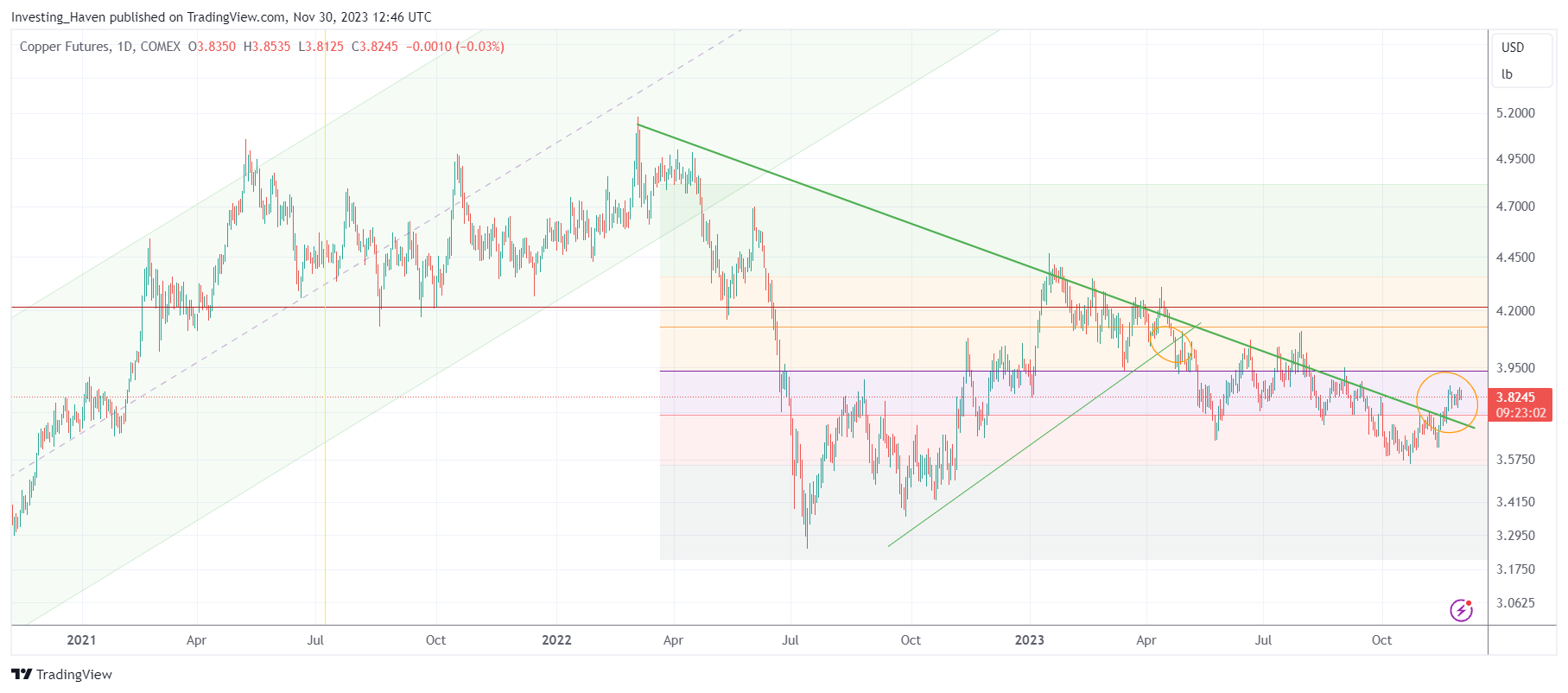

Copper has a special place in our market analysis methodology. We tend to look at the trends on the copper chart to understand the market’s view and expectations about markets, particularly the economy. That’s why we refer to ‘Dr. Copper.’ When we look at the current setup and chart structure of copper, we observe some hesitation right below a ‘line in the sand’ level. The ‘good news’ is that copper was able to ‘clear’ its 18-month downtrend line. In a way, Dr. Copper is not too concerned about the economy in 2024, and it might be really excited once it moves slightly higher.

Let’s look at the copper chart setup first, and then look at another fundamental driver of markets and the economy (Yields).

The copper price peaked in March of 2022. Since then, it came down sharply (2022), bounced sharply (Q1/2023) and started consolidating in a range of 3.5-4.4 USD. More importantly, copper moved above its falling trendline, a few weeks ago, confirming that it does not want to be in a downtrend (which does not necessarily imply it will be in an uptrend).

With that said, if we flip the view, and look at the horizontal levels, we find copper right below the critical 50% retracement level (fine purple line).

