Nickel has emerged as a vital player in the universe of commodities, driven by its diverse applications, especially in the burgeoning electric vehicle (EV) industry. The question that often preoccupies investors and industry observers is whether the price of nickel will continue its upward trajectory in the years ahead, particularly in 2024 and 2025. This article delves into the intricate balance between the short-term supply dynamics and the enduring demand fueled by the EV revolution. Note that nickel is part of the green battery metals super cycle, although one of the less known minerals with a smaller market size compared to lithium.

Nickel market: Short-term surplus vs. long-term EV demand

Nickel’s price dynamics are governed by a delicate interplay of short-term supply and long-term demand, primarily anchored in the expanding EV market. Recent reports from prominent research sources provide valuable insights into this complex equation.

Short-Term Challenges

On July 10th, 2023, ING Bank’s Commodities department reported a short-term surplus in the global nickel market due to a building surplus and a sluggish global economy that has impacted stainless steel demand. This short-term pressure led ING Bank to project average nickel prices around $21,000/t in the third quarter and $20,000/t in the fourth quarter of 2023. However, the report also emphasized the enduring allure of nickel as a green metal, crucial for the global energy transition and EV battery manufacturing.

Australian Resources & Investment echoed this sentiment, acknowledging the short-term challenges posed by excess Class 2 nickel production from Indonesia and China. Despite these headwinds, the report noted tight LME nickel inventories and the enduring role of nickel in the green energy transition, particularly in EV manufacturing. The demand for nickel in electric vehicles, where it enhances energy density and range, offered a silver lining. While the short-term average price forecast was adjusted downwards, BMI’s long-term outlook sees nickel prices averaging $US26,500 per tonne by 2027.

In line with these analyses, a July 12th, 2023 report by Investing News highlighted the ongoing impact of excess nickel supply coupled with sluggish demand, especially from the Chinese economy. However, the report underlines the potential turnaround in the second half of the year due to Chinese economic incentives and the growth of the battery segment. The longer-term perspective anticipates a shift in demand segments, particularly the rise of the battery space, which is projected to account for 41 percent of nickel demand by 2033.

Long-Term Resilience

On the other hand, demand for nickel, long term, supported by booming EV growth, will remain solid.

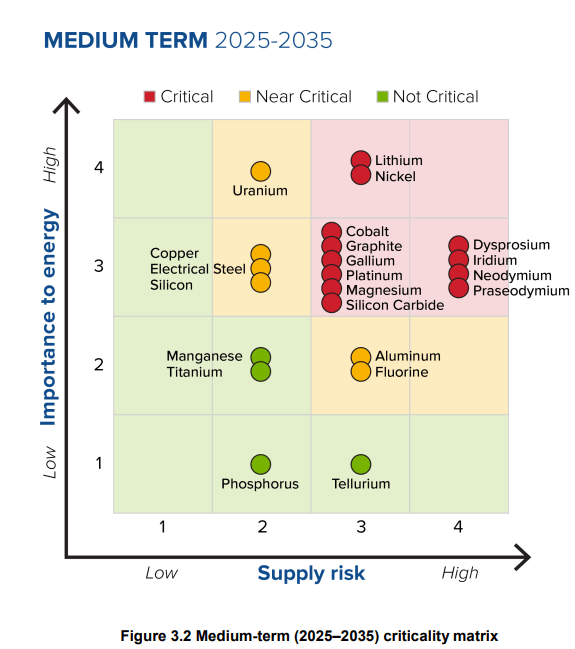

The U.S. Department of Energy Critical Materials Assessment published this critical mineral matrix, in June of 2023:

As per the research, on page 29, there are six critical materials in the short term, which include cobalt, dysprosium, gallium, natural graphite, iridium, and neodymium. The uses for these critical materials are spread across rare earth magnets, batteries, LEDs, and hydrogen electrolyzers. There are nine near-critical materials, which include electrical steel, fluorine, lithium, magnesium, nickel, platinum, praseodymium, silicon carbide, and uranium. Finally, there are seven noncritical materials including aluminum, copper, manganese, phosphorous, silicon, tellurium, and titanium.

Between the short term and medium term, the importance to energy and supply risk scores shifts for most materials. There are 12 critical, six near-critical, and four noncritical materials in the medium term. For example, the importance to energy scores for copper and silicon increase while their supply risks remain the same. In addition, supply risk scores for aluminum, iridium, manganese, neodymium, phosphorous, platinum, and SiC increase, while their importance to energy stays constant. Nickel increases in both importance to energy and supply risk. Dysprosium, on the other hand, falls in energy importance due to potential substitutions in the medium term but increases in supply risk, remaining a critical material. All other key materials remain in the same category from the short term to medium term.

We believe there is a solid case to be made that the short term supply surplus in the nickel market will be a short to medium term phenomenon. Long term, nickel will continue to be in high demand.

