The US Dollar is known to have profound impacts on other markets once it rises or falls sharply. Think of the US Dollar rally in 2015 which resulted crude oil to crash, but also serious Dollar weakness in 2016 resulting in the strong rise in emerging markets (EEM) and base metals. These examples reveal the outspoken negative correlation between Dollar vs. emerging markets and commodities. What is likely to happen in the Dollar going forward, and how may it impact emerging markets and commodities in 2018 and beyond, is what InvestingHaven’s research team tries to forecast in this article.

The US Dollar impact on emerging markets

First of all, emerging markets have a strong correlation with commodities because of fundamental reasons. When emerging markets perform well they tend to increase demand for commodities, but also export much more commodities. It is sort of positive feedback loop.

As the first chart shows emerging markets (lower pane) have done well when the Dollar was falling (upper pane), those periods indicated with a light blue oval are the ones to focus on. This chart goes back 15 years in time.

In recent years, especially the 2015 and 2016 time periods, the ones mentioned in the intro paragraph, are the ones that stand out.

The million dollar question is whether there a new trend with a strong US Dollar started recently? If yes, it would imply that emerging markets will be very weak in 2018 and 2019. The opposite is true as well: if the US Dollar stops rising or even falls it would have very bullish effects on emerging markets (also on commodities).

Chart courtesy: analyst Ralf Lai from InvestingHaven

US Dollar outlook for 2018 and 2019

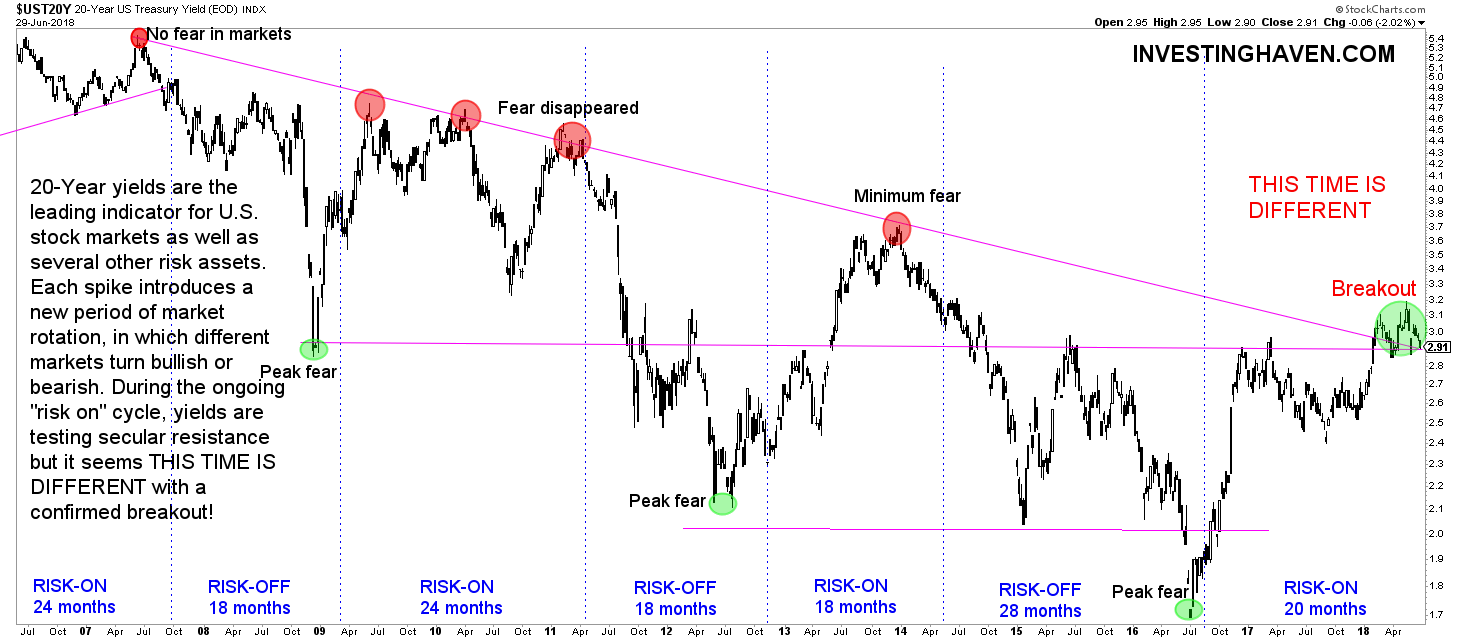

At InvestingHaven we tend to believe that one market heavily influences the US Dollar: Treasury Yields, primarily 20-year Yields. We’ll come back to this in the last chart.

