The market is turning into a really weird place right now. Several commodities are pushing higher, think crude oil and agricultural commodities. At the same time, the USD looks eager to continue its uptrend. Whether markets are now officially ‘crazy’, whether these are major divergences or whether all this will make sense in the not too distant future… frankly, we don’t know. All we do know is that the USD is pushing higher until it has reached its bullish target. We will be watching closely how this will impact our Dow Jones forecast, gold and silver forecast, but also our green battery metals forecast.

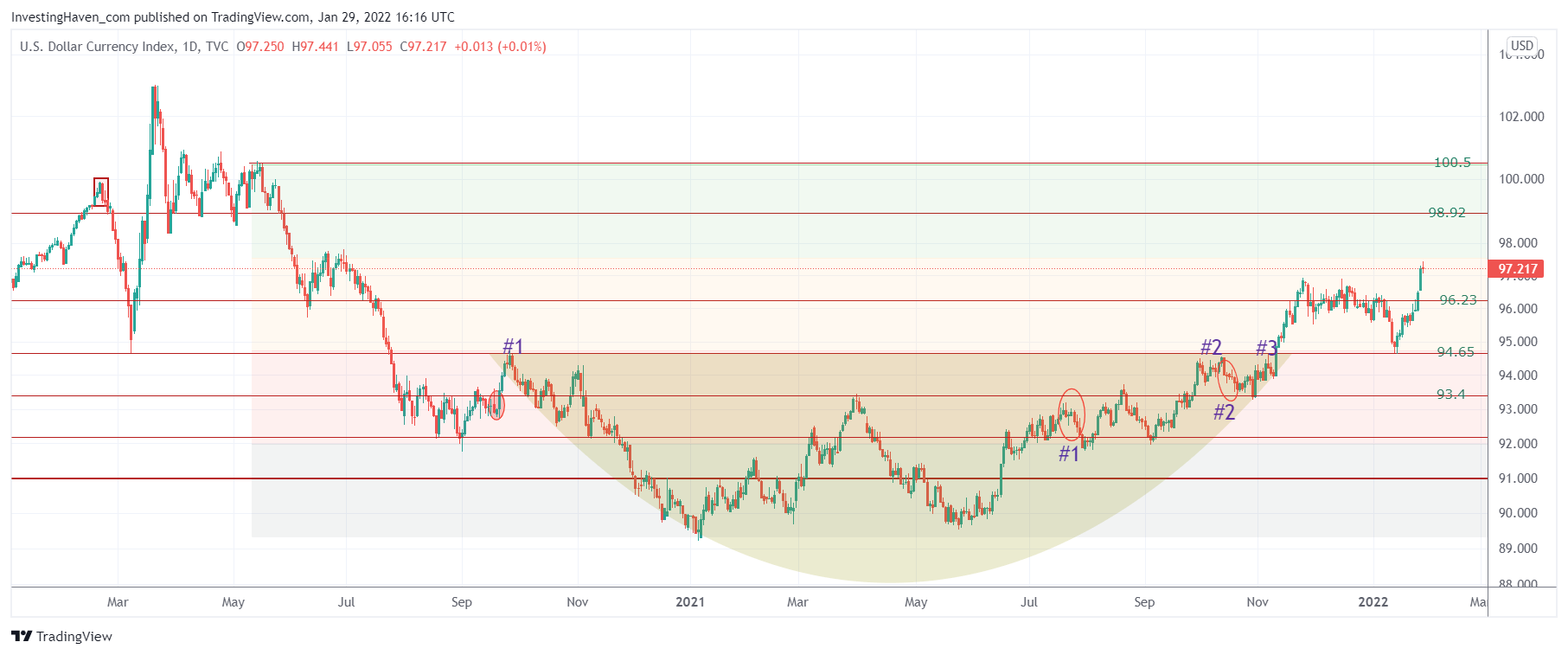

Below is the daily USD chart, with our annotations.

This big reversal is really bullish, and it is clear that this is not the end of the USD rise. There is more upside potential, a first logic target is 99-100 points which is a rise of another 2 to 3 pct.

How much damage will the USD create, and also which markets exactly will it impact?

Interestingly, many commodities are seemingly unimpressed by the USD. Think softs and grains, they continue their uptrend, some of them are really strongly bullish (especially agricultural commodities).

At the same time, special metals like lithium, cobalt, vanadium are unstoppable, at least for now. They keep on pushing higher, as if there is no USD strength (they are probably totally uncorrelated).

But stocks were hit hard, and USD sensitive small caps in the Russell 2000 got a big hit. As said, the next market crash would start once the Russell 2000 would breach 2101 points, and it happened exactly as outlined a while ago.

The USD is not done rising, it clearly is on a mission to 99-100 points. Whatever happens above 100 points is unknown, we have to closely watch the structure once it gets near 100 points.

For now, though, we assume that the next leg higher in the USD is going to be complete in the next two months. That’s the period in which stocks will also print another leg down, the only question is whether they will go for a lower low or double bottom (against last week).

One of the most important impacts we will be monitoring over here at InvestingHaven is the gold and silver impact. We continue to believe that silver will turn wildly bullish in the not too distant future. In the end, all commodities have gone up. Metals made new ATH in the last 12 months. Silver is almost 60% below its 2011 ATH. There is no way that the silver price will continue to be as depressed as it is today.

If the USD reaches 100 points with silver respecting its multi-year lows we can be sure to get much more aggressive on entering the silver market.

In our Trade Alerts service we will flash a special silver edition if silver respects its support as the USD moves to its bullish target. In our Momentum Investing service we might share our top 3 silver miners, again whenever the above scenario will play out. Between now and then, we will cover the impact of the USD in our premium services.