Since early November, markets went through the so-called ‘Trump effect’. That entails an outperformance of the value stock market sector (financials, industrials, energy), higher Yields (symbolizing rising risk appetite) resulting in a stronger dollar, lower gold price. Interestingly, though many did not identify that emerging markets were one of the strongest winners.

Robert Shiller explains on TheGuardian that the Trump effect on markets is an illusion. His point is that the economy will not be doing better. “The combination of Trump and a succession of new asset-price records – call it Trump-squared – has been sustaining the illusion underpinning current market optimism.”

MarketWatch points out that the Trump effect on markets will bring stock market anxiety.

Financial Times shows 7 charts of the Trump effect on markets in which the rally of small caps and amazing performance of financial stocks stands out.

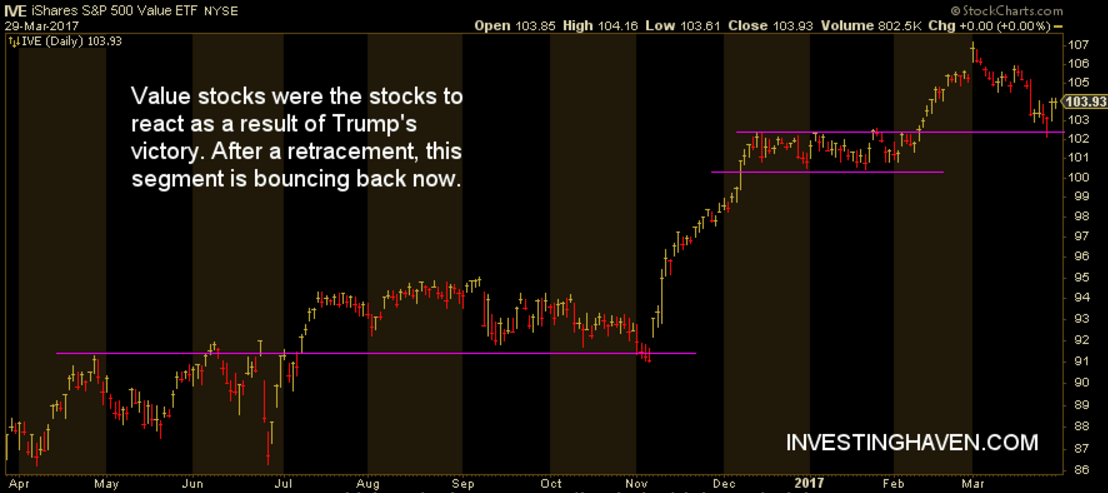

From our own perspective, we see that the Trump effect slowed down in the first three weeks of March, but could be picking up steam again. Let’s revise 5 key markets and charts in that respect.

First, value stocks were one of the winners. That includes financial stocks, industrials and energy. After a 2-month consolidation, they went higher again February, retraced in March and are starting April 2017 with a bounce from support.

Yields went sharply higher as a result of increased risk appetite. Hence, prices of Treasuries went lower. That effect slowed down, and Treasuries are consolidating right now, though still sharply below their Trump victory price levels. This is an important market to watch.

The U.S. dollar is in an interesting spot right now. Though much higher than when Trump won, it is now right at a decision point.

Gold fell sharply after Trump’s victory only to recover of late. Right now, gold is in an in-between spot. This can go both directions, but gold is still lower than in November.

Last but not least, the real winner of Trump’s victory are emerging markets. They keep on moving higher, almost non-stop. As said before, our emerging markets forecast for 2017 is playing out as anticipated, and Trump only reinforced our forecast.

All in all, we see a continuation of strength in stocks as well emerging markets. However, Yields should be watched closely, as rising Yields will confirm higher stock prices. The dollar and gold are still in line with their Trump effect but they are both close to decision points.