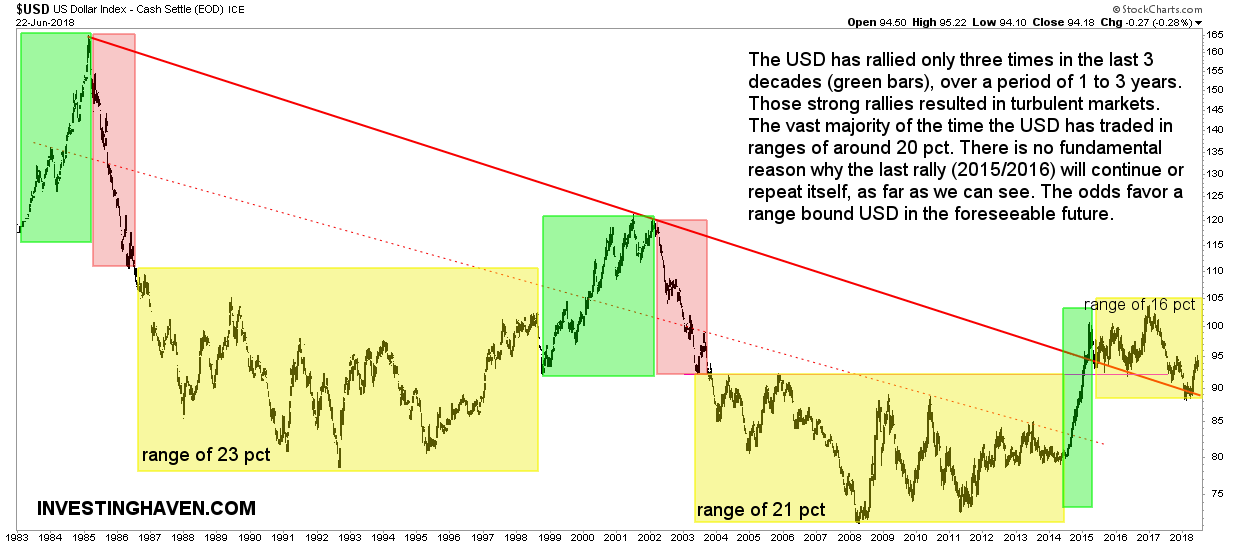

On the other hand, though, looking at the long term Dollar chart, it is clear that most often the Dollar tends to be range bound. History has shown that the vast majority of time the Dollar trades in a range of approx. 20 pct (yellow boxes). Only very exceptionally there is a strong rise (green areas) sometimes followed by sharp declines (red areas).

Right now, the US Dollar, on its long term chart, is setting a range of some 16 pct after it broke out of a 4-decade long decline trend (red line). In other words, the odds favor a range bound Dollar (between 88 and 104 points).

However, we cannot accept this prediction just based on some historic trends. InvestingHaven’s view on markets is based on intermarket dynamics: key market tend to influence each other as capital moves from one asset to another one over time, and, in doing so, influences prices.

What is the key ‘pair’ to watch for the US Dollar? As said before, 20-year Yields.

The most influential market in the world: U.S. Treasury Yields

It is pretty tough to do a forecast of the US Dollar based on 20-year Yields, primarily because Yields are at a make-or-break level right one. However, is it pretty easy to determine key decisive price levels.

If, and that’s a big IF, 20-year Yields respect their support level at 2.9 points, and, presumably, go higher from here, it will put pressure on the US Dollar, not necessarily on a day-by-day basis but certainly in the medium term (3 to 9 months). On the other hand, weakness in Yields would push them back in their long term downtrend, and give boost to the Dollar.

With the strong correlations between the US Dollar vs emerging markets and commodities, it becomes clear that the most important market we are looking at is 20-year Treasury Yields (in the U.S.). Yes, this is, by far, the most important market in the world with the most important influences on a global scale. Bare with us as Yields are about to reveal future direction of the Dollar, emerging markets, US stocks, commodities, and precious metals any time soon!