The Corona crash will go in history books, and in 50 years investors will still be talking about this. We witnessed it, and protected our members in this once-in-a-generation type of cataclysmic crash. Our short term Trade Alerts portfolio is closing this quarter with astonishing results (30% to 49% in green), our medium term Momentum Investing portfolio is slightly in green at the time of writing (with 2 open positions). Is the crash over? Maybe, and there are several indicators that we share with our premium members to position ourselves correctly for the inevitable rebound. This is premium content preserved for premium members. There is one particular indicator that is worth sharing: the transportation sector IYT ETF.

The transportation sector was one of the 3 sectors that got hit hardest. The other 2 sectors were the banking and energy sectors.

Consequently it is worth paying attention to the end of selling signals on the transportation chart.

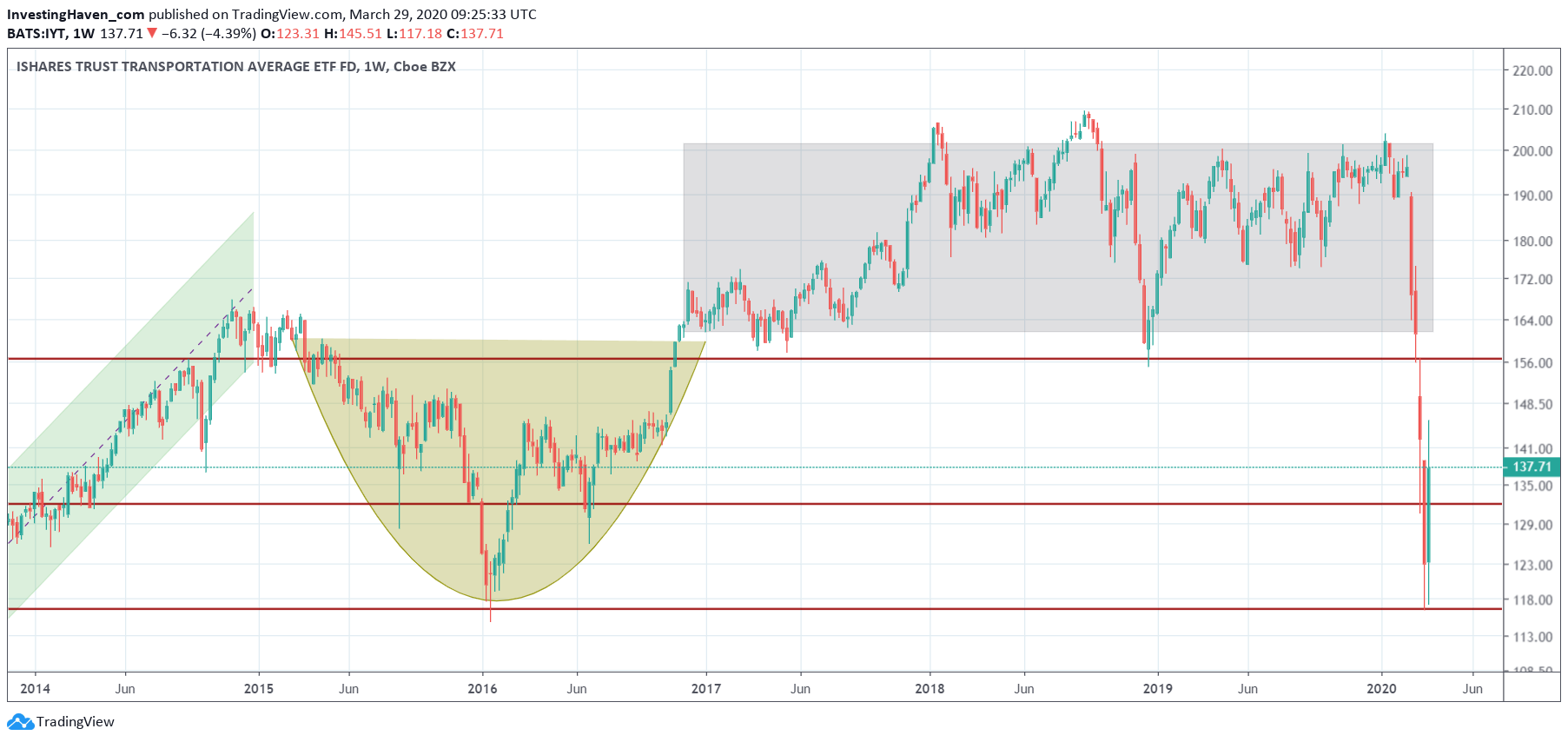

Below is the weekly transportation sector ETF IYT.

Visibly the 2016 crash lows is where this ETF found support. This very simple trick to remember is to watch the weekly opening prices, especially 123 points (2 consecutive weekly openings). If IYT ETF trades above 123 points in the next few days and weeks we have additional confirmation that selling is largely over.

It also may justify taking a longer term position around current levels for once we get ‘back to normal’ in this sector.