Early January we published the first investment roadmap for Q1 2018 with 12 stocks which we considered worth buying.

Early April we published our Q2 updates: some changes in this portfolio given the state of the market at that point in time as well as our forecast for the second quarter.

For those who did not buy the previous reports we provide access to the report in pdf format by clicking these 2 hyperlinks:

InvestingHaven’s_Top_12_Stocks_for Q1 2018

InvestingHaven’s_Top_12_Stocks_for Q2_2018

Before we proceed, let us recap our initial investment constraint based on investors’ requests in point form.

- $12,000 as initial capital at the start of January 2018;

- no short-selling of stock is allowed, not even by using options;

- we are not concerned about a gap up or gap down of stock prices due to earnings or unexpected news;

- commission of trades will be excluded and dividend received will not be computed;

- sudden market changes will not affect our holdings;

- entry of newly selected stock will be on the opening price on the first day of new quarter;

- there will not be any trades in between.

Q3 2018 changes to the portfolio

Our choice of stocks remain resilient throughout the 1st and 2nd quarter of year 2018. Our portfolio choices survived a total of three periods of vicious sell-off as illustrated on the S&P500 daily chart below.

InvestingHaven’s research team is totally unimpressed nor affected by the trade war between USA with China, Europe and Canada that has been dominating the mainstream news for almost 6 months, the flattening of yield curve that could lead to recession and other baseless frightening tactic to scare off the masses.

We remain focused, in a disciplined way, on what the chart is telling us.

Besides, we also intensively scan for sectors that could bring out a number of profitable stocks going forward. Hence, diversification against a basket of sectors could overall improve the performance of our stock portfolio provided we pick the correct sector(s).

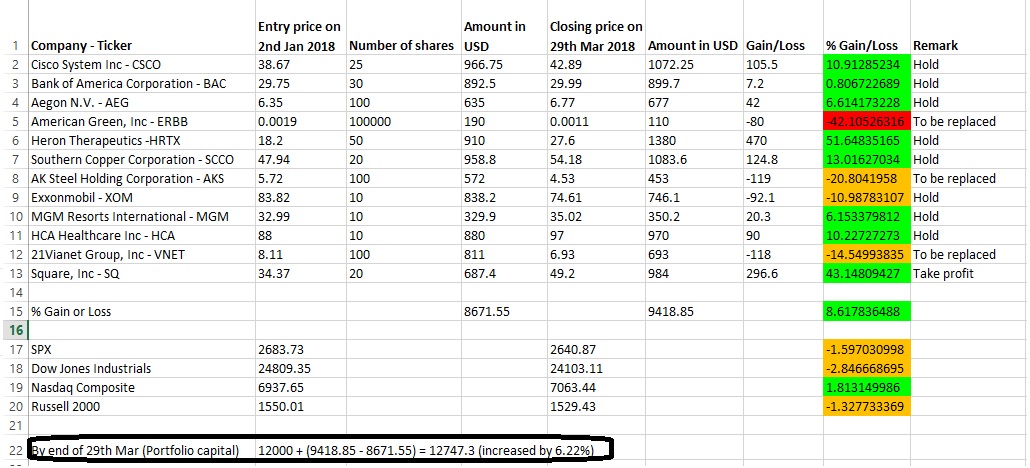

Let’s recap our 1st quarter performance:

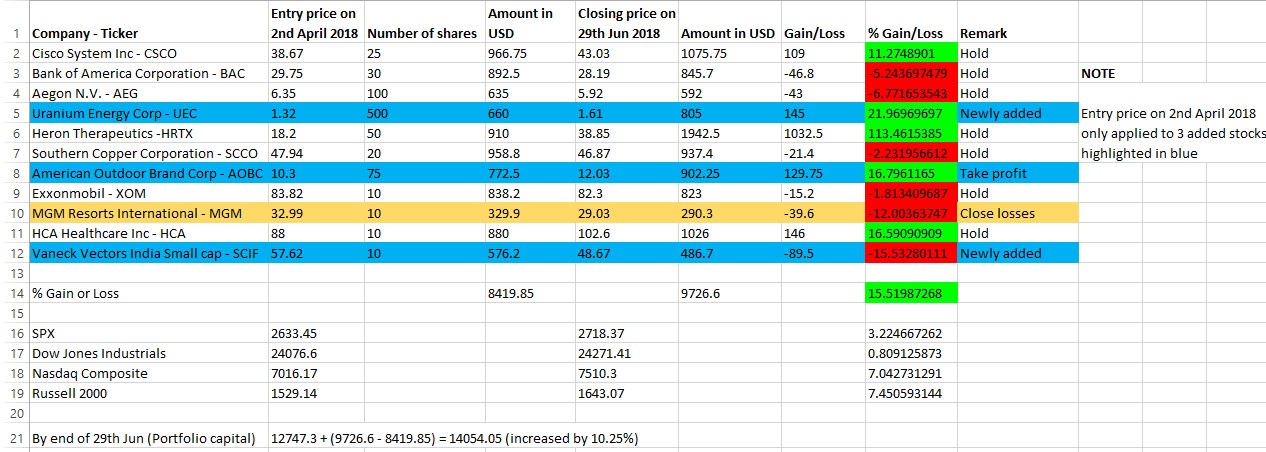

And next our 2nd quarter performance:

