This article features a must-see chart of junior silver miners. Admittedly, it’s a ‘niche segment’ in the stock market. It also is a high risk segment. However, this silver junior mining chart is awesome and justifies tracking silver junior miners closely in 2023. It also tells us that 2023 will be the year of silver miners even if silver is only going to rise mildly (which is the worst case scenario in our silver forecast). Please continue reading about our silver stocks analysis in this comprehensive article: our silver stocks outlook for 2023.

We wrote two articles that featured silver mining ratio charts that are the basis for our bullish junior silver mining call.

First, from our post Silver Miners To Silver Price Ratio Flashing Long Term Buy Signal:

Every time this ratio dipped to the 1.20 area it marked the start of a big run in silver miners.

Moreover, we wrote in Silver Miners To S&P 500 Ratio: An Epic Test Ongoing As 2023 Kicks Off:

The silver mining chart should help us with a buy signal on the sector while individual silver mining stocks might already be in a ‘buy’ area. The ultimate confirmation comes from the SIL to SPY chart convincingly clearing 0.08.

With that said, we made the point that silver miners, in general, are entering a long term buy area. We can watch very specific levels for confirmed buy signals.

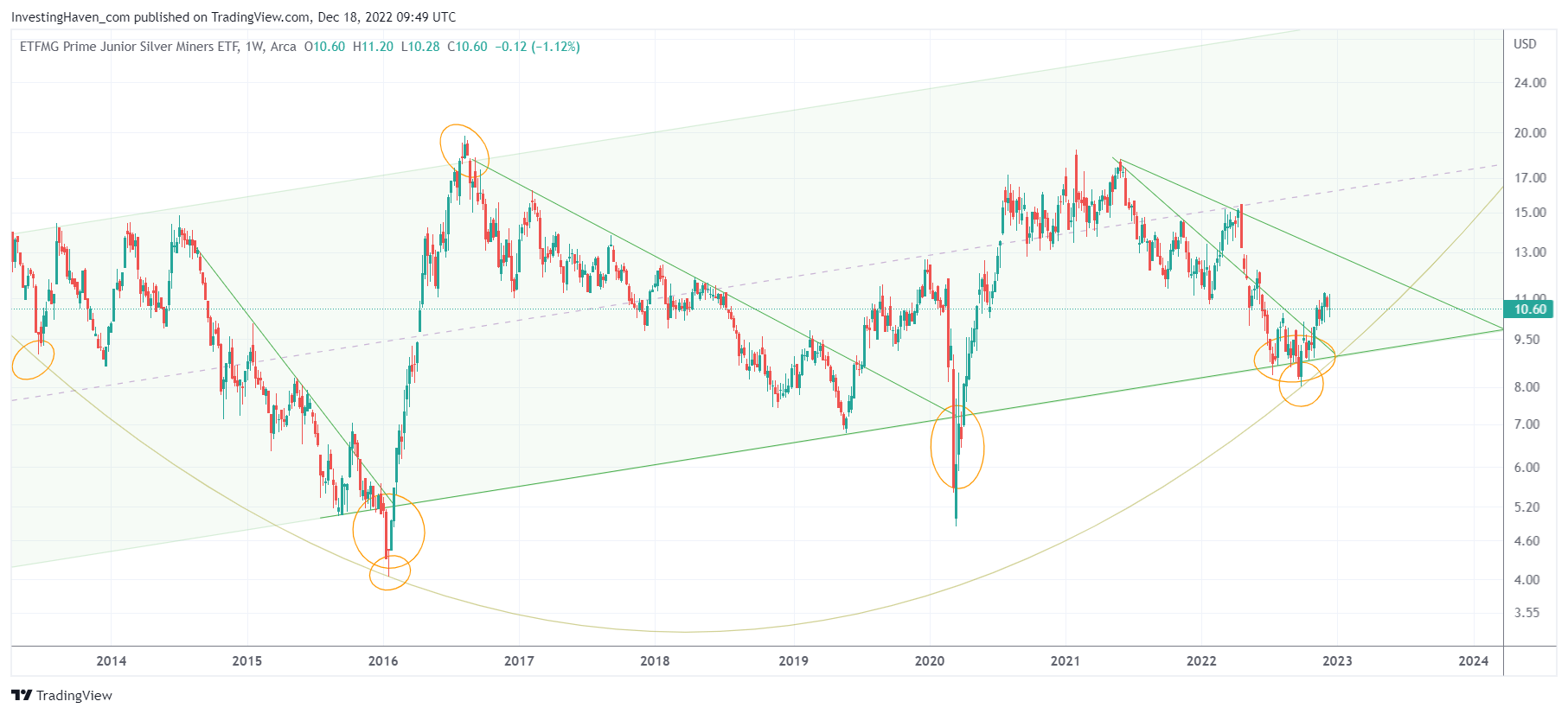

We assume that silver miners will continue to improve as they work through long term bullish reversal patterns. Based on this assumption we turn to the SILJ ETF chart representing junior silver miners.

What a chart, what an amazing chart this.

The long term channel got tested in Sept/Oct and junior silver miners convincingly confirmed channel support. Moreover, a long term rounded pattern was confirmed on Sept 19th, 2022.

Double confirmation that long term dynamics are in place.

Bullish?

No.

Very bullish!

One very important remark. Just like any other market and asset, junior silver miners will not go up in one straight line. As seen on below chart, there is a real possibility that they will retest the lows of the channel. Not saying it will happen, saying it might happen.

So, you must have a long term timeframe when you are looking for exposure in the junior silver mining space.

You also must know which junior miners to pick, otherwise you go with SILJ ETF.

Last but not least, if a hard landing in broad markets is underway, junior silver miners might have a mixed performance: initially a move higher (driven by rising Treasuries, a new trend in markets) followed by a move lower (driven by broad market selling). Not saying it will play out that way, just illustrating the point about ‘not a straight line’.

It is clear, based on the silver mining ratio charts combined with the long term SILJ chart that select junior miners will double and triple in 2023. Mark our words and please feel free to challenge us on this forecast at a later point in 2023.