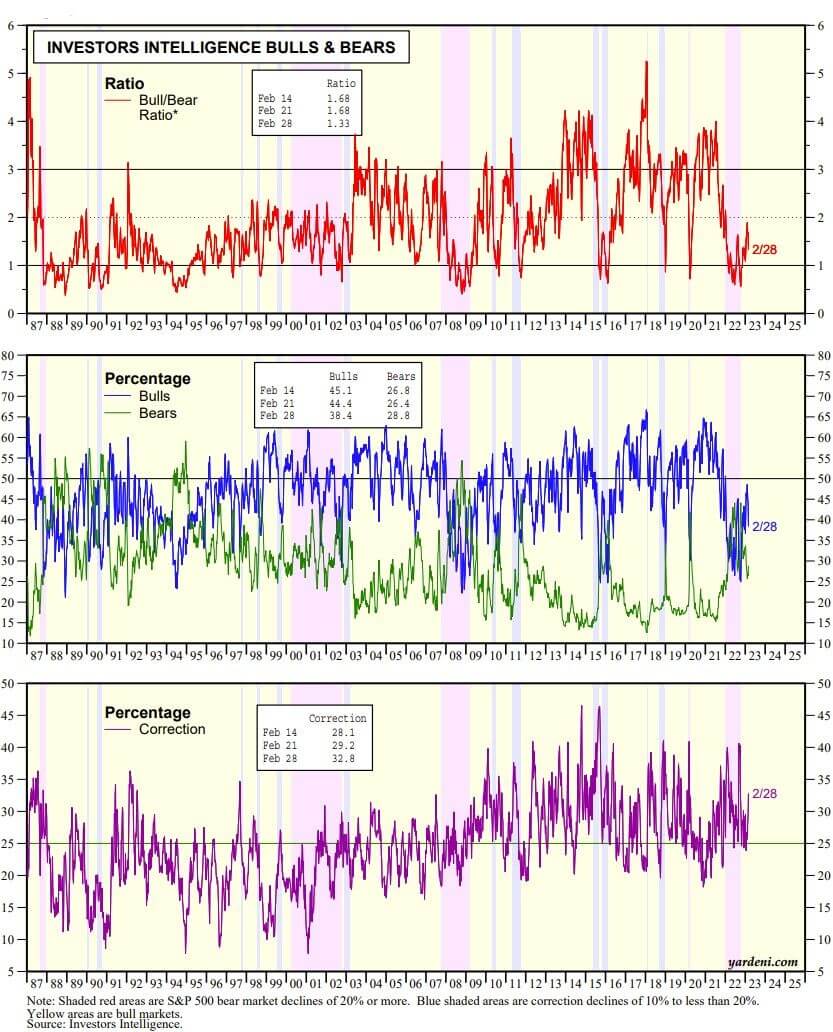

Particularly, the Investors Intelligence Bull/Bear Ratio is a reliable contrarian indicator.

Last year, the Investors Intelligence Bull/Bear Ratio fell to 0.60 in the second half of June. It rebounded during the summer but fell to a new bear market low of 0.57 mid-October. Yardeni notes: “The BBR bottomed at 0.41 during the bear market of the Great Financial Crisis during the week of October 21, 2008“.

Fast forward to today, what do we observe when it comes to Investors Intelligence Bull/Bear Ratio:

Investors Intelligence Bull/Bear Ratio readings of 1.00 or less have offered great buying opportunities for long-term investors. That’s why we concluded that last year’s stock market low on October 12 was probably the end of the latest bear market. The BBR fell to 1.33 this past week from 1.68 the previous week.

We couldn’t agree more with this conclusion.

The contrarian signal of this Bull/Bear Ratio is clearly confirming that stock market investors can become more aggressive in initiating positions. One really important thing: this market requires investors to be very selective, extremely selective. It’s better to look for quality stocks and wait a few more months before considering momentum stocks.

In our stock market investing service Momentum Investing we are preparing our top stock picks in what we call our “stocks shortlist”, to be released in our premium service in the next 48 hours. We identified quality stocks in a variety of sectors, first and foremost industrials and AI stocks. We are planning to be fully invested in stocks by the end of March.