We recently said that the next really big market crash should start in the second half of 2023: a Stock Market Crash In 2022? No, It Will Start In 2023. Here is one important index and one crucial support level that might trigger big selling, maybe even a market crash. The chart in this article makes it very easy for investors to know when to be really cautious as the odds of a market crash, even before 2023, will increase exponentially. Although we do not forecast such a bad outcome in the short we need to stay open minded for any outcome. Needless to say, this will directly impact many of our 2022 forecasts, especially in terms of timing.

The one index we are talking about is the Russell 2000.

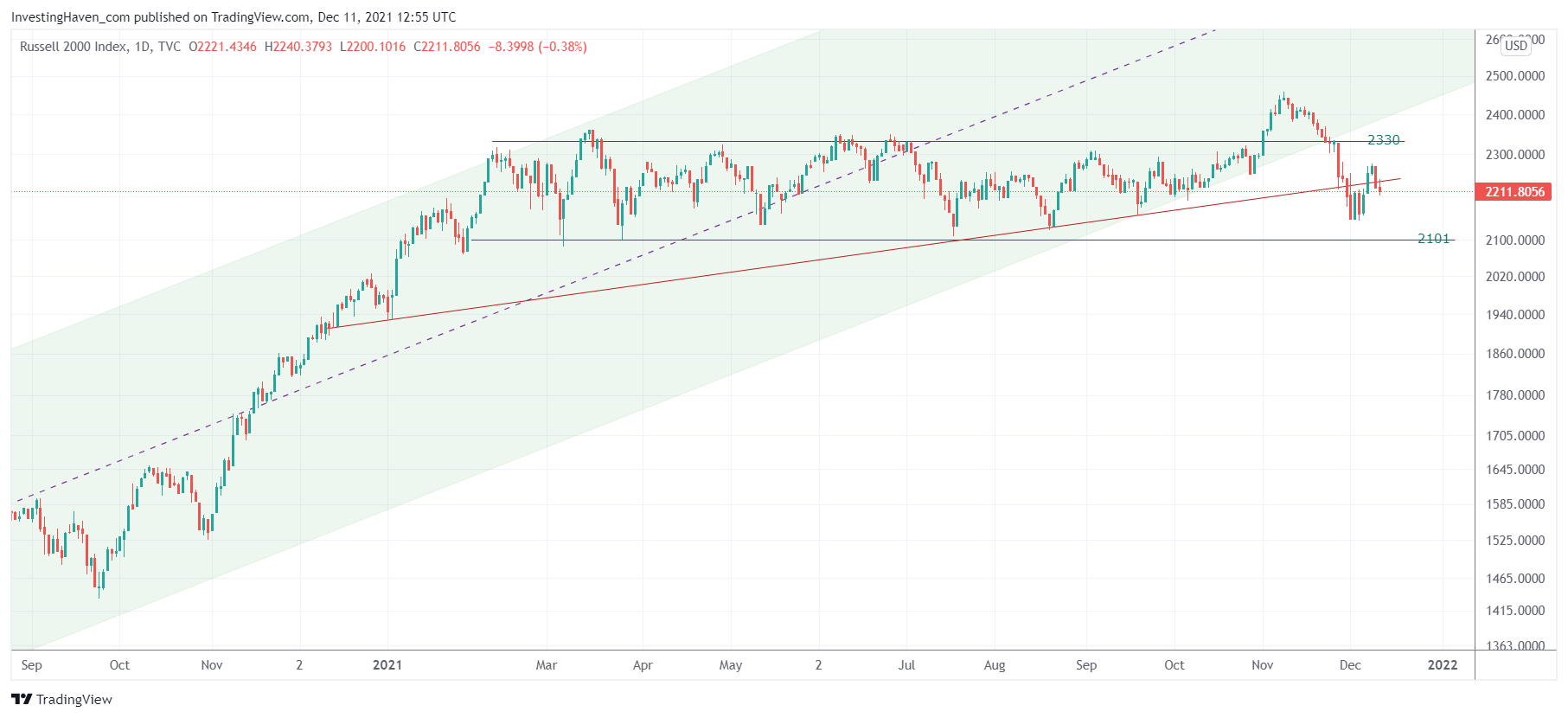

The line in the sand level we are talking about is 2101 points.

What we are really talking about is the downside potential that the Russell 2000 has once the important support level 2101 points gives up. You can easily observe this from the next chart: it is close to 20%.

The problem with the Russell 2000 is that it has a lot of impact on other stock indexes. It is a leading indicator, we said so many times.

The Russell 2000 index has been range bound for nearly a year. It may continue to be stuck in a range for longer, but not for endlessly. So at one point, this index has to start trending, it may be many months out, but a trend higher or lower should come at a certain point.

All we are trying to do is make investors are aware of the risk of this index violating 2101 points. Better to be cautious whenever this index falls below 2140 points, where it found good support last week (see the large candles of a week ago).

In our Momentum Investing in-depth weekend updates we include the Russell 2000 as part of the weekly market roundup, and use the info from that chart to inform portfolio decisions.