This really means that copper is not bearish, at all, but not yet bullish. It has a tendency to move higher, but the bullish area is above 3.95 USD.

Is Dr. Copper Concerned for 2024?

Dr. Copper is not too concerned about the economy in the first half of 2024, is how we interpret this chart setup.

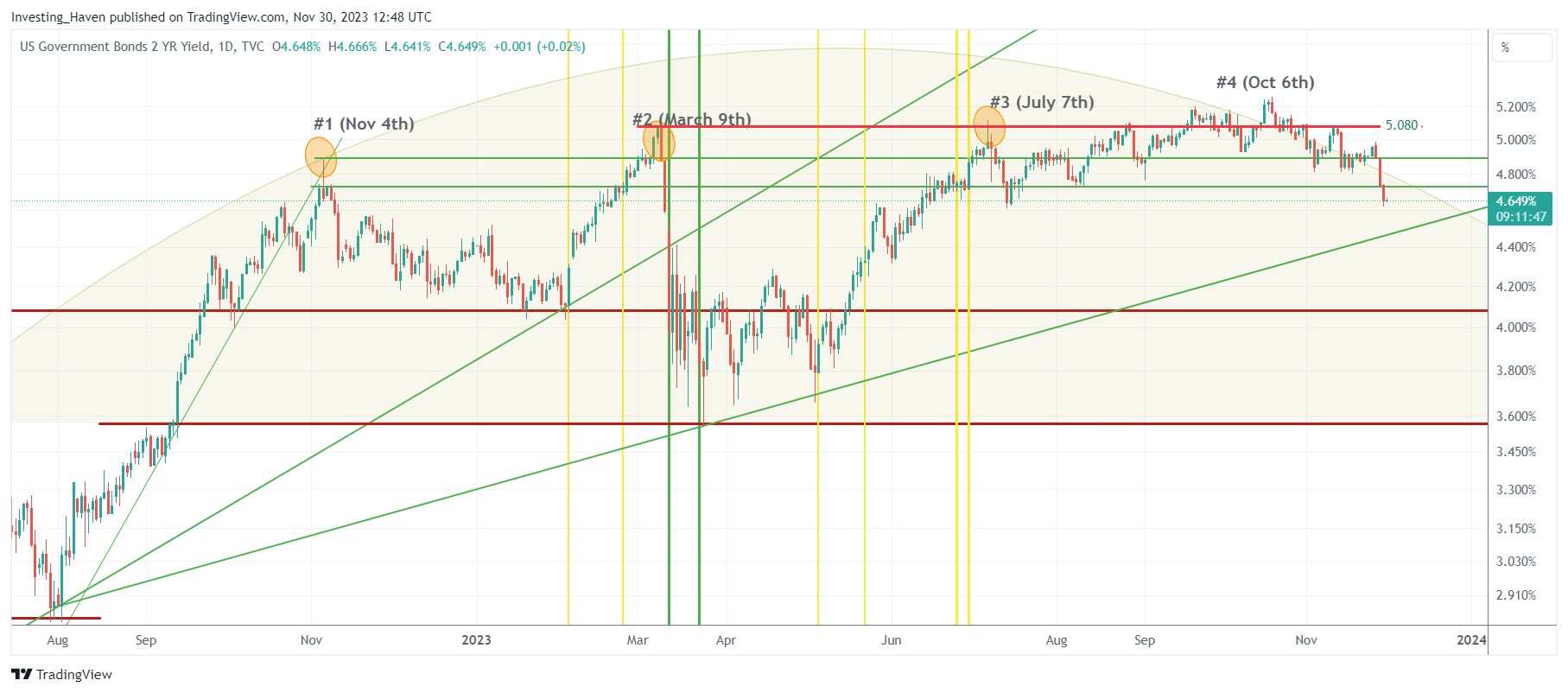

If we compare copper with Yields, another fundamental driver of the economy, we see that Yields already confirmed a local and likely lasting top. Particularly, 2-Year Yields (where the market believes that the Fed’s Funds Rate will be in approx. a year from now), confirmed a top.

With Dr. Copper not bearish, and 2-Year Yields confirming a top, we can reasonably say that the market believes the economy is not in a bad shape, at all.

The soft landing is now confirmed. Inflation goes into history books.

The next concern for markets will come up, somewhere in 2024, between now and then there will be a bullish bias of this market and the U.S. economy.

We invite readers to consider our premium services for more detailed work: Momentum Investing (stock market and segment analysis), S&P 500 / Gold / Silver price analysis (detailed price analysis), our Passive Income service (auto-trading).