In the Momentum Investing alert shared with premium members today, we explore promising opportunities in several commodities markets: oil equipment & services, nuclear energy, and silver miners. Each of these markets presents distinct possibilities for investors with varying time horizons, covering the end of 2023 and into 2024. In this public blog post, we feature a few charts, directionally. However, members of our premium service have access to multiple related in-depth reports which contain a lot of detail and stock analysis.

Before looking at the three commodities markets covered in the remainder of this article, we want to highlight another very powerful trend that is just now starting. In particular, it is in the lithium space, as discussed in this article This Hidden Gem Lithium Stock Exploded, Introducing A Big Trend In The Lithium Market. We featured 2 similar stocks, one of them with multi-bagger potential, in today’s premium services alert: Opportunities In The Commodities Space.

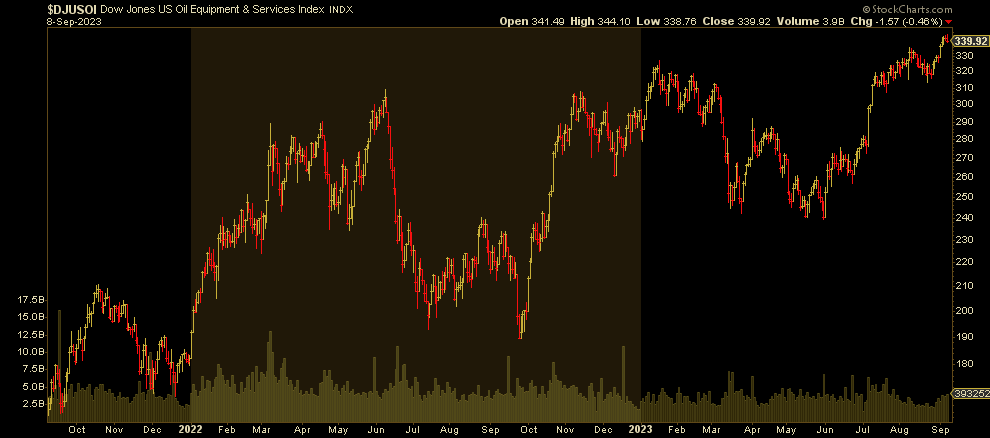

Dow Jones U.S. Oil Equipment & Services Index (DJUSOI): Our first chart reveals a compelling breakout in the Dow Jones U.S. Oil Equipment & Services Index. As shown in the chart, the index has surged past a critical juncture, indicating a bullish outlook for the oil equipment and services sector. This development aligns with the ongoing revival in the energy sector and provides investors with opportunities for growth. As we progress toward the end of 2023 and into 2024, this market is poised to benefit from increased energy demand, presenting potential gains for those who take advantage of this trend.