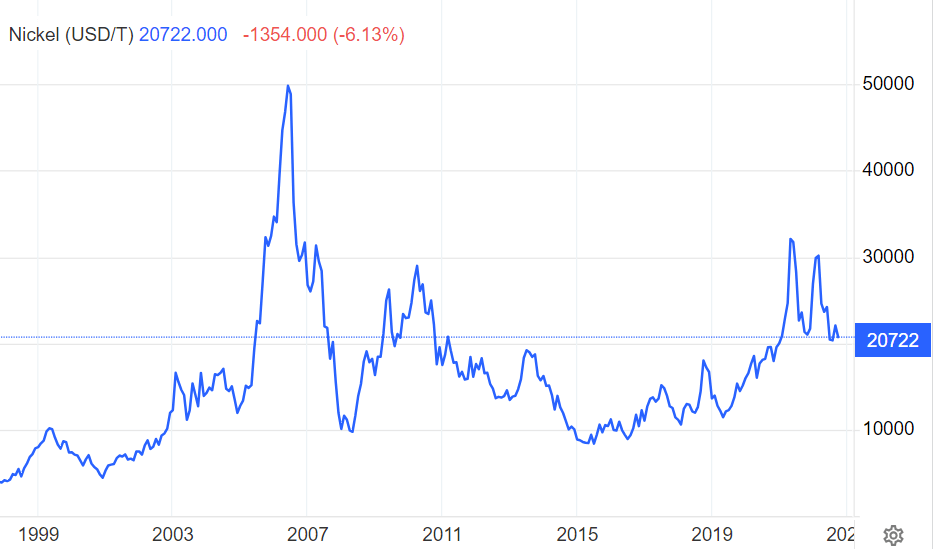

Nickel’s 25-Year Price Trend

The longer timeframe, particularly nickel’s 25-year price chart, is even more interesting. During the big commodities boom, back in 2006, nickel truly exploded in price. It went to 50k USD/t, a price point that coincides with the 2022 top which is visible on the candlestick chart above (but not on the line chart below). Interestingly, the nickel chart has some similarities with silver’s historical 50-year chart.

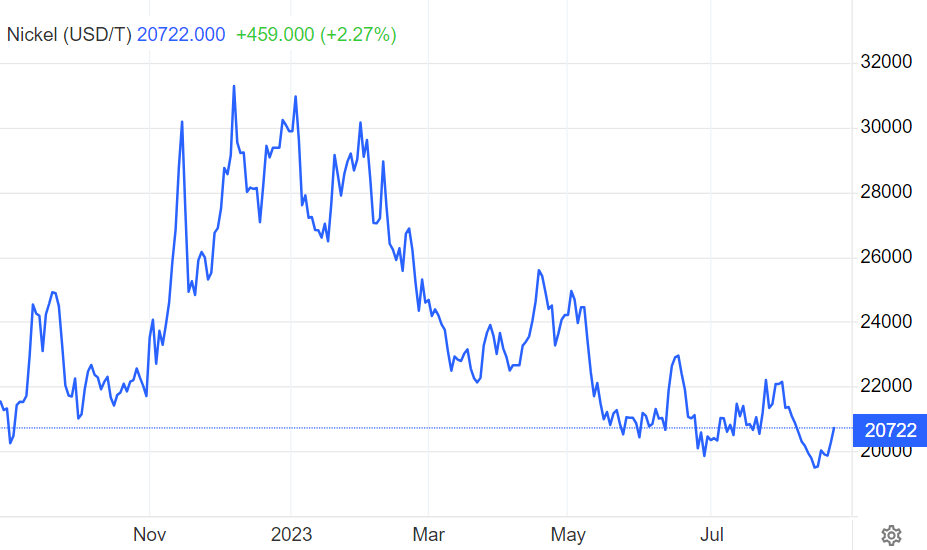

Analyzing Nickel’s 10-Year Price Trend

To predict the future movement of nickel’s price in 2024 and 2025, it’s essential to examine its historical price behavior. The provided nickel price chart spanning a decade reveals significant insights into its long-term trends and potential future trajectories.

Long-Term Price Channel: A Dominant Trend

The chart showcases a prominent long-term price channel, which has historically defined nickel’s price movements. This channel acts as a crucial guideline for understanding the broader price trends over extended periods. The upper and lower boundaries of the channel provide an essential context for evaluating nickel’s price swings.

Shift to a Horizontal Structure and the W-Reversal Pattern

Amid this shift from the trend channel, the chart introduces a compelling new perspective. Astute observers will note the emergence of a W-reversal pattern, initiated by the price decline in April/May 2022. If this pattern establishes itself as the new dominant trend, it could signify a transformative change in nickel’s price trajectory.

This W-reversal pattern hinges on a double bottom scenario. The current support area should be respected, in 2023 and 2024, in comparison to the 2022 lows. Such a development would create a robust W pattern, potentially driving nickel’s price to its early 2023 highs.

The 10-year nickel chart also features a long term rising trendline, in red. This trendline needs to be respected. Interestingly, this trendline is about to coincide with support of the double bottom structure that is in the making.

Stated differently, the current area must act as support in 2024 in order for the price of nickel to double in 2025.

Note that the short term nickel price chart, shown below, features the right part of what potentially can become a bullish W-reversal. The importance of the current level, as a support area, is shown on the above chart though.

Conclusion: Navigating Nickel’s Future

In the quest to anticipate nickel’s price movements in 2024 and 2025, the journey through historical patterns, short-term supply dynamics, and long-term EV demand reveals a multi-faceted picture. The immediate challenges of a surplus in the market and subdued demand are offset by nickel’s enduring role in the green energy transition, especially in the EV sector.

While short-term projections vary, the trajectory of nickel’s price seems inherently tied to the unfolding EV revolution. As the world pivots towards sustainable energy solutions, nickel’s importance as a key green metal is set to support its resilience. The intricate dance between short-term fluctuations and long-term demand for EV batteries promises an exciting path forward for nickel, making the prospect of its continued rise in 2024 and 2025 an intriguing one.

In essence, the chart depicting nickel’s 10-year price history speaks volumes about its potential trajectory. As the market shifts from the established trend channel to the emerging W-reversal pattern, investors must consider the timing and dynamics that this pattern entails. While predicting exact price points remains elusive, the evolving chart patterns offer valuable insights into the direction that nickel’s price might take in 2024 and 2025.

Sign up to Momentum Investing, get instant access to this in-depth report Lithium & Graphite: Top Stocks Selection.