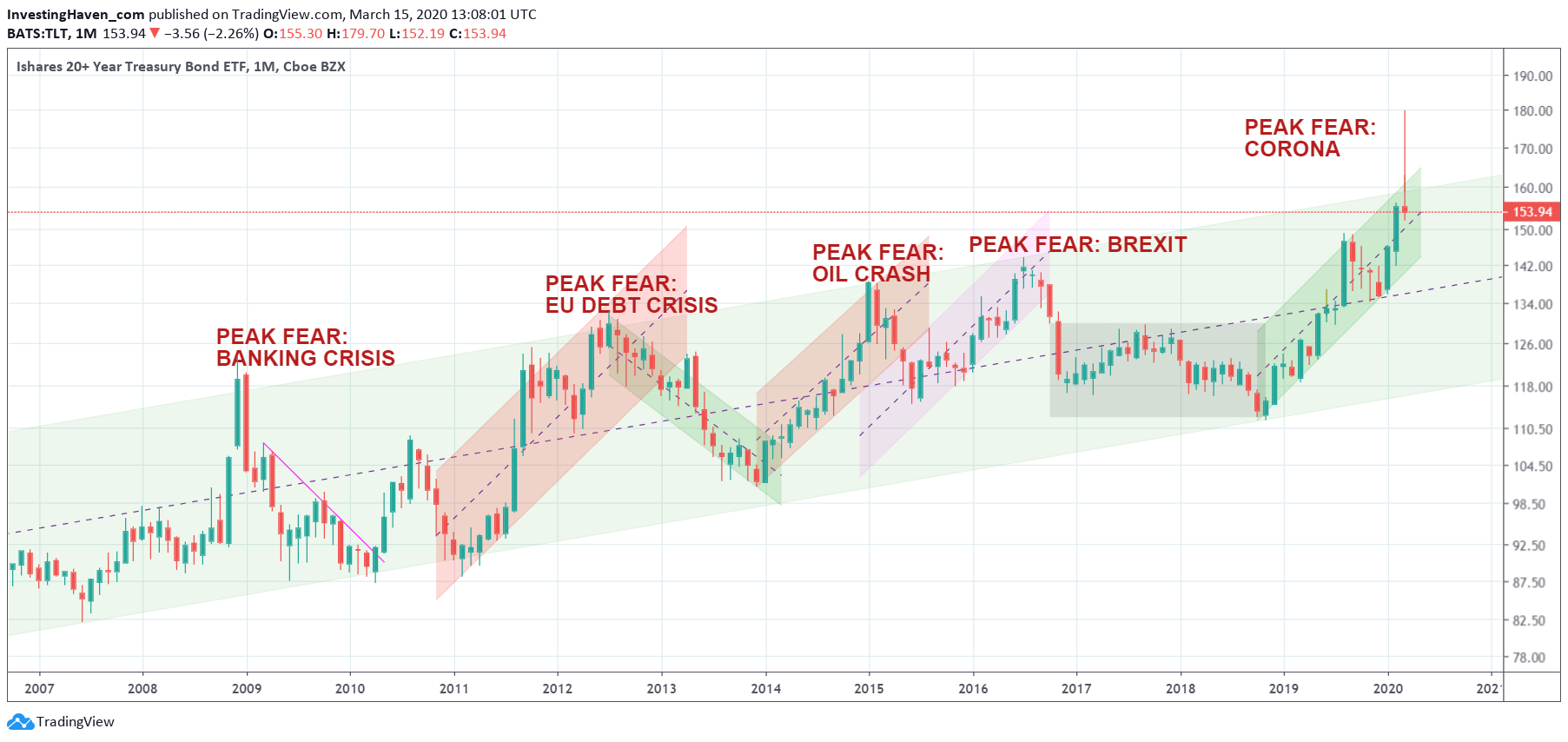

This was a week for history books. Any fear indicator hit records this week, especially on Thursday March 12th, 2020. No coincidence this will go into history books as Black Thursday. Not any asset was able to survive this week (gold, Bitcoin, stocks) with the exception of the Euro. Last week we said that Treasuries Registered A Once In A Decade Off The Charts Peak. This week we see a wick

This is what we wrote last week:

The ‘corona effect’ is not a systemic, but an epidemic effect. That’s how it is playing out in markets right now. Very sudden declines, extremely sharp and aggressive. Consequently we can expect the opposite to happen as a reversal. The million dollar question is ‘when’?

There is no way to justify standing in front of a selling avalanche. We believe markets are at crossroads right now: stabilization of +10% additional selling. And as things move fast right now we can expect IF (it’s a big IF) additional selling takes place it would go very fast.

The charts are beyond imagination, especially the fear indicators.

First, the 20 yr Treasuries chart, the monthly chart, registered this month a peak never seen before. Literally, off the charts it is. Assuming the worst is over, we cannot accept ‘risk on’ to return too soon.

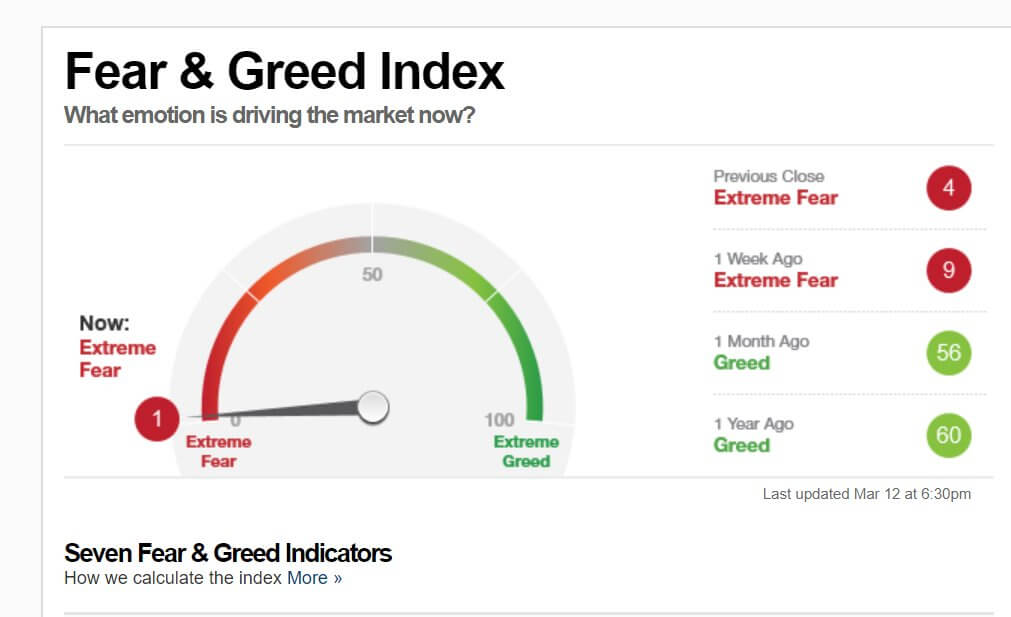

Second, the CNN’s fear & greed index hit a value never seen before on Black Thursday: 1. Never before did this barometer fall that low.

We keep on tracking global market action, on a day by day basis.