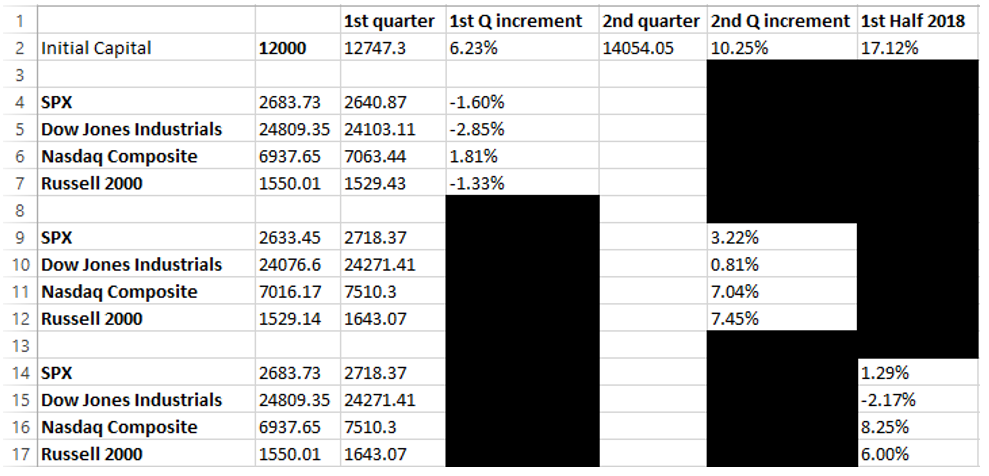

The table below summarizes how our portfolio capital management compares to the 4 major indices:

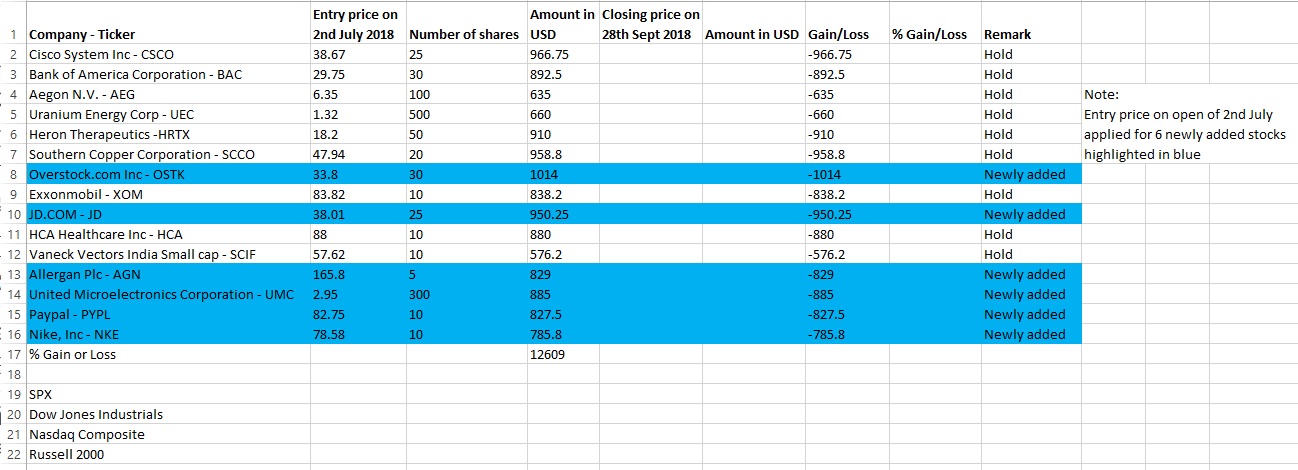

As we were under-invested during the last two quarters (we only utilized 70% of our 12,000 dollar), we seek to invest more aggressively for the 3rd quarter of 2018 by having ~85% of the total capital invested.

We remove 2 stocks: We will take profit on AOBC and close the losses on MGM.

We add 6 stocks: In addition, we are going to add 6 stocks: JD, AGN, UMC, OSTK, NKE, PYPL.

1. JD.com (JD) is chosen due to the reasons published a month ago.

2. Allergan Plc (AGN) is added as it is near support, setting a strong bottom, right at a time healthcare stocks are about to outperform.

3. United Microelectronics Corporation (UMC): UMC broke out of multi-year downtrend channel, coupled with the fact that semiconductor is growing exponentially as published here, we believe this could have larger upside potential.

4. Ovestock.com inc (OSTK): InvestingHaven’s team still feel that blockchain has huge and untapped potential, and it almost moves in tandem with cryptocurrencies. Chartwise, price hit the channel top, got rejected and had a swift plunge to the major support zone which happened to be the neckline zone of the previous head and shoulder top. From here price could either slowly go up or collapse, we will only be able to know by 29th September 2018.

5. Paypal Holdings Inc (PYPL): We believe that cashless transactions will grow exponentially, hence Paypal is a top pick as it has been accepted globally. The daily chart below shows that price has been consolidating for 7 months, there is an opportunity to break above the bull flag. If earnings would be bad, it could gap down before it resumes its uptrend.

6. Nike Inc (NKE): The chart of Nike needs no introduction as it was mentioned for the last 6 months as we track the price movement closely. Being part of Dow 30 components, we deem it suitable to add in NKE to capitalize on the ongoing retail boom in tandem with growing economy.

All in all, InvestingHaven’s research team has included 4 technology related stocks to capitalize on the upcoming boom in the technology sector that is to cater for growth rather than defensive approach. Whether we will be rewarded with this approach or not will have to be seen.

This is the spreadsheet overview for 3rd quarter portfolio of stocks:

The next 6 months could impose even more volatility and it is going to be a challenge as the earning season is coming while we will keep our position until the end of September. Although our portfolio is green for both quarters we refuse to be complacent as we treat it as a business to make ongoing profits. We would like to advise subscribers to conduct their own due diligence as we can’t guarantee all of them will be profitable.

We would like to thank you for all your support and again, we will be back again in early October as soon as our results are computed and portfolio reviewed.