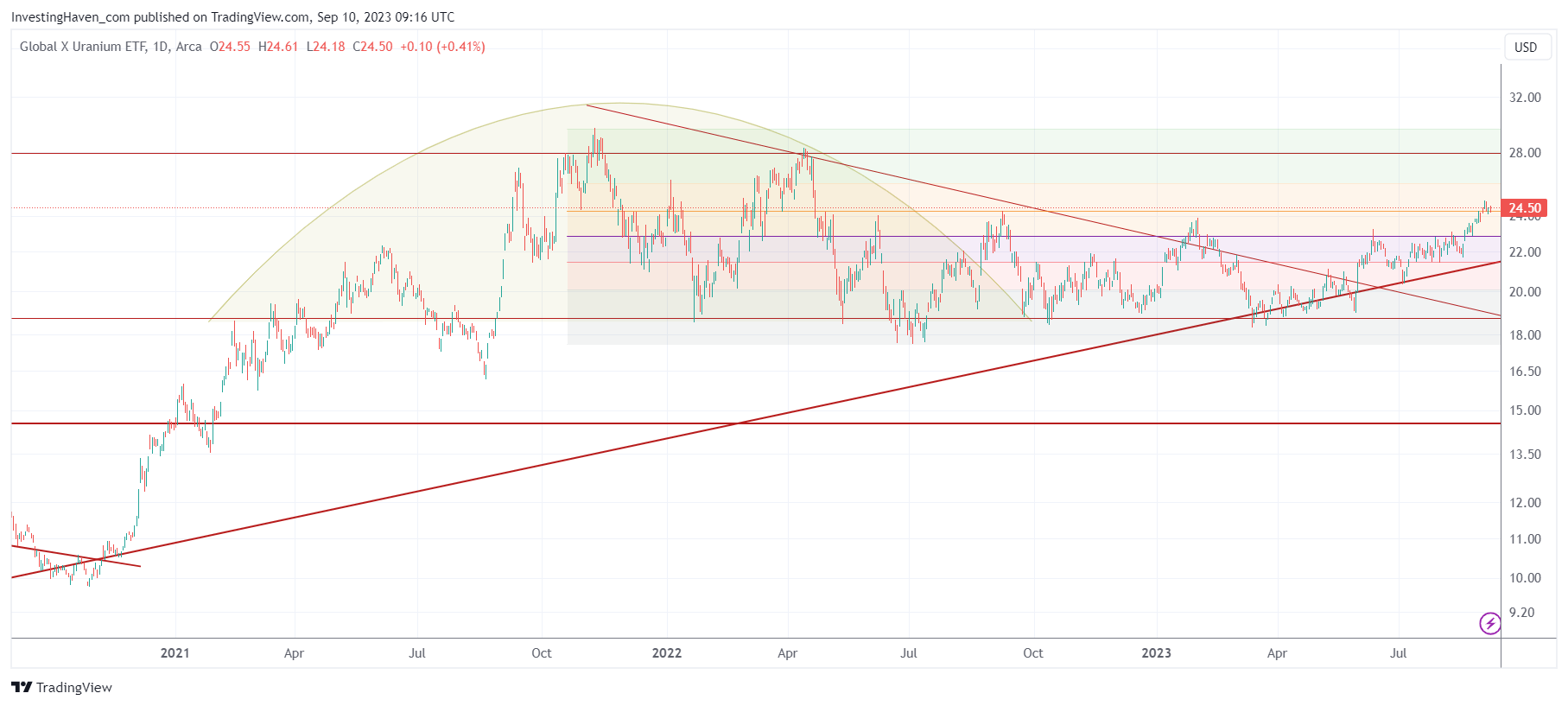

Nuclear Energy (URA – Global X Uranium ETF): Another promising opportunity lies in nuclear energy, particularly within the Uranium sector. The chart displays the impressive move above the crucial 50% retracement level. This breakout signifies renewed interest in nuclear energy as a cleaner and more sustainable power source. With a focus on the end of 2023 and the coming year, uranium markets are positioned for significant growth. Factors such as increased demand for nuclear energy, support from environmental policies, and a shift towards carbon-neutral solutions all contribute to a bullish outlook. Investors keen on long-term prospects may find this sector particularly enticing.

More detail in Alternative Energy: Top Stocks Selection >>

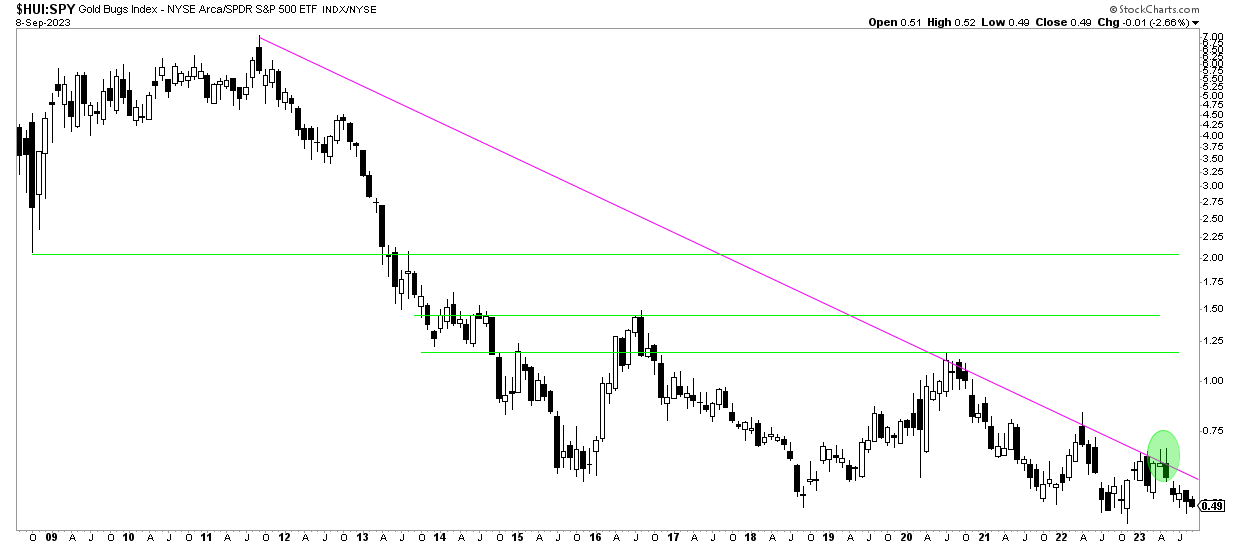

Silver Miners (HUI – NYSE Arca Gold BUGS Index) vs. S&P 500: For those interested in silver, the long-term chart comparing Silver Miners (HUI) to the S&P 500 offers valuable insights. This chart reveals potential opportunities for bottom fishing in the silver market. While silver has faced challenges, including periods of price consolidation, the overall outlook is promising. As we look ahead to the end of 2023 and into 2024, silver’s role as both a precious metal and an industrial commodity makes it an intriguing asset. Silver miners, in particular, are well-positioned to benefit from the current rising demand for precious and industrial metals.

More detail in Silver: Top Stocks For Long Term Portfolios >>

In conclusion, some specific commodities markets offer a range of opportunities for investors in 2023 and 2024. Whether you’re interested in the energy sector’s resurgence, the promising future of nuclear energy, or exploring silver’s potential, each market presents unique advantages. By keeping an eye on these developments and considering your investment horizon, you can make informed decisions to capitalize on the commodities market opportunities.