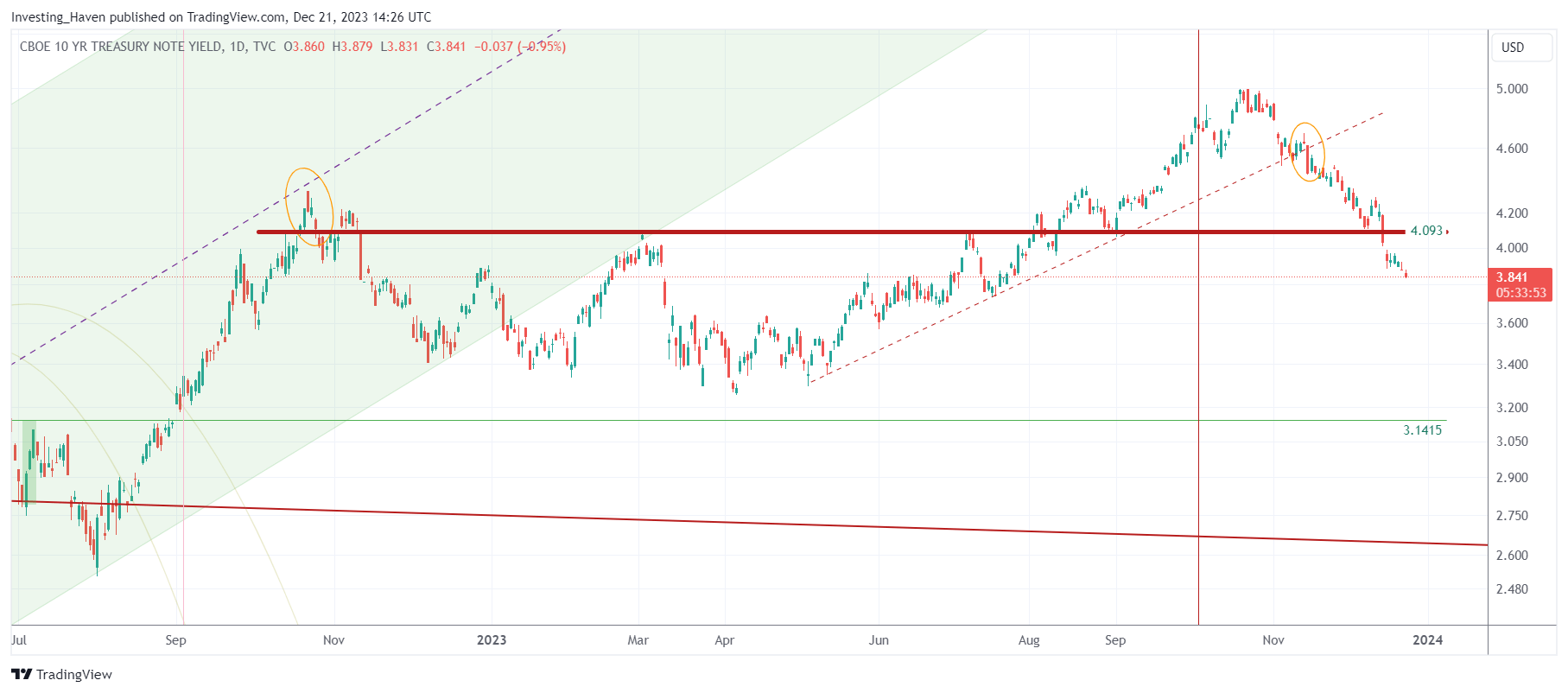

In 2023, financial markets were held hostage by the fear of rising interest rates, a narrative fueled by the Federal Reserve’s commitment to a “higher for longer” approach. This fear culminated in a dramatic climax at the close of the year, as illustrated by a compelling chart (below), showcasing the breakdown of 10-Year Yields in November, just in time for the year-end rally to start, an ‘event’ we predicted in August Do We Expect An End-of-Year Rally In 2023 and re-iterated the first days of November in Did The Year-End Rally 2023 Officially Kick Off and Ready For A Headline Inflation Surprise That Will Fuel The 2023 End-Of-Year Rally?

Evolution of the Rising Rates Narrative: Throughout the year, investors grappled with the implications of the Fed’s hawkish stance. Rising rates cast a long shadow over various asset classes, triggering uncertainty and directly influencing investment strategies. The chart, spanning the year, reflects the ebb and flow of market sentiment in response to interest rate dynamics.

The Climax – November’s Unprecedented Breakdown: The turning point came in November, as shown on the chart, above, featuring the decisive breakdown of 10-Year Yields. This turning point, seemingly unexpected by the majority of investors, unleashed a torrent of bullish energy, defying the consensus. This did not come as a surprise for InvestingHaven readers because we were warning readers about the contrarian nature of the consensus view: Investor Wisdom – Be Very Careful With Consensus As Illustrated By The ‘Higher Rates’ Narrative.

Chart Analysis: The chart above visualizes the year-long struggle with rising rates. Key elements include the gradual ascent of yields, the moments of market jitters, and ultimately, the sharp decline in November & December. The zig zag, with wild intra-year swings, explains investor sentiment and mounting fear heading into the anti-climax of November/December.

Conclusion: The breakdown of 10-Year Yields in December marked a pivotal moment in the financial narrative of 2023. This article has endeavored to capture the evolution of the rising rates theme, culminating in a climax that defied expectations. As we step into 2024, the lessons learned from this year’s market dynamics will undoubtedly shape investor strategies in the face of evolving macroeconomic factors.

Readers would want to read our 2024 forecasts, they were written in October and November, back then already factoring in the breakdown in Yields. Our top 2024 forecasts are listed below: