One of the most important ‘threats’ for financial markets is inflation. That’s because higher than expected inflation numbers, as evidenced by the monthly CPI and PCE numbers, suggest that monetary policy by policy makers will remain tight (or tighten up). That said, the question top of mind of investors is whether inflation will continue to push markets lower in November of 2023, similar to the October effect because of slightly higher than expected September CPI and PCE readings. We think primarily of markets like SPX, Nasdaq, Industrials, gold, silver.

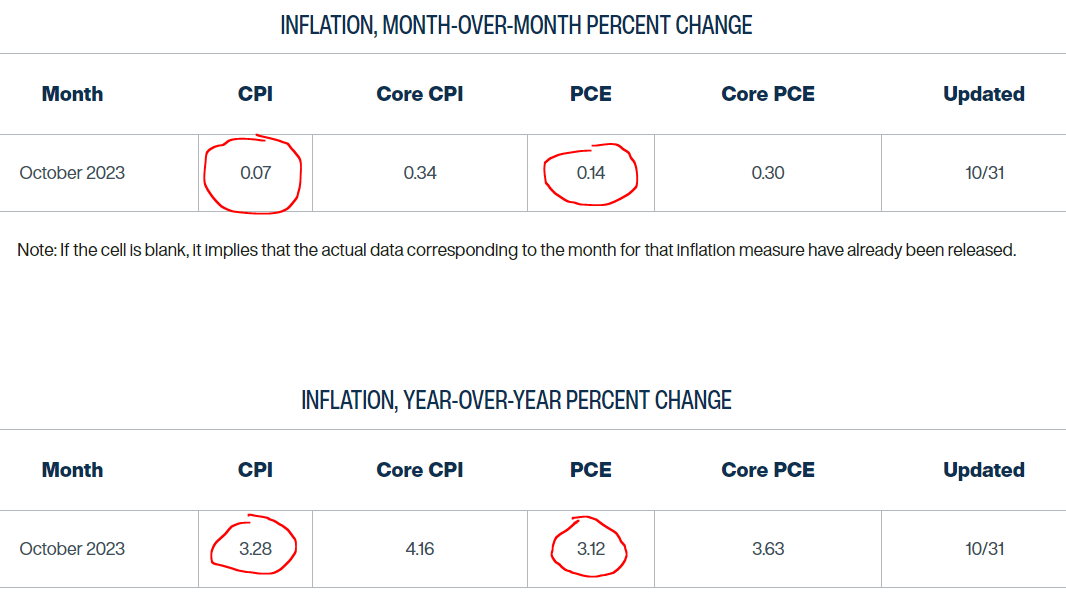

There is evidence that the inflationary readings of October which will be published mid-November and end of November 2023, will be below the recent trend. They will certainly be significantly lower than the September data, published in October.

The expected inflation over the month of October, as Cleveland’s Fed ‘Inflation Nowcasting’ estimates, is dropping to multi-year lows. The month-over-month measure of headline inflation runs at a ridiculous level acknowledging where we are coming from a 12 months and 6 months ago. Even the year-over-year is now almost below 3%, incredible, comparing with the numbers a year ago.

Remember one thing which we mentioned several weeks ago, specifically mid-October. We did publish a bullish market forecast for November of 2023: “We believe November of 2023 will be a bullish month for stocks.”

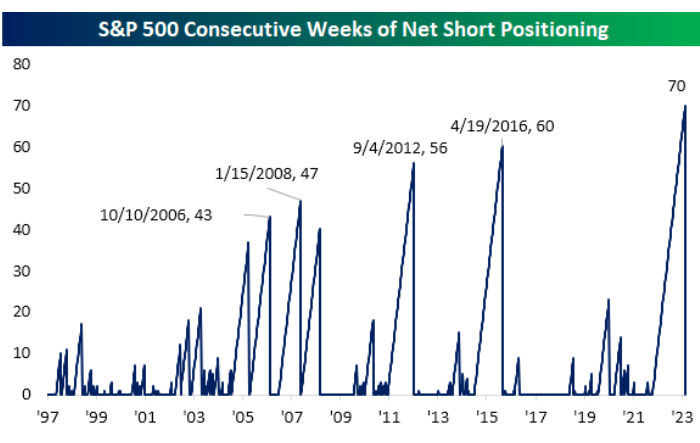

Coincidence or not, Bespoke Invest published this statistic, this week: speculators are turning net long for the first time in 70 weeks. Since June of 2022, speculators were net short, the longest stream in recent history. As shown on below chart, there were four similar occurrences in the last 30 years. We checked the chart – all of them coincided with a multi-month advance in the S&P 500 (not necessarily the exact same week though). Only the one in January of 2008 did only last for 5 months, the other 3 occurrences lasted at least 12 months.

On November 1st, 2023, bullish price action may be confirming the data points in this article, first and foremost our bullish timeline forecast which we published many weeks ago might be materialized. We could not know what the expected CPI/PCE data would be, back then, so it looks like our timeline readings will be confirmed.

Do you like this analysis? You can receive much more detail and charts, we recommend to become a premium research member >>