Yes, stocks did phenomenally well in the period November-January. Yes, the music stops playing at a certain point. More importantly, we saw ‘momentum implosion’ in the last 3 weeks, and Tesla’s decline illustrates our point. Momentum is gone for a while, unclear for how long. If anything, crash indicator VIX is eager to introduce bearish momentum in March before bullish momentum picks up again in April/May. This is a short to medium term 2021 market forecast, and it certainly doesn’t invalidate our long term bullish DJ stocks forecast for 2021.

We do realize we had a several warning sign coming out of the USD and VIX charts at the end of February. The subsequent damage in stock indexes was a laughable 4%, and the recovery took 72h to complete. There was an exceptionally strong ‘buy the dip’ reaction from the market. We did document this in It’s Official: The Weakest Sell-off In History Is A Fact, backed up by data.

However, this time may be different … or, last month may have been different, as the ‘buy the dip’ was truly exceptional. In historic terms, the softest sell-off ever on the wildest swing in VIX ever!

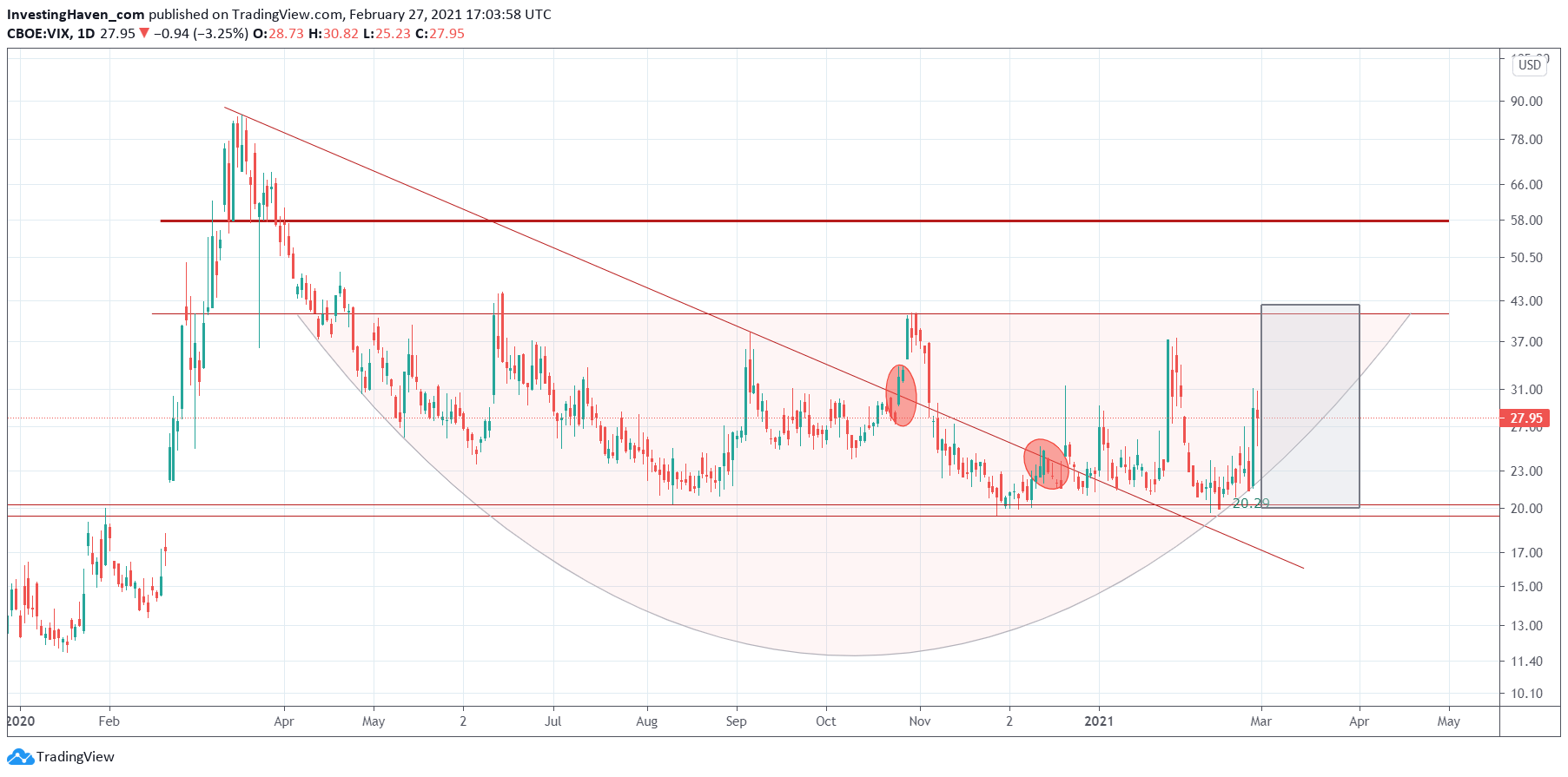

So in other words the VIX setup we see on below chart is once more very solid. Bullish VIX implies bearish stocks. This is happening at a time leading indices show a short to medium term topping pattern.

The grey area is the one in which VIX can create damage.

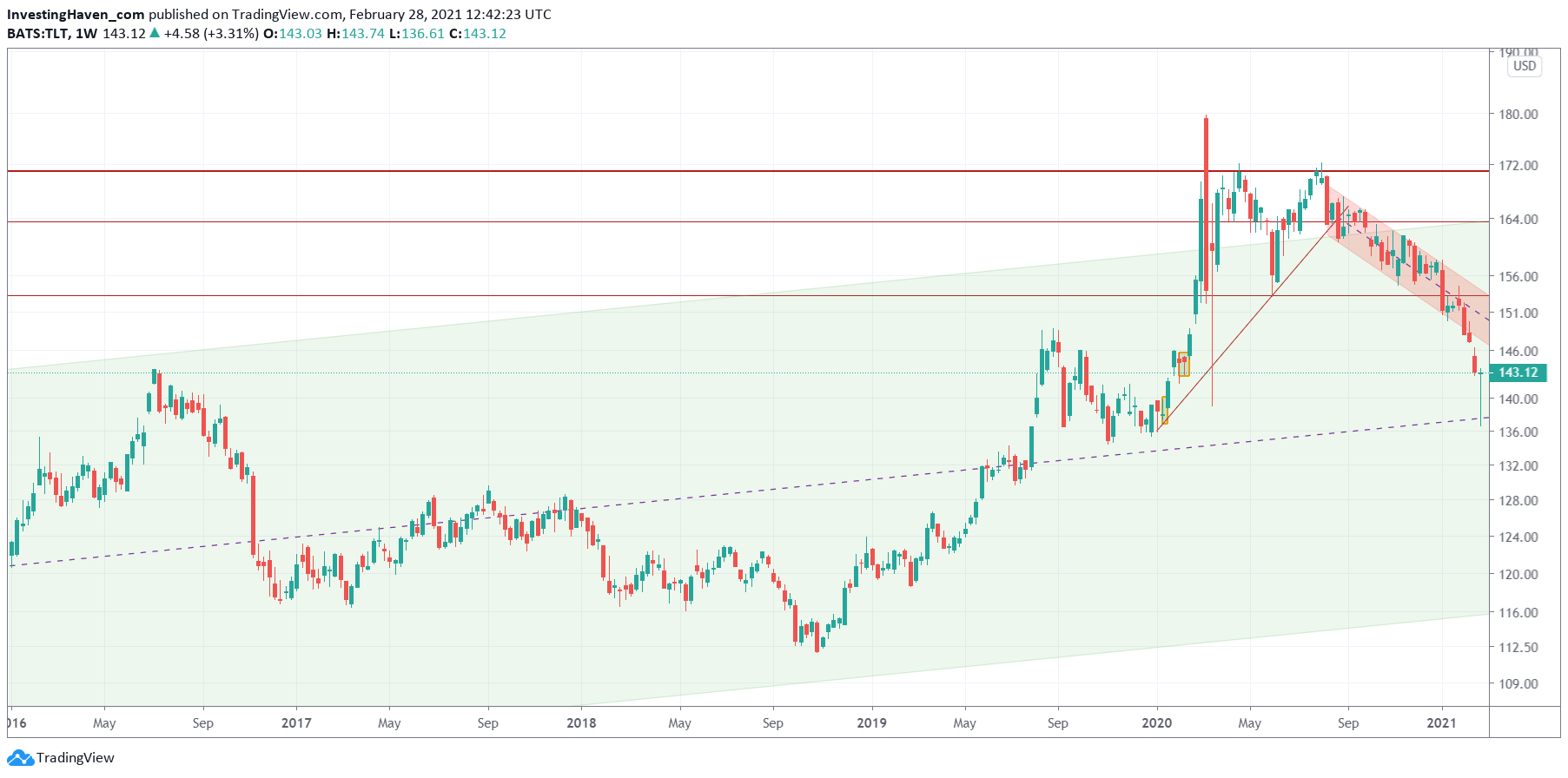

But wait a second, didn’t we say here on the same blog just one week ago that Stocks Will Be Uber Bullish In 2021 Because Of This Monster Breakdown In Treasuries?

Yes we did, and Treasuries did exaggerate since then.

What a difference one week can make, right.

The Treasuries chart accelerated its move lower, but went in overdrive. It found ‘support’ at its multi-decade median line. The big wick on the last weekly candle on below chart is over the top, and it is likely supporting evidence of a weakening stock market, when combined with the VIX chart.

We believe March will be volatile, and next week we will see if the ‘buy the dip’ will occur or not. We have serious doubts!

Enjoying our work? We invest in broad stocks as wel as commodities in our Momentum Investing portfolio. In our Trade Alerts premium service we focus on SPX trading in the short term. Next to SPX trading we take a few swing trades per year. In 2020 the combined portfolio delivered +93%. Results are tracked in our trade log books, and publicly shared every 6 months on our Mission 2026 page.