A few weeks ago we noticed how Tech Stocks Were Attempting To Take Over Leadership. Indeed, back then, it was had to believe because ‘everyone and his Uncle’ was 100% convinced that a hard recession was about to hit the world, it was so obvious. Fast forward to today, tech stocks are working on a ‘breakout’ which, obviously, will not work out, not yet, because the breakout is too obvious. Tech stocks will do well, but need to drop first before they can start a rally. The market is moving in line with our 2023 forecasts, notably no market crash and bullish leading indexes like Dow Jones and Nasdaq.

Just one week ago, we wrote about the 200 day moving average of the Nasdaq:

As the 200 dma is falling (still not flat) the structure below the 200 dma is improving. The first signs of leadership of tech stocks are there. It’s not visible, it happens from time to time. It should start happening more often, spread over the next 2 to 3 months. We pay attention to these early signs of improvement, do you as well?

We continued explaining why the moment is not right, not yet at least, for a big momentum move:

Our expectation is that the Nasdaq 200 dma will be extensively tested for the next 4 to 8 weeks. There will be pumps and dumps, confusing and sidetracking both bulls and bears. The market will decide on a direction, not later than March 24th, 2023, is our thinking.

Two really important sentences from that article:

- We believe the direction will be higher, because both market participants will be confused, exhausted, and frustrated.

- Remember, the bull wants less participants, it wants to shake out first before running.

That’s how it goes: the majority was bearish 1 and 2 months ago, they are turning bullish now right before a drop, they will panic again in 3 to 4 weeks right before a major turnaround.

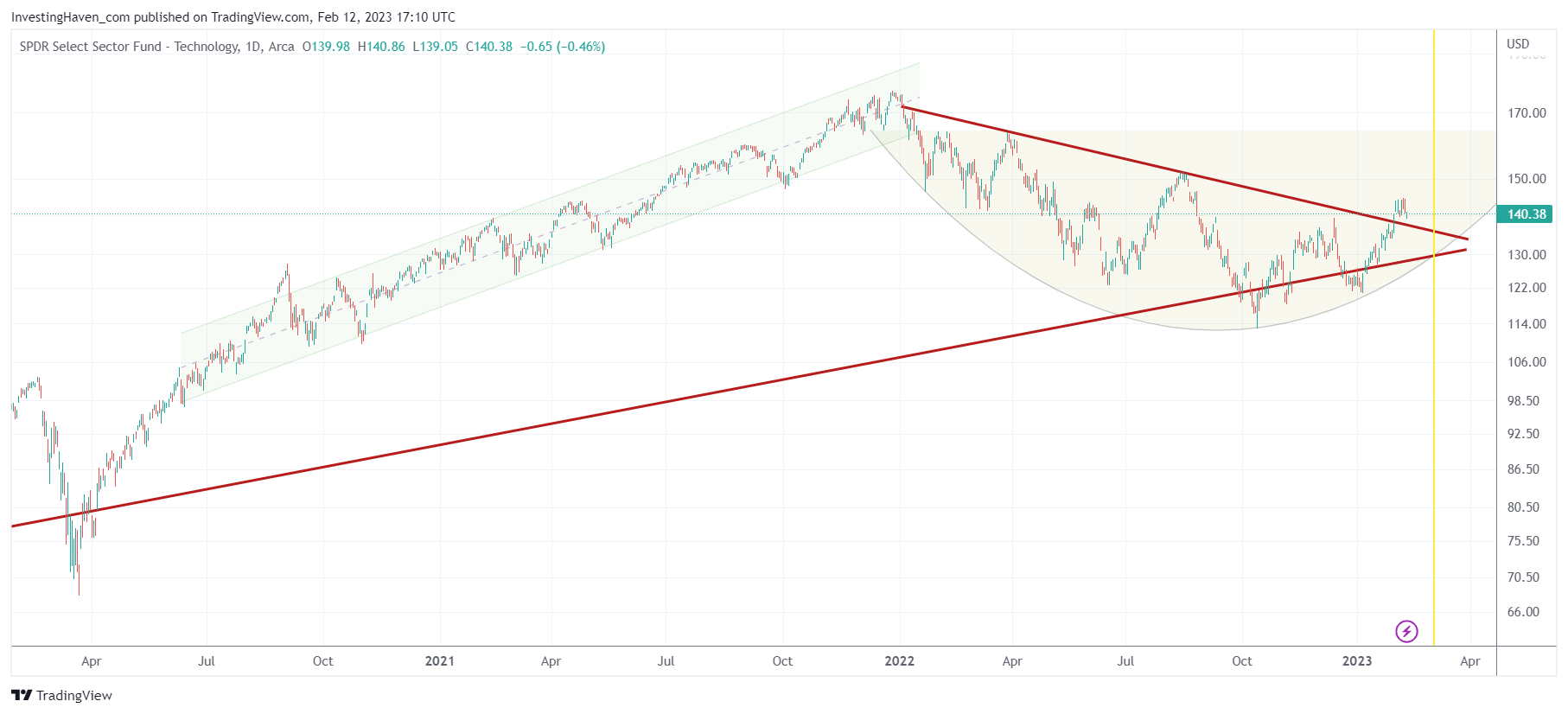

That’s exactly how we read the XLK ETF chart shown below:

- The breakout started two weeks ago. However, it is hitting ‘horizontal resistance’.

- There is a lot of tension on this chart, as seen as of mid-March tension will be released as the falling trendline will move to the background.

- The yellow line will coincided with a critical date, you better write down the week of March 6th to watch for a turning point.

- Provided the rounded pattern will hold and the long term rising trendline will successfully be tested, mid-March should come with an epic buy opportunity.

In our stock market investing service Momentum Investing we are preparing a special about artificial intelligence stocks. We will pick out 2 high potential tech stocks to buy in March, aiming for 50 to 100 pct upside potential.