This is a short update on the Greek National Bank, a stock we discussed several times this year.

- It all started with our vision that the National Bank Stock Which Crashed 99 Pct In 24 Months, Could Be The Next Ten-Bagger

- In July of this year, we said: National Bank Of Greece Breaks Out

- In June of this year, we identified the Greek National Bank as The Best Small Cap Banking Stock To Buy.

Of course that is all based on the extreme collapse of the Greek economy, and the assumption that the European Union will want to help the Greeks to overcome their crash. Given the extreme collapse it does not take much for leading Greek stocks to double or triple in the medium term, and become tenbaggers on the long run.

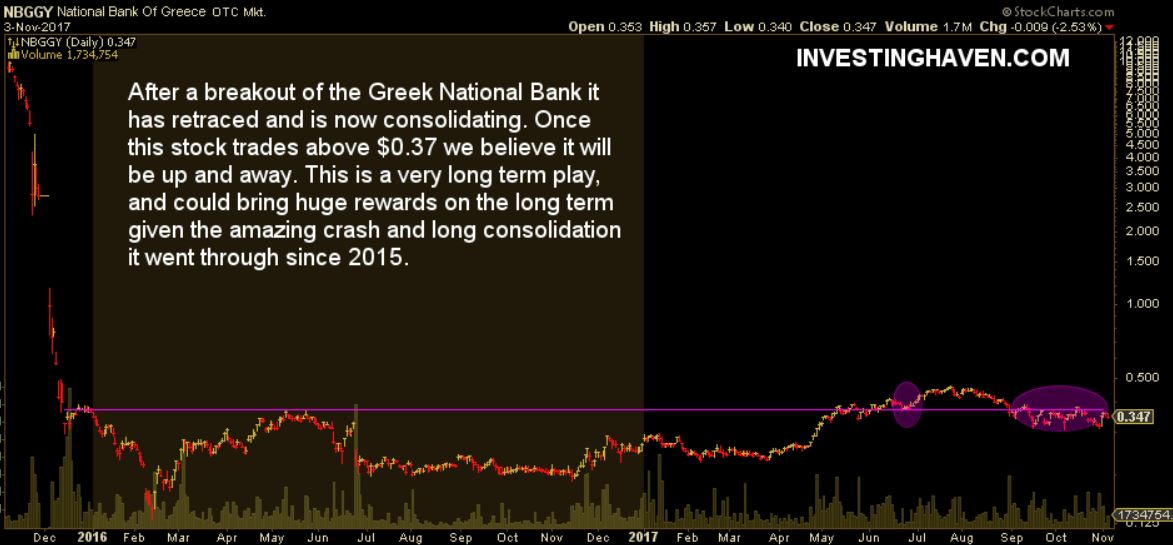

The Greek National Bank broke out this summer once it crossed 0.37 USD (NBGGY on the OTC market). After a strong rise, it came back to test its January 2017 highs at 0.30 USD. So far, that support level has held.

The key level to watch is, according to us, still 0.37 USD. We consider that the breakout point. As soon as the first signs of a recovery in the Greek economy kick in we should easily see the Greek National Bank move to 1 to 2 USD, presumably towards 2020. For now, we expect a continuation of the current consolidation shown on the chart.

This is a long term play, holdings can be accumulated